Question: EVALUATING RISK AND RETURN Stock X has a 10% expected return, a beta coefficienta 0.9. and a 35.0 standard deviation of expected returns. Stock Y

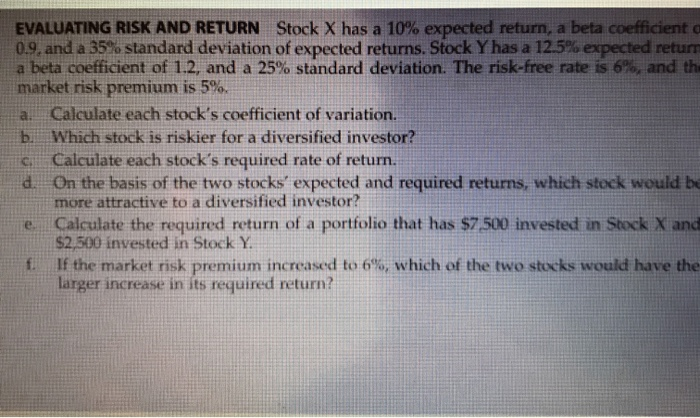

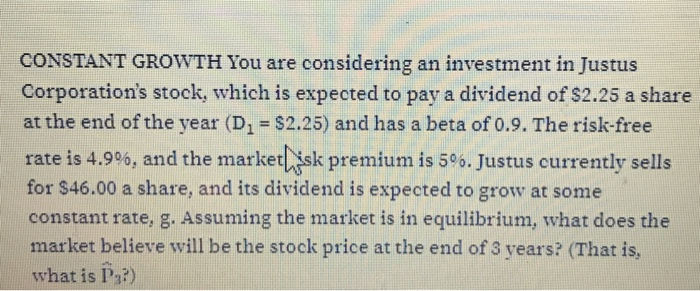

EVALUATING RISK AND RETURN Stock X has a 10% expected return, a beta coefficienta 0.9. and a 35.0 standard deviation of expected returns. Stock Y has a 12.5% expected return a beta coefficient of 1.2, and a 25% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. al Calculate each stock's coefficient of variation. Which stock is riskier for a diversified investor? Calculate each stock's required rate of return. d. On the basis of the two stocks' expected and required returns, which stock would be more attractive to a diversified investor? Calculate the required return of a portfolio that has $7500 invested in Stock X and AJ If the market risk premium increased to 6%, which of the two stocks would have the larger increase in its required return? CONSTANT GROWTH You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.25 a share at the end of the year (D, = $2.25) and has a beta of 0.9. The risk-free rate is 4.9%, and the marketsk premium is 5%. Justus currently sells for $46.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is it?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts