Question: Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally

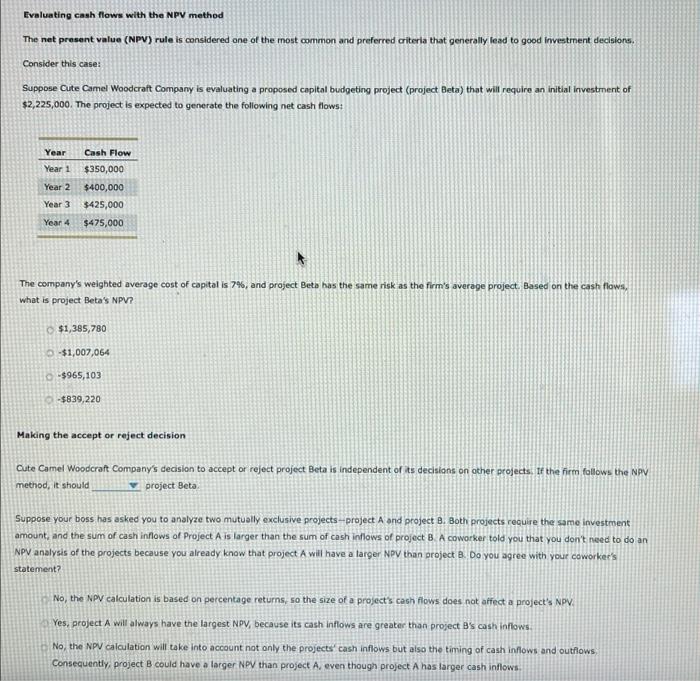

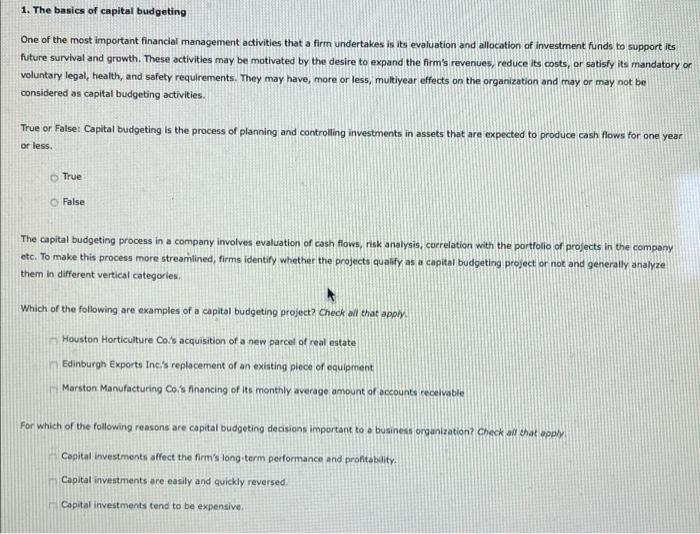

Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Cute Camel Woodcraft Company is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $2,225,000. The project is expected to generate the following net cash flows: Year Year 1 Year 2 Cash Flow $350,000 $400,000 $425,000 $475,000 Year 3 Year 4 The company's weighted average cost of capital is 7%, and project Bets has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NPV? $1,385,780 -$1,007,064 -$965,103 -$839,220 Making the accept or reject decision Cute Camel Woodcraft Company's decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta Suppose your boss has asked you to analyze two mutually exclusive projects - project A and project B. Both projects require the same investment amount, and the sum of cash inflows of Project A is larger than the sum of cash intlows of project B A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project will have a larger NPV than project B. Do you agree with your coworker's statement? No, the NPV calculation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPV Yes, project A will always have the largest NPV, because its cash inflows are greater than project Bs cash inflows No, the NPV calculation will take into account not only the projects' cash inflows but also the timing of cash inflows and outflows Consequently, project B could have a larger NPV than project A, even though project A has larger cash intlows 1. The basics of capital budgeting One of the most important financial management activities that a firm undertakes in its evaluation and allocation of investment funds to support its future survival and growth. These activities may be motivated by the desire to expand the firm's revenues, reduce its costs, or satisfy its mandatory on voluntary legal, health, and safety requirements. They may have, more or less, multiyear effects on the organization and may or may not be considered as capital budgeting activities True or False: Capital budgeting is the process of planning and controlling investments in assets that are expected to produce cash flows for one year or less. True False The capital budgeting process in a company involves evaluation of cash flows, risk analysis, correlation with the portfolio of projects in the company etc. To make this process more streamlined, firms identify whether the projects qualify as a capital budgeting project or not and generally analyze them in different vertical categories Which of the following are examples of a capital budgeting project? Check all that apply. Houston Horticulture Co.'s acquisition of a new parcel of real estate Edinburgh Exports Inc.'s replacement of an existing piece of equipment Marston Manufacturing Co.'s financing of its monthly average amount of accounts receivable For which of the following reasons are capital budgeting decisions important to business organization? Check all that apply Capital investments affect the firm's long term performance and profitability, Capital investments are easily and quickly reversed. Capital investments tend to be expensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts