Question: Evaluating Alternative Notes A borrower has two alternatives for a loan: (1) issue a $450,000, 30-day, 6% note or (2) issue a $450,000, 30-day note

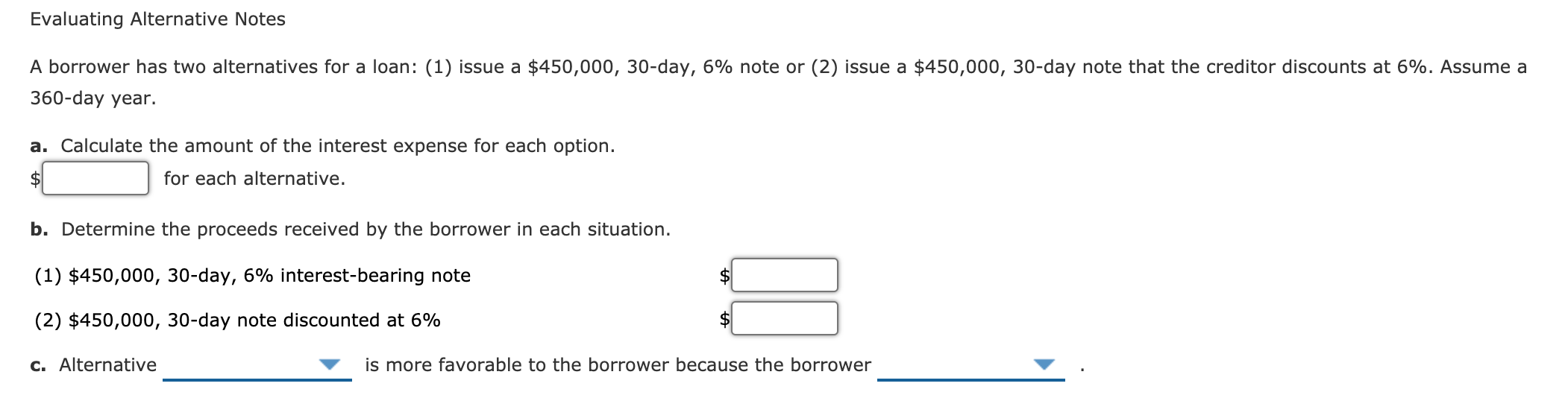

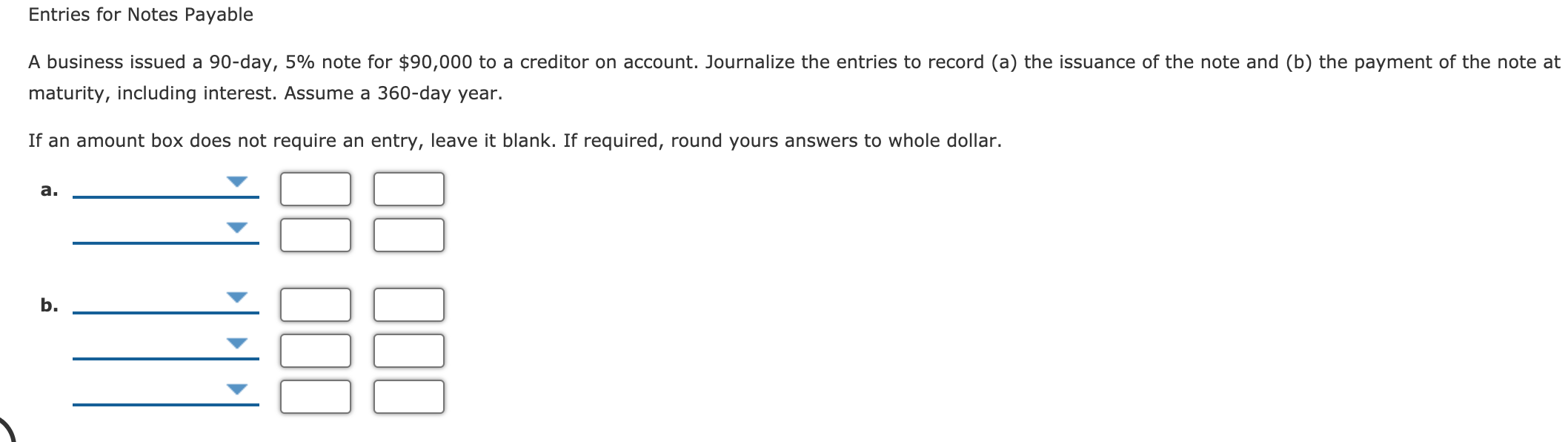

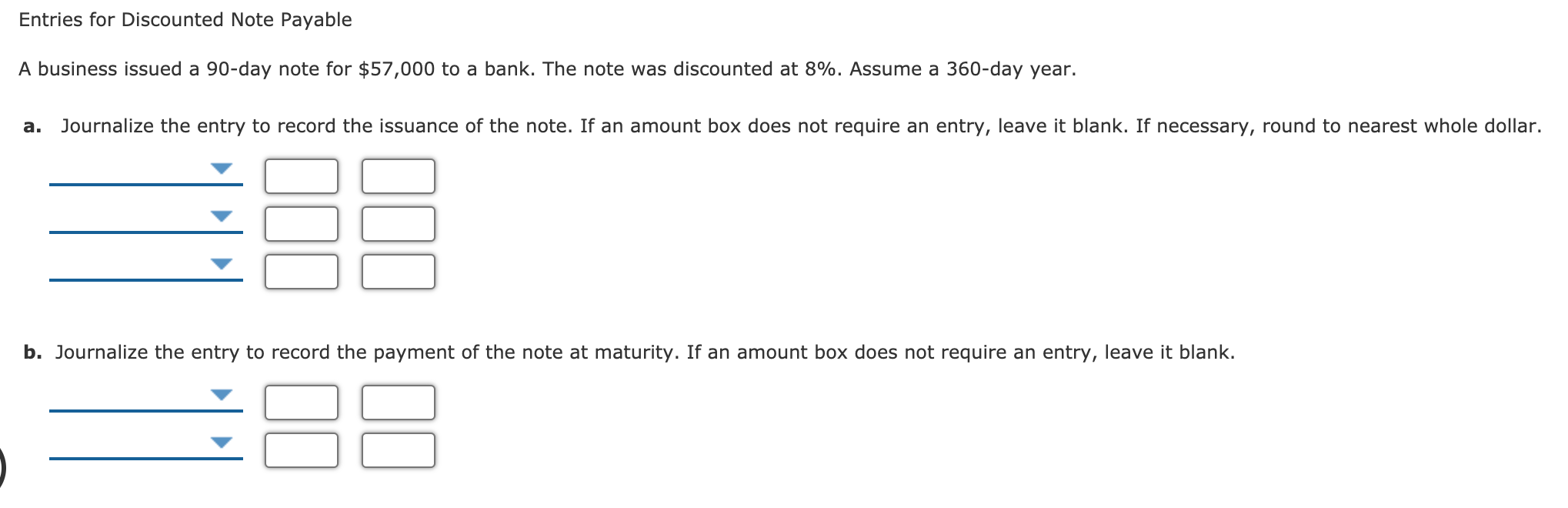

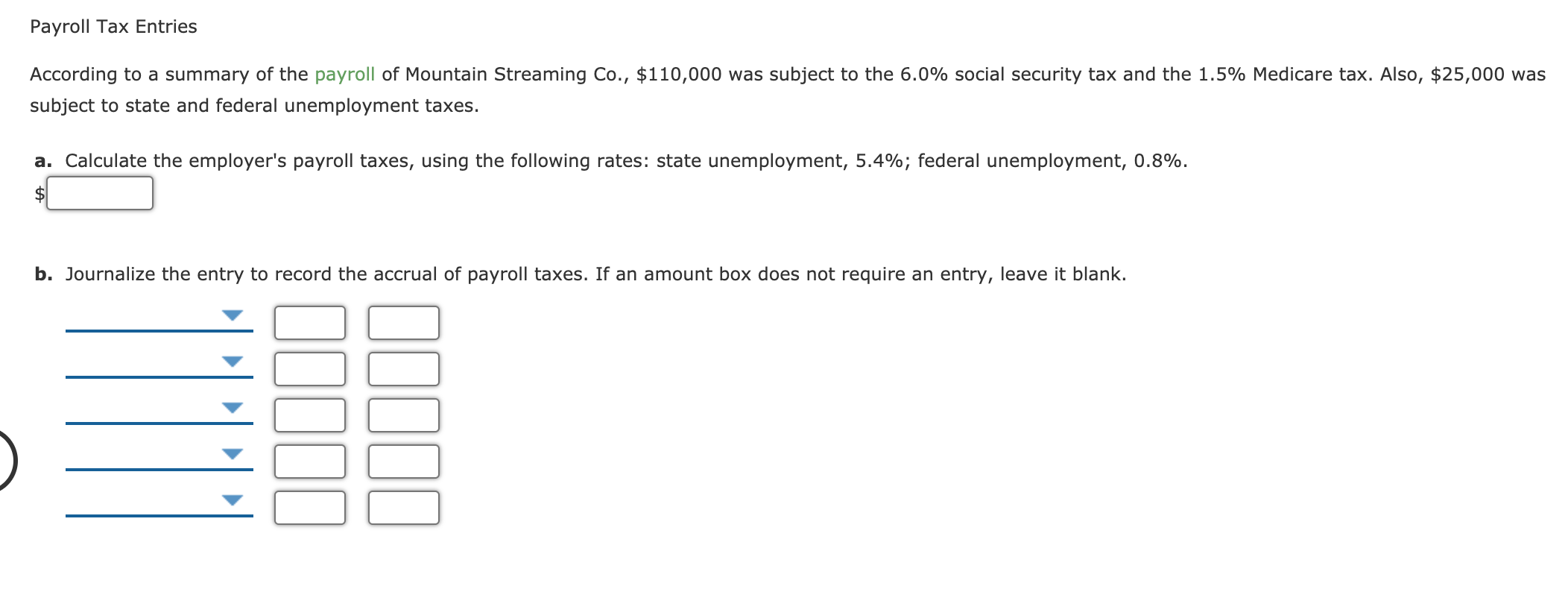

Evaluating Alternative Notes A borrower has two alternatives for a loan: (1) issue a $450,000, 30-day, 6% note or (2) issue a $450,000, 30-day note that the creditor discounts at 6%. Assume a 360-day year. a. Calculate the amount of the interest expense for each option. for each alternative. b. Determine the proceeds received by the borrower in each situation. (1) $450,000, 30-day, 6% interest-bearing note (2) $450,000, 30-day note discounted at 6% c. Alternative is more favorable to the borrower because the borrower Entries for Notes Payable A business issued a 90-day, 5% note for $90,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. a. b. Entries for Discounted Note Payable A business issued a 90-day note for $57,000 to a bank. The note was discounted at 8%. Assume a 360-day year. a. Journalize the entry to record the issuance of the note. If an amount box does not require an entry, leave it blank. If necessary, round to nearest whole dollar. b. Journalize the entry to record the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Payroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8%. $ b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts