Question: Evaluate the Take-over; who 'won', going forward what challenges face the new Arcelor-Mittal group? Please provide as much information as possible in detail. INSEAD 307-145-1

Evaluate the Take-over; who 'won', going forward what challenges face the new Arcelor-Mittal group? Please provide as much information as possible in detail.

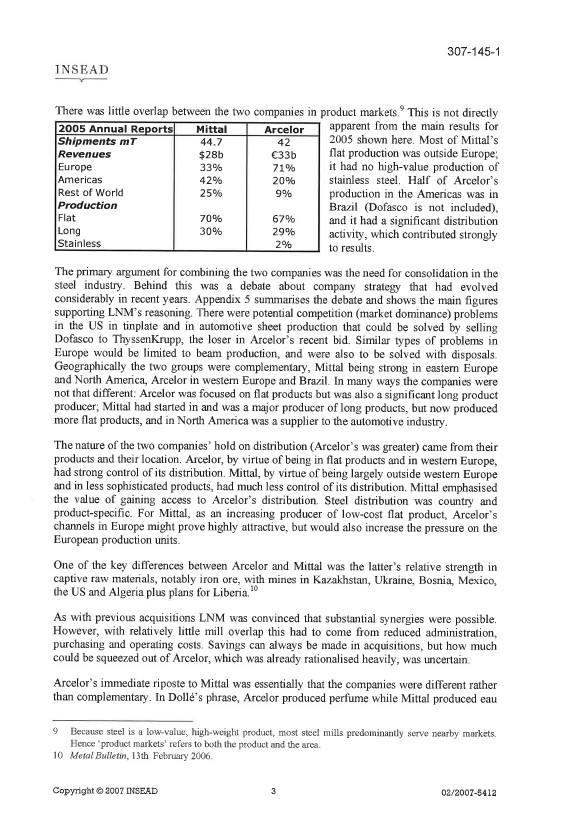

INSEAD 307-145-1 The Business School for the World The Takeover of Arcelor by Mittal Steel: Change in a Mature Global Industry (A) 02/2007-5412 This case was written by Martin Flash, Managing Director of Mega Associates, with the help of Professor Jonathan Story, Emeritus Professor of International Political Economy at INSEAD, and Professor James Burnham, Murrin Professor in Global Competitiveness, Donahue Graduate School of Business, Duquesne University, Pittsburgh, Pennsylvania, USA. It is intended to be used as a basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. Copyright @ 2007 INSEAD N.B. PLEASE NOTE THAT DETAILS OF ORDERING INSEAD CASES ARE FOUND ON THE BACK COVER, COPIES MAY NOT BE MADE WITHOUT PERMISSION. Distributed by acch, UK and USA Best of the world ecch the case for learning www.soch.com All rights reserved 1 44 10 1234 750600 Primed in UK and USA 1 +44 10128 751125 itcheechcan307-145-1 INSEAD On 28" July 2006 Mittal Steel announced that it had received more than 90% acceptance to its agreed offer for Arcelor. Lakshmi Niwas Mittal (LNM), 88% owner of Mittal Steel, thought about the immediate tasks in front of him. Since he had launched his hostile bid at the end of January 2006, winning had been more difficult than LNM had anticipated. Although not too much should be read into initial offers in hostile bids, he had had to change his first offer by some 44% in value and give several other concessions, (The difference between the First and last offer is shown in Appendix 1.) Prologue In November 2005 Arcelor launched an unsolicited cash bid of $3.8 billion for the Canadian flat product producer Dofasco, with which it had a technology agreement. This agreement covered part of Dofasco's production and was for producing automotive exterior body panel galvanised sheet, one of the steel industry's highest-value-added products. The bid tried to pre-empt a rumoured agreed merger between Dofasco and Thyssenkrupp. The bidding see- sawed up between the two companies, and although Arcelor equalised bids at one point to signal it was open to negotiations, eventually it had to outbid Thyssenkrupp with $5.6 billion on 17" January 2006, closing on 8"February. The price was almost unprecedented for a steel company (see Appendix 2), and there were mutterings in the financial press that some shareholders of Arcelor were less than happy with this use of the company's cash. Similar mutterings had been heard in 1998 when Usinor (one of the component companies of Arcelor) had purchased the Belgian flat product company Cockerill Sambre. First Phase Lakshmi Mittal launched his own bid of (18.6 billion for Arcelor on 27" January 2006. He had tried, without much success, to warn Guy Dolle, leader of Arcelor, who was then enmeshed in the final stages of Arcelor's acquisition of Dofasco. The two men knew each other well, and indeed at a dinner at Mittal's house in London on 13" January Mittal had at least broached the possibility of a merger. Opinions differ on exactly what was said, but Dolle claimed his reply was that '75% to 80% of mergers fail because of cultural differences". The bid was not well received. Dolle said: 'Arcelor does not want to embark on a future with Mittal. Arcelor has deep roots in Europe, extended now to Brazil. But we have a certain culture and values deeply rooted in the European way of doing things." He also dismissed the bid financing, which was 25% in cash and 75% in Mittal Steel shares, as 'funny money', "monnaie de singe' in French. Goldman Sachs was the lead adviser for Mittal Steel, Morgan Stanley was the adviser for Arcelor, and the size and importance of the battle involved a wide range of advisory 1 Usinor paid the equivalent of approximately $200/t for Cockerill Sambre. New York Times, 16th October 1998. See Appendix 2 for comparisons. The Magazine, 12th February 2006. Metal Bulletin, 6th February 2006. Copyright @ 2007 INSEAD 02/20 07-5412307-145-1 INSEAD businesses. Fees would be at least $90 million to $110 million for the 14 merchant banks involved in the 618.6 billion bid, nearly 20% of the annual fees for mergers and acquisitions. The debate on the merits of the bid and the tactics of the two sides were news for the next five months. The Mittal Bid Justification, and Arcelor's Immediate Defence LNM's rationale for the bid was very simple on the face of it. Both companies nominally had the same strategy of going for size in the global steel industry, although each company had reached its existing form via a different route. LNM had a long series of acquisitions to his credit, while Arcelor was the product of a lengthy period of rationalisation in the European steel industry. The background is given in the industry note in Appendix 3. In response to the accusation that both companies had the same strategy Dolle said: "There is a difference between consolidation and amalgamation. We have both proposed ... the need to consolidate, but ... from different vantage points and with different growth strategies." The histories of both companies are laid out in Appendix 4. The backgrounds of the two men were very different, although both were steel men through and through. Dolle was a French industrialist," a graduate of the highest of French engineering schools, X-Mines, who started his career in steel research and then managed both flat and long products at Usinor. Before leading Arcelor he had been in charge of strategic planning and was a long-term thinker, with a direct, unflamboyant style. Mittal was educated in one of India's top schools" and had constructed an international steel group starting from his family's steel trading business. Visionary, highly and visibly successful, and wealthy, he was an opportunistic entrepreneur on a world scale.' With a flat in a modest part of Paris, a summer home near industrial Dunkirk and one of the least elevated salaries of senior French industrialists," Dolle had a very different public image from Mittal, who lived in one of London's largest houses, and who had organised the marriage of his daughter in the Palace of Versailles and the Chateau of Vaux-le-Vicomte. Financial Times, 24th February 2006, Bor 1942, Irsid (Steel research) 1966, Usinor 1980, CEO Arcelor 2002. Born 1950, Ispat Indonesia 1976, Mittal Steel 2004. Le Figaro, 26th April 2006, Le Monde, 5th April 2006. Copyright @ 2007 INSEAD 2 02/2007-6412307-145-1 INSEAD There was little overlap between the two companies in product markets." This is not directly 2005 Annual Reports Mittal Arcelor apparent from the main results for Shipments mT 44.7 42 2005 shown here. Most of Mittal's Revenues $28b C33b flat production was outside Europe; Europe 33% 71% it had no high-value production of Americas 42% 20% stainless steel. Half of Arcelor's Rest of World 25% 9% production in the Americas was in Production Brazil (Dofasco is not included), Flat 70% 67% Long 30% 29% and it had a significant distribution Stainless 2% activity, which contributed strongly to results. The primary argument for combining the two companies was the need for consolidation in the steel industry. Behind this was a debate about company strategy that had evolved considerably in recent years. Appendix 5 summarises the debate and shows the main figures supporting LNM's reasoning. There were potential competition (market dominance) problems in the US in tinplate and in automotive sheet production that could be solved by selling Dofasco to Thyssenkrupp, the loser in Arcelor's recent bid. Similar types of problems in Europe would be limited to beam production, and were also to be solved with disposals. Geographically the two groups were complementary, Mittal being strong in eastern Europe and North America, Arcelor in western Europe and Brazil. In many ways the companies were not that different: Arcelor was focused on flat products but was also a significant long product producer; Mittal had started in and was a major producer of long products, but now produced more flat products, and in North America was a supplier to the automotive industry. The nature of the two companies' hold on distribution (Arcelor's was greater) came from their products and their location. Arcelor, by virtue of being in flat products and in western Europe, had strong control of its distribution. Mittal, by virtue of being largely outside western Europe and in less sophisticated products, had much less control of its distribution. Mittal emphasised the value of gaining access to Arcelor's distribution. Steel distribution was country and product-specific. For Mittal, as an increasing producer of low-cost flat product, Arcelor's channels in Europe might prove highly attractive, but would also increase the pressure on the European production units. One of the key differences between Arcelor and Mittal was the latter's relative strength in captive raw materials, notably iron ore, with mines in Kazakhstan, Ukraine, Bosnia, Mexico, the US and Algeria plus plans for Liberia." As with previous acquisitions LNM was convinced that substantial synergies were possible. However, with relatively little mill overlap this had to come from reduced administration, purchasing and operating costs. Savings can always be made in acquisitions, but how much could be squeezed out of Arcelor, which was already rationalised heavily, was uncertain. Arcelor's immediate riposte to Mittal was essentially that the companies were different rather than complementary. In Dolle's phrase, Arcelor produced perfume while Mittal produced eau 9 Because steel is a low-value, high-weight product, most steel mills predominantly serve nearby markets. Hence "product markets" refers to both the product and the arca. 10 Metal Bulletin, 13th February 2006. Copyright @ 2007 INSEAD 02/2007-5412Arcelor management withdrew its plans for a share buyback." Combined with the deal with Severstal, the buyback would have raised Mordashov's stake from 32% to 38% without obliging him to make a takeover of the whole group. This caused considerable angst amongst the minority shareholders. Arguably the decisive factor may have been a letter organised by Mittal's banker Goldman Sachs on 2" June, purportedly representing hedge funds holding 30% of the shares," that demanded a shareholder meeting. If true, this was much more than the 20% needed to call such a meeting, which had to be done within 30 days. It was not clear from the letter either exactly what all the funds were or the exact status of their holding, but the board had no time to verify matters. In a long board meeting on 12" June the board decided to open talks with Mittal. On 19" June Arcelor cancelled the special shareholder meeting, and on 25" June recommended a merger with Mittal. There was no riposte from Severstal, and Mittal and Arcelor became one. The 30" June announcement of a shareholder meeting to agree to the merger noted that the shareholders requesting a special meeting held not even 20% of the shares. The Result Arcelor shareholders gained more in the five months of the bid than in the previous two years. And LNM won, but at a cost. He had paid 44% more than he first offered and made considerable governance concessions, In all of his previous acquisitions, he had been fully in charge when they were completed. In nearly every case (Inland in the US was an exception), the acquired firm was bankrupt in one form or another. The merger with Arcelor was very different LNM did not control the board, and managing the internal political issues was going to be challenging. As a first step he needed to decide what management team to put in charge of the new entity, and how to achieve the promises made in the bid. The struggle had been especially bitter, and integrating Arcelor successfully into the new group - called Arcelor Mittal - would be challenging. Metal Bulletin, the steel industry's journal in Europe, on 17th July titled its leading editorial article 'Mittal's toughest test'. As if to illustrate the forthcoming problems, in the half-year results of both companies, announced at the beginning of the European torpor of the August holidays, the combined companies had results slightly less than half those needed to achieve the first year's predicted joint result, with the slower half of the year to come. An article in Business Week on 26 June had suggested that the victory would prove to be pyrrhic (a comment echoed in other journals), in essence because LNM had conceded complete control and created a sour atmosphere inside Arcelor. Inevitably there were some suggestions that he had paid too much. Dolle also lost, by virtue of the fact that his arguments did not prevail, but by forcing changes in Mittal's original offer, he could claim some success. At least Arcelor and Mittal shareholders had been led to have high expectations. Other steel mills began to ponder the lessons for them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts