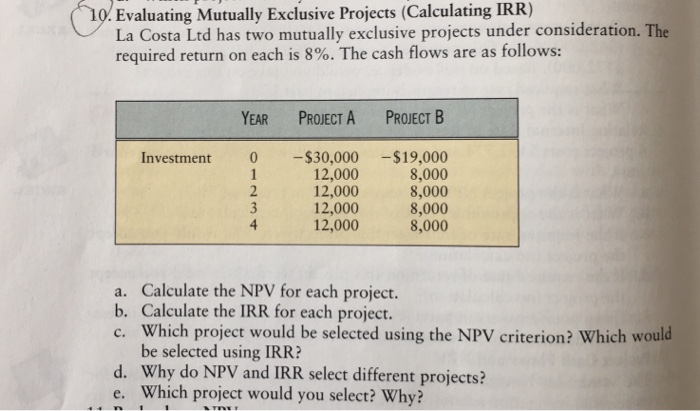

Question: Evaluating Mutually Exclusive Projects (Calculating IRR) La Costa Ltd has two mutually exclusive projects under consideration. The required return on each is 8%. The cash

Evaluating Mutually Exclusive Projects (Calculating IRR) La Costa Ltd has two mutually exclusive projects under consideration. The required return on each is 8%. The cash flows are as follows: YEAR PROIECT A PROJECT B Investment 0 $30,000$19,000 8,000 8,000 8,000 8,000 12,000 12,000 12,000 12,000 4 a. Calculate the NPV for each project. b. Calculate the IRR for each project. c. Which project would be selected using the NPV criterion? Which would be selected using IRR? d. Why do NPV and IRR select different projects? e. Which project would you select? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts