Question: Evaluating Risk and Return Drop down in section f is (1) are or are not Bartman Industries's and Reynolds Inc.s stock prices and dividends, along

Evaluating Risk and Return

Drop down in section f is (1) are or are not

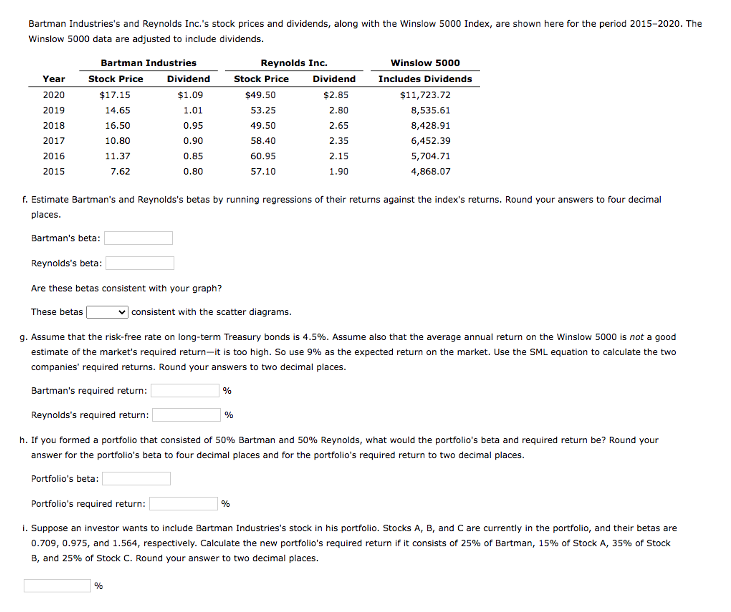

Bartman Industries's and Reynolds Inc."s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 2015 -2020. The Winslow 5000 data are adjusted to include dividends. f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places. Bartman's beta: Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the scatter diagrams. 9. Assume that the risk-free rate on long-term Treasury bonds is 4.5\%. Assume also that the average annual return on the Winslow 5000 is not a good estimate of the market's required retum-it is too high. So use 9% as the expected return on the market. Use the SML equation to calculate the two companies' required returns. Round your answers to two decimal places. Bartman's required return: % Reynolds's required return: h. If you formed a portfolio that consisted of 50% Bartman and 50% Reynolds, what would the portfolio's beta and required return be? Round your answer for the portfolio's beta to four decimal places and for the portfolio's required return to two decimal places. Portfolio's beta: Portfolio's required return: 86 i. Suppose an investor wants to include Bartman Industries's stock in his portfolio. Stocks ArB, and C are currently in the portfolio, and their betas are D.709, 0.975, and 1.564, respectively. Calculate the new portfolio's required return if it consists of 25% of Bartman, 15\% of Stock A, 35\% of Stock B, and 25% of Stock C. Round your answer to two decimal places. 86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts