Question: EVALUATE the potential for using direct sales techniques and strategies In relation to the specific projects and target markets that you service; Objectives: Business wonts

EVALUATE the potential for using direct sales techniques and strategies

In relation to the specific projects and target markets that you service;

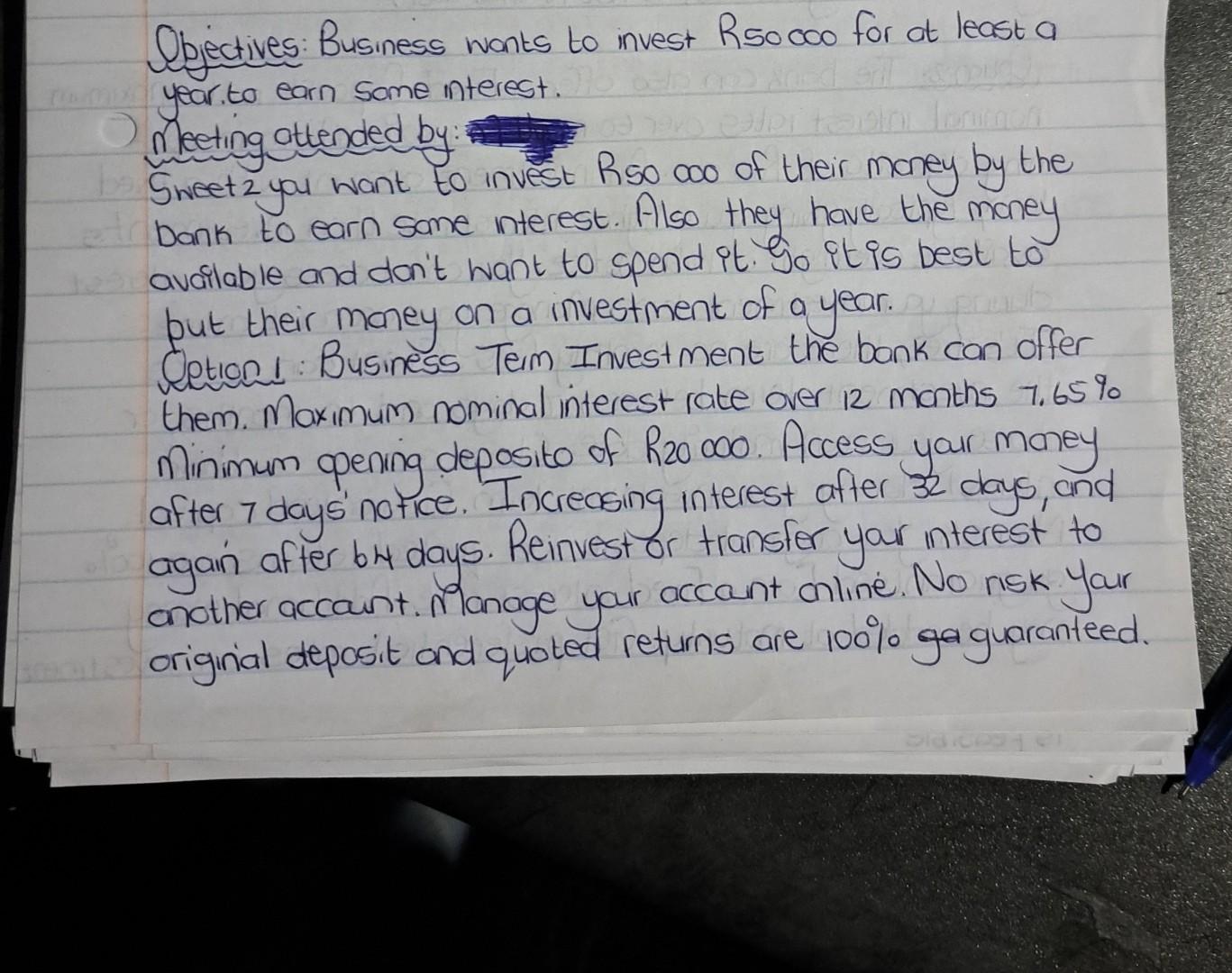

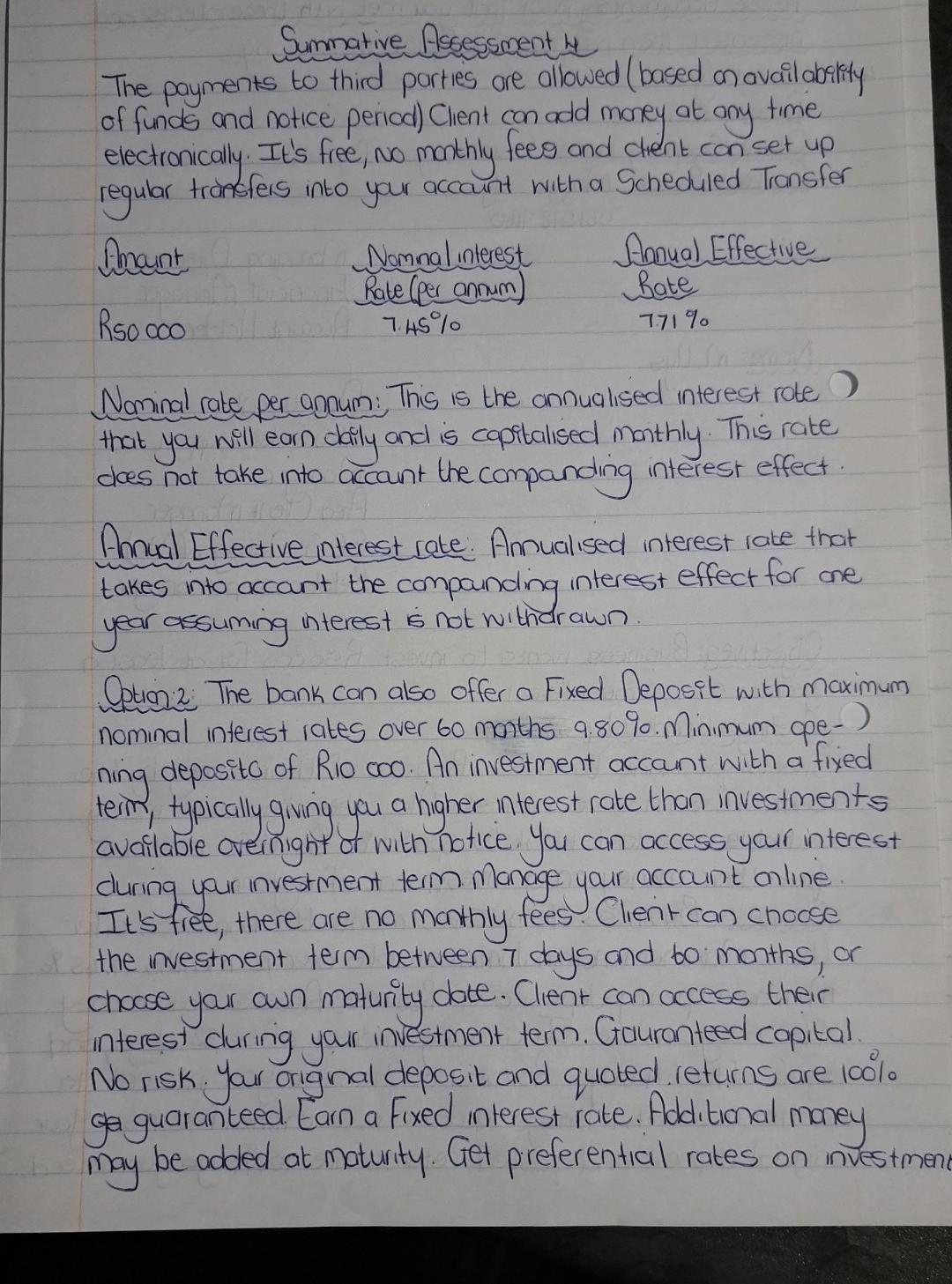

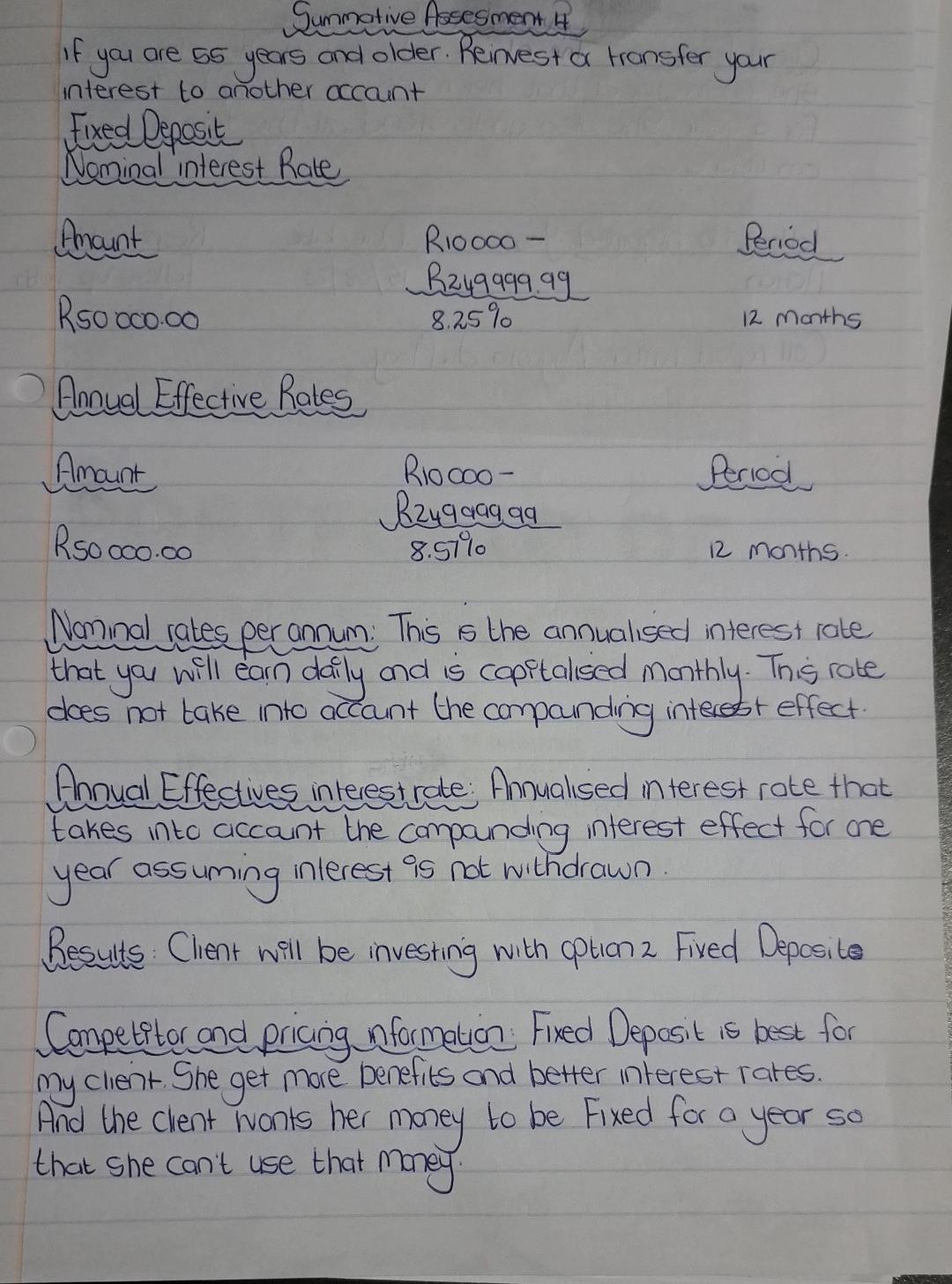

Objectives: Business wonts to invest R50 coo for at least a year to earn some interest. Meeting attended by: Sweet 2 you want to invest Rso coo of their maney by the bank to earn some interest. Also they have the money available and don't want to spend it. So it is best to put their maney on a investment of a year. chetion!: Business Term Investment the bank can offer them. Maximum nominal interest rate over 12 manths 7.65% Minimum opening deposito of R20000. Access yoir maney after 7 days' notice. Increasing interest after 32 days, and again after bH days. Reinvest or transfer your interest to onother accaint. Mlanage your accaunt mline. No risk Yaur originial deposit and quoted returns are 100% ga guaranteed Summative Assessment H The payments to third parties are allowed (based on availability of funds and notice period) Client con add money at ony time electronically. It's free, no manthly feeg and dient con set up regular transfers into your accaunt with a Scheduled Transfer Nominal rate fer annum: This is the annualised interest rote? that you will earn daily and is capitalised manthly. This rate does not take into accaut the companding interest effect. Annual Effective interest rate: Amnualised interest rate that takes into accant the compainding interest effect for one year assuming interest is not witharawn. Qption 2: The bank can also offer a Fixed Deposit with maximum nominal interest rates over 60 months 9.809. Minimum ope-) ning deposito of R1o coo. An investment accaint with a fixed term, typically giving you a higher interest rate than investments availabie overnight of with notice. Yau can access your interest during your investment term manage your account anline. It's free, there are no monthly fees. Client can choose the investment term between 7 days and bo manths, or chocse your own maturity date. Client can access their interest during your investment term. Gauranteed capital No risk. Your orignal deposit and quoted returns are 100% ga guaranteed Earn a Fixed interest rate. Additional maney may be added at maturity. Get preferential rates on investm Summative Assesment 4 if you are 55 years and older. Reinvest or transfer your interest to another account Fixed Deposit Nominal interest Rate Annual Effective Rates Nominal rates perannum: This is the annualised interest rate that you will earn daily and is copitalised manthly. This rate does not take into account the compainding interest effect. Annual Effectives interestrate: Annualised interest rate that takes into account the compounding interest effect for one year assuming interest is not withdrawn. Results: Client will be investing with option 2 Fived Deposite Competitor and pricing information: Fixed Deposit is best for my client. She get more benefits and better interest rates. And the client wonts her maney to be Fixed for a year so that she can't use that maney. Sumative Assesment H Client Feedback: The client is happy with her choice and she understand that her money is goining to be fixed for a year. She also understand all the terms and conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts