Question: Evaluating how well a company's strategy is currently working involve s assessing the strategy from a qualitative and also a quantitative strategic ch standpoint. The

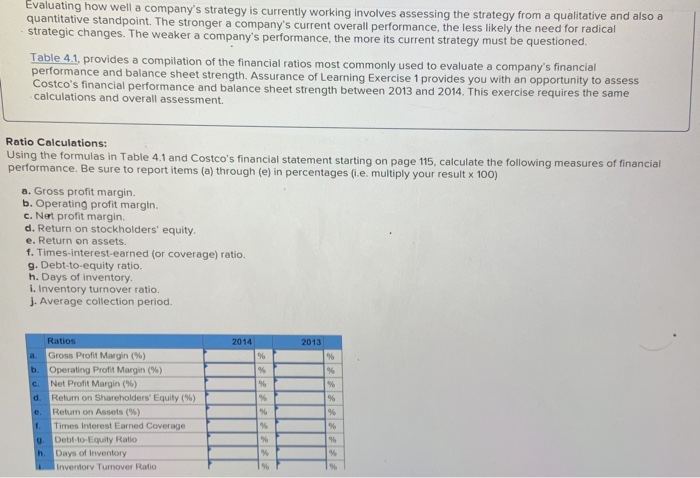

Evaluating how well a company's strategy is currently working involve s assessing the strategy from a qualitative and also a quantitative strategic ch standpoint. The stronger a company's current overall performance, the less likely the need for radical anges. The weaker a company's performance, the more its current strategy must be questioned. Table 41, provides performance and a compilation of the financial ratios most commonly used to evaluate a company's financial balance sheet strength. Assurance of Learning Exercise 1 provides you with an opportunity to assess tco's financial performance and balance sheet strength between 2013 and 2014. This exercise requires the same calculations and overall assessment Ratio Calculations: Using the formulas in Table 4.1 and Costco's financial statement starting on page 115, calculate the following measures of financial performance. Be sure to report items (a) through (e) in percentages (i.e. multiply your result x 100) a. Gross profit margin. b. Operating profit margtn. c. Net profit margin. d. Return on stockholders' equity. e. Return on assets. f. Times-interest-earned (or coverage) ratio. 9. Debt-to-equity ratio. h. Days of inventory i. Inventory turnover ratio. j. Average collection period. Gross Profit Margin (%) Operating Profit Margin (%) Net Profit Margin (%) Return on Shareholders' Equity (%) Return on Assets (%) Times Interest Earned Coverage Debt-to-Equity Ratio . e. h. Days of Inventory Inventory Tumover Ratio Evaluating how well a company's strategy is currently working involve s assessing the strategy from a qualitative and also a quantitative strategic ch standpoint. The stronger a company's current overall performance, the less likely the need for radical anges. The weaker a company's performance, the more its current strategy must be questioned. Table 41, provides performance and a compilation of the financial ratios most commonly used to evaluate a company's financial balance sheet strength. Assurance of Learning Exercise 1 provides you with an opportunity to assess tco's financial performance and balance sheet strength between 2013 and 2014. This exercise requires the same calculations and overall assessment Ratio Calculations: Using the formulas in Table 4.1 and Costco's financial statement starting on page 115, calculate the following measures of financial performance. Be sure to report items (a) through (e) in percentages (i.e. multiply your result x 100) a. Gross profit margin. b. Operating profit margtn. c. Net profit margin. d. Return on stockholders' equity. e. Return on assets. f. Times-interest-earned (or coverage) ratio. 9. Debt-to-equity ratio. h. Days of inventory i. Inventory turnover ratio. j. Average collection period. Gross Profit Margin (%) Operating Profit Margin (%) Net Profit Margin (%) Return on Shareholders' Equity (%) Return on Assets (%) Times Interest Earned Coverage Debt-to-Equity Ratio . e. h. Days of Inventory Inventory Tumover Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts