Question: Evaluate the three projects by using the Mean-semi-variance approach ( b =5),and give recommendations for the airport. The possibility of each scenario is shown in

- Evaluate the three projects by using the Mean-semi-variance approach (b=5), and give recommendations for the airport.

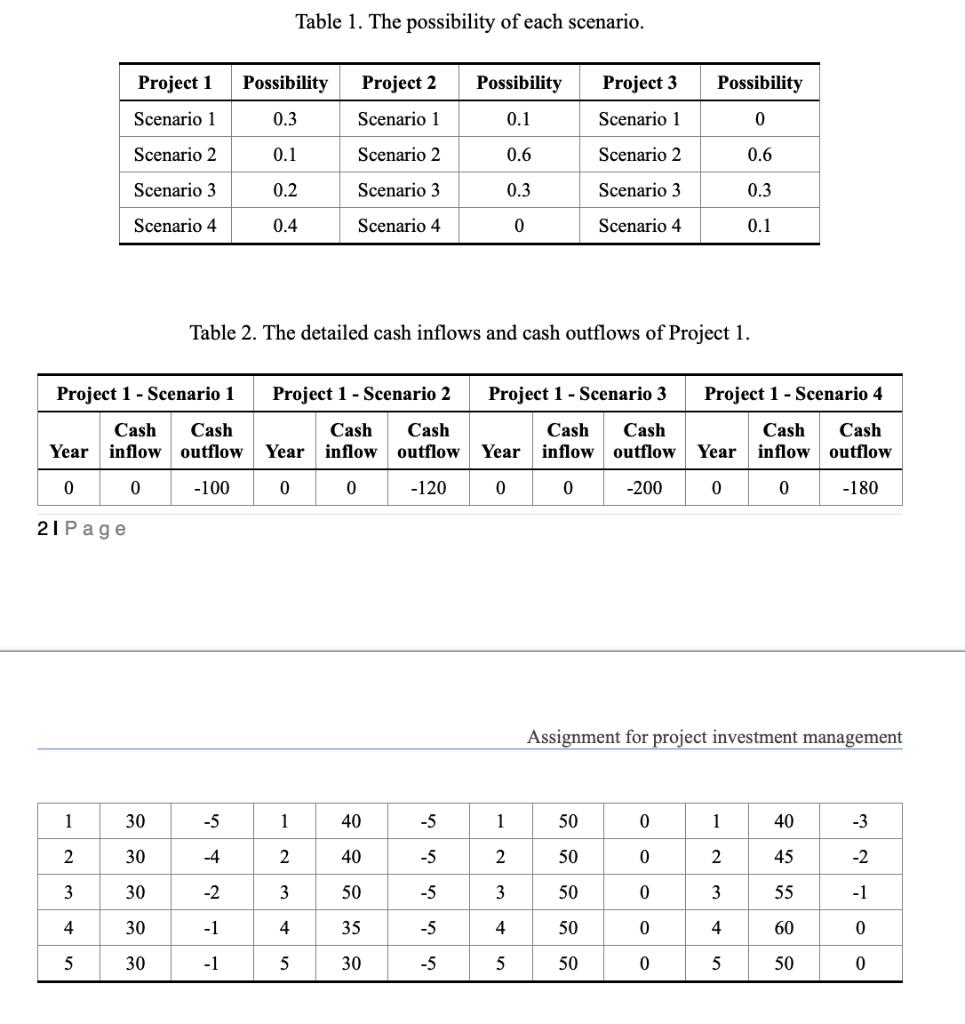

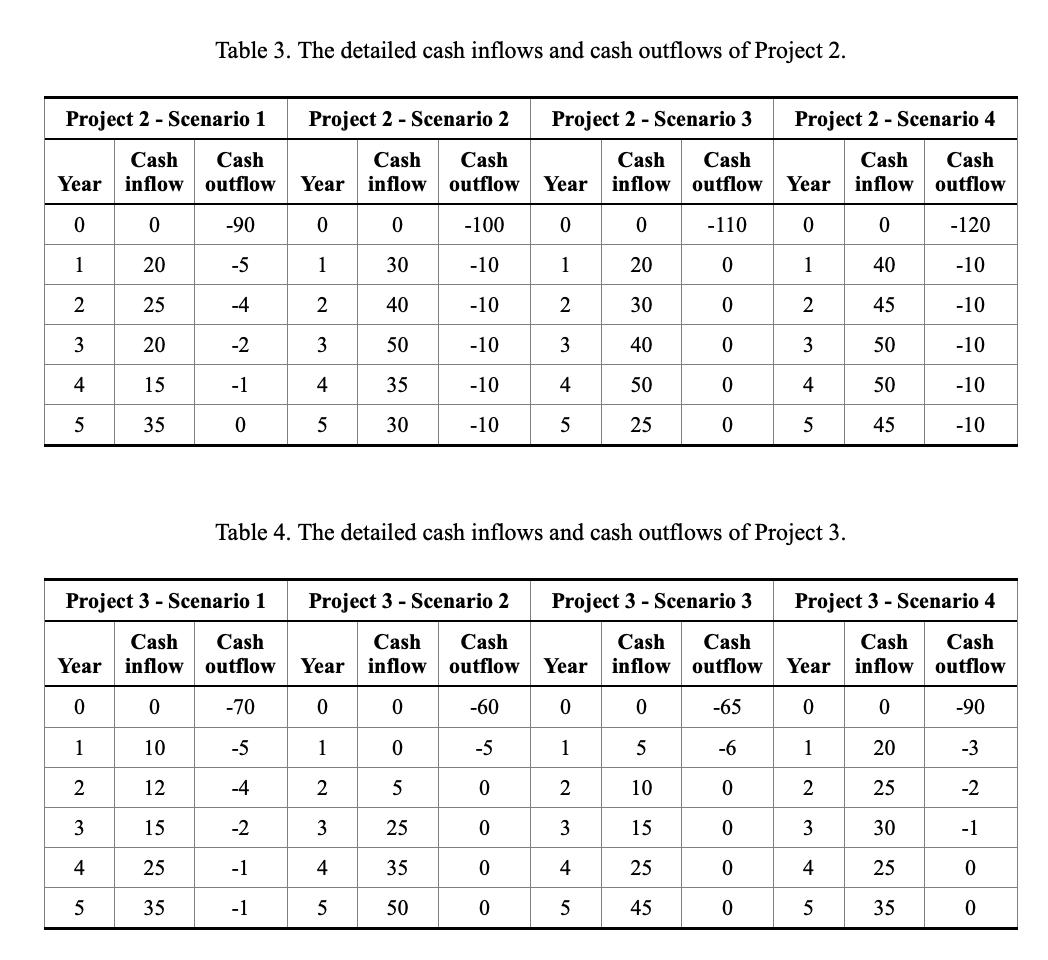

The possibility of each scenario is shown in Table 1. The detailed cash inflows and cash outflows of the three projects under each scenario are shown in Table 2, Table 3, and Table 4. All the cash flows are in billion USD. Assume the discount rate is 10% per year. Please complete the following tasks, and show your calculation steps. The numbers shall keep two decimals in this assignment. (10%)

21 Page Project 1 Scenario 1 Scenario 2 Scenario 3 Scenario 4 1 2 3 4 5 Project 1 Scenario 1 Cash Cash Year inflow outflow 0 0 -100 30 30 30 30 30 Possibility 0.3 0.1 0.2 0.4 -5 -4 -2 -1 -1 Table 2. The detailed cash inflows and cash outflows of Project 1. Project 1 Scenario 2 Cash Cash outflow -120 1 Table 1. The possibility of each scenario. Year inflow 0 0 WN 2 Project 2 Scenario 1 Scenario 2 Scenario 3 Scenario 4 3 4 5 40 40 50 35 30 Possibility 0.1 0.6 0.3 0 -5 -5 -5 -5 -5 Project 1 Scenario 3 Cash Cash outflow -200 Year inflow 0 0 1 2 4 5 50 50 888 Project 3 Scenario 1 Scenario 2 Scenario 3 Scenario 4 Assignment for project investment management 50 50 50 Possibility 0 0.6 0.3 0.1 0 0 0 0 0 Project 1 Scenario 4 Cash Cash Year inflow outflow 0 0 -180 1 2 3 4 5 5 40 45 55 60 50 -3 -2 -1 0 0

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Evaluating Airport Projects with MeanSemivariance b5 Heres a complete breakdown of evaluating the three airport projects using the MeanSemivariance ap... View full answer

Get step-by-step solutions from verified subject matter experts