Question: Evaluate the investment using net present value analysis: a) A company is interested in making an invostment that would pay $100,000 per year for five

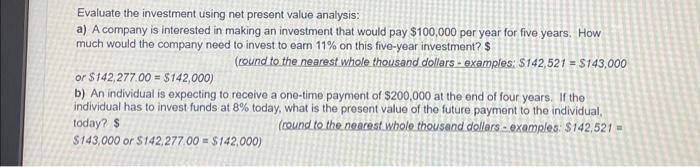

Evaluate the investment using net present value analysis: a) A company is interested in making an invostment that would pay $100,000 per year for five years. How much would the company need to invest to earn 11% on this five-year investment? $ (round to the nearest whole thousand dollars - examples: $142,521=$143,000 or $142,277.00=$142,000) b) An individual is expecting to receive a one-time payment of $200,000 at the end of four years. If the individual has to invest funds at 8% today, what is the present value of the future payment to the individual. today? $ $143,000 or $142,277.00=$142,000) (round to the nearest whole thousand dollars - examples: $142,521=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts