Question: Evaluating an Expansion Project Please be sure to answer the entire question, I'd really appreciate it. Also, it would be great if you could list

Evaluating an Expansion Project

Please be sure to answer the entire question, I'd really appreciate it. Also, it would be great if you could list the formulas used. Thank you in advance, I will rate your answer if it is complete!

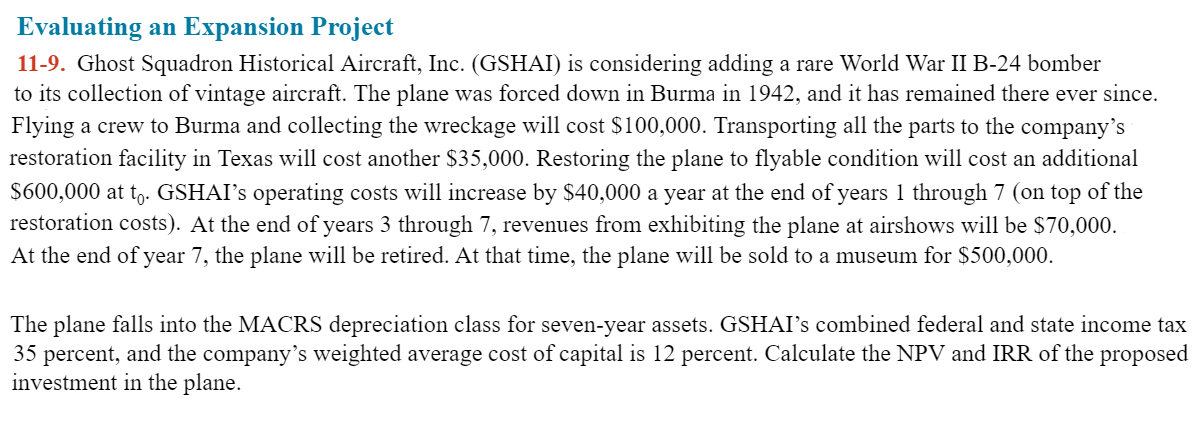

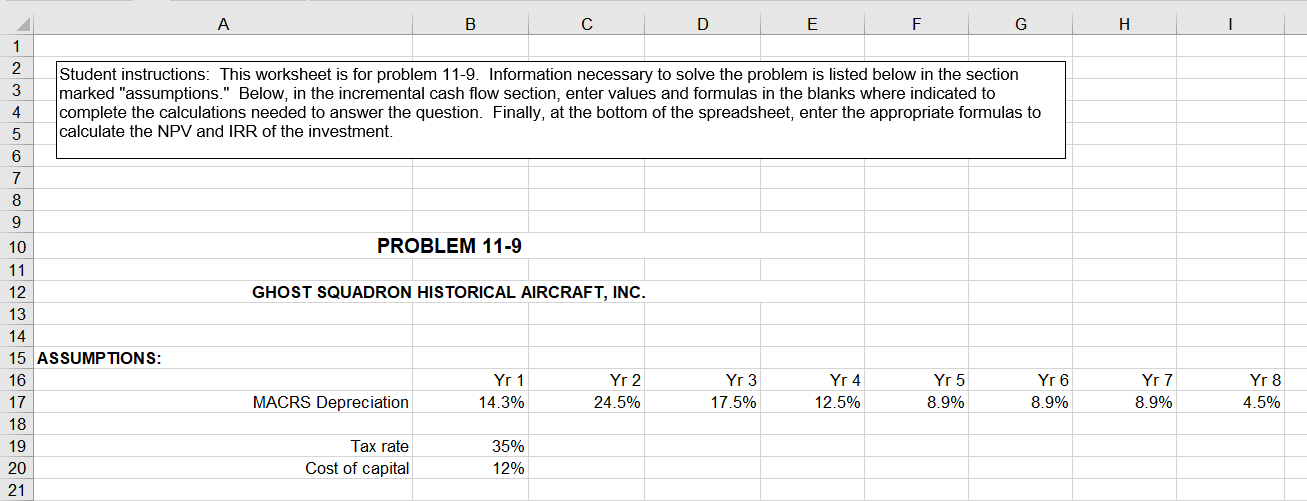

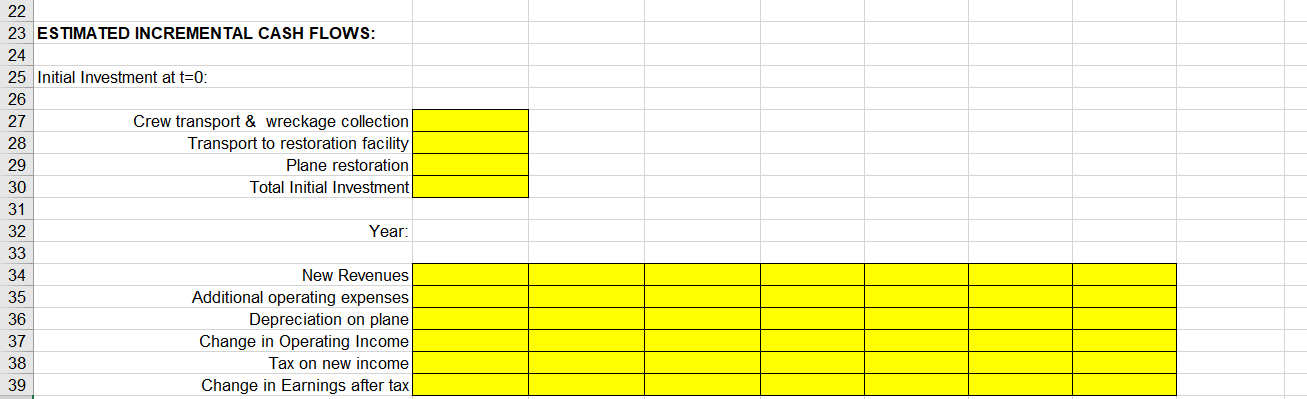

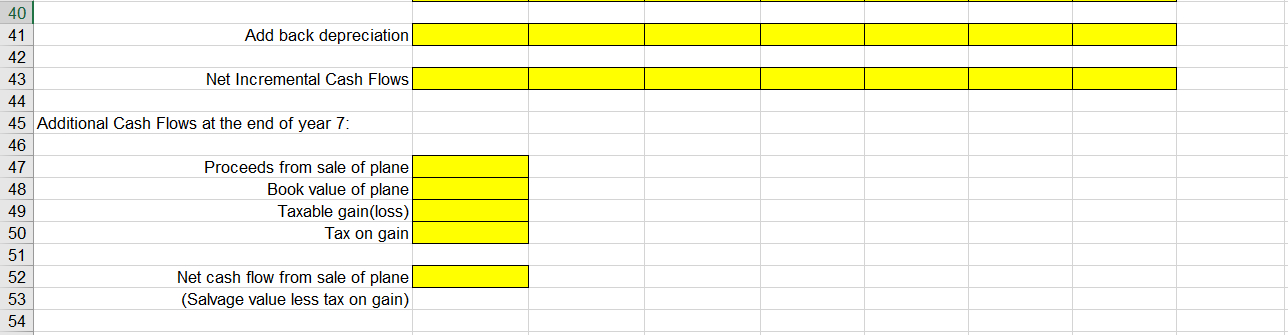

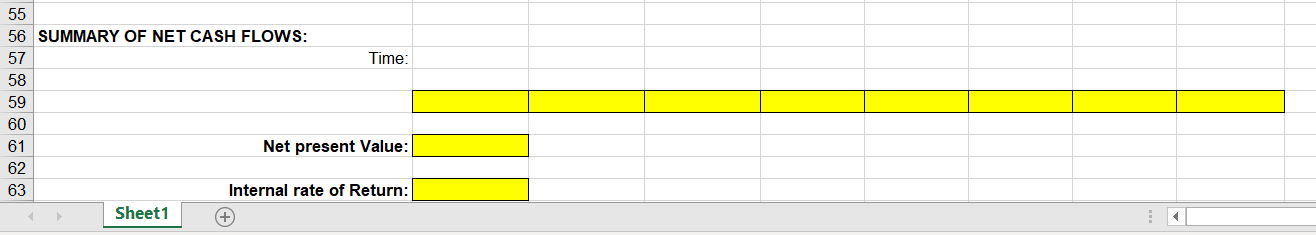

Evaluating Expansion Project an 11-9. Ghost Squadron Historical Aircraft, Inc. (GSHAI) is considering adding a rare World War II B-24 bomber to its collection of vintage aircraft. The plane was forced down in Burma in 1942, and it has remained there ever since Flying a crew to Burma and collecting the wreckage will cost $100,000. Transporting all the parts to the company's restoration facility in Texas will cost another $35,000. Restoring the plane to flyable condition will cost an additional $600,000 at to GSHAI's operating costs will increase by $40,000 a year at the end of years 1 through 7 (on top of the restoration costs). At the end of years 3 through 7, revenues from exhibiting the plane at airshows will be $70,000. At the end of year 7, the plane will be retired. At that time, the plane will be sold to a museum for $500,000 The plane falls into the MACRS depreciation class for seven-year assets. GSHAI's combined federal and state income tax 35 percent, and the company's weighted average cost of capital is 12 percent. Calculate the NPV and IRR of the proposed investment in the plane. A C D E G H 2 Student instructions: This worksheet is for problem 11-9. Information necessary to solve the problem is listed below in the section marked "assumptions." Below, in the incremental cash flow section, enter values and formulas in the blanks where indicated to |complete the calculations needed to answer the question. Finally, at the bottom of the spreadsheet, enter the appropriate formulas to calculate the NPV and IRR of the investment. 4 5 9 PROBLEM 11-9 10 11 GHOST SQUADRON HISTORICAL AIRCRAFT, INC 12 13 14 15 ASSUMPTIONS: 16 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8 MACRS Depreciation 4.5% 17 14.3% 24.5% 17.5% 12.5% 8.9% 8.9% 8.9% 18 Tax rate 19 35% Cost of capital 20 12% 21 22 23 ESTIMATED INCREMENTAL CASH FLOWS: 24 25 Initial Investment at t-0: 26 27 Crew transport & wreckage collection Transport to restoration facility Plane restoration 28 29 Total Initial Investment 30 31 32 Year: 33 34 New Revenues Additional operating expenses Depreciation on plane Change in Operating Income Tax on new income 35 36 37 38 Change in Earnings after tax| 39 40 Add back depreciation 41 42 Net Incremental Cash Flows 43 44 45 Additional Cash Flows at the end of year 7: 46 Proceeds from sale of plane Book value of plane Taxable gain(loss) Tax on gain 47 48 49 50 51 Net cash flow from sale of plane 52 53 (Salvage value less tax on gain) 54 55 56 SUMMARY OF NET CASH FLOWS: 57 Time: 58 59 60 61 Net present Value: 62 Internal rate of Return: 63 Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts