Question: Evaluating the ability to pay long term debt 4. Debt ratio 5. Number of times interest charges earned Noteuse Interest, net for both companies as

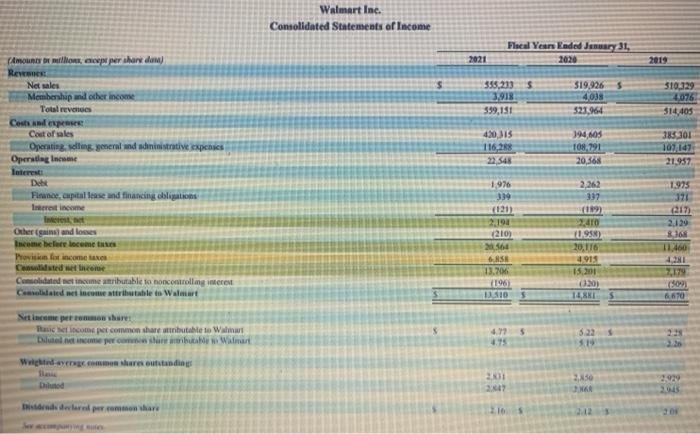

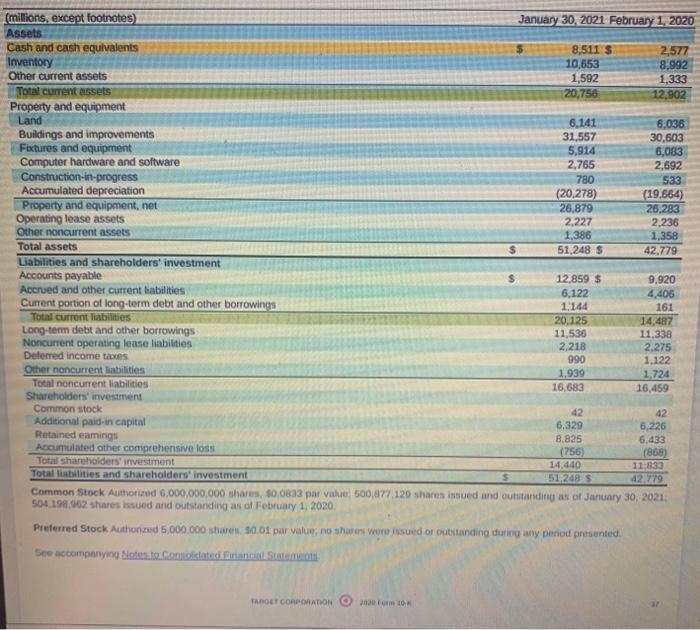

Evaluating the ability to pay long term debt 4. Debt ratio 5. Number of times interest charges earned Noteuse Interest, net for both companies as Interest Expense Evaluating profitability (Show results as a percentage) 6. Profit margin percentage Note Net income is called Net earnings by Target. Use Consolidated net income attributable to Walmart as Walmart's net income Return en assets 1. Return on equity Note: Neither company has preferred stock, so preferred dividends are zero) Evaluating stock as an investment 9. Price-Earnings (PIE) ratio Walmart Inc. Consolidated Statements of Income Fiscal Years Ende January 31, 2020 2021 2019 $ 353,213 3,918 599,151 519,9265 4035 321,964 510,329 2076 314, 405 420 315 116,28 32,548 394,00 108,291 20,368 385301 107,147 21,957 Amounty or millions, exemperature dam) RES Net sales Membership and other income Total revenge Cestan expo Coat of ales Operating dinggeld sinistrative spesies Operating Income Interesti Det Finance capital and financing obligation Irrest income Inici Other gains and losses Imee beleeloceme Profox income Cated when Comblidated set income atributable to noncontrolling interest Celalede stributablets Walmart 1976 1975 2.262 332 999 (121) 2193 210) 40 0988) 20,176 4.913 15.301 371 217) 2.129 2166 11,460 431 7,179 09 670 ASH 13.7 196 BUSIO 14,8 Set income per now where Naic Sincome per common share attributable to What Dulce permitiu o Walmart 5 4.72 4.75 522 19 Weight res outstanding 201 25 MER 2.999 Dised sederen share 2.16 (millions, except footnotes) January 30, 2021 February 1, 2020 Assets Cash and cash equivalents 8,511 S 2,577 Inventory 10,653 8.992 Other current assets 1,592 1,333 Total current assets 20,756 12.902 Property and equipment Land 6.141 6,036 Buildings and improvements 31,557 30,603 Fixtures and equipment 5,914 6,083 Computer hardware and software 2.765 2,692 Construction-in-progress 780 533 Accumulated depreciation (20,278) (19,664) Property and equipment, net 26,879 26,283 Operating lease assets 2.227 2.236 Other noncurrent assets 1.386 1.358 Total assets 51,248 $ 42,779 Liabilities and shareholders' investment Accounts payable 12,859 $ 9.920 Accrued and other current liabilities 6,122 4,406 Current portion of long-term debt and other borrowings 1144 161 Total current liabilities 20.125 14,487 Long-term debt and other borrowings 11,536 11.338 Noncurrent operating lease liabilities 2.218 2,275 Deferred income taxes 990 1.122 Other noncurrent abilities 1.939 1,724 Total noncurrent liabilities 16,683 16,459 Shareholders investment Common stock 42 42 Additional paid-in capital 6.329 6.226 Retained earnings 8.825 6.433 Accumulated other comprehensive loss (756) (868) Total Shareholders' investment 14.440 11830 Total liabilities and shareholders investment S 51,248 42.779 Common Stock Authorized 6,000,000,000 shares. $0.0833 par value 500,877, 120 shares inued and outstanding as of January 30, 2021; 504.198,062 shares issued and outstanding as of February 1, 2020, Preferred Stock Authorized 5.000.000 shares $0.01 par value no shares were issued or outstanding during any period presented See accompanying to constated in State TARGET CORPORATION o com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts