Question: Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects Daniel Company uses a periodic inventory system. Data for the

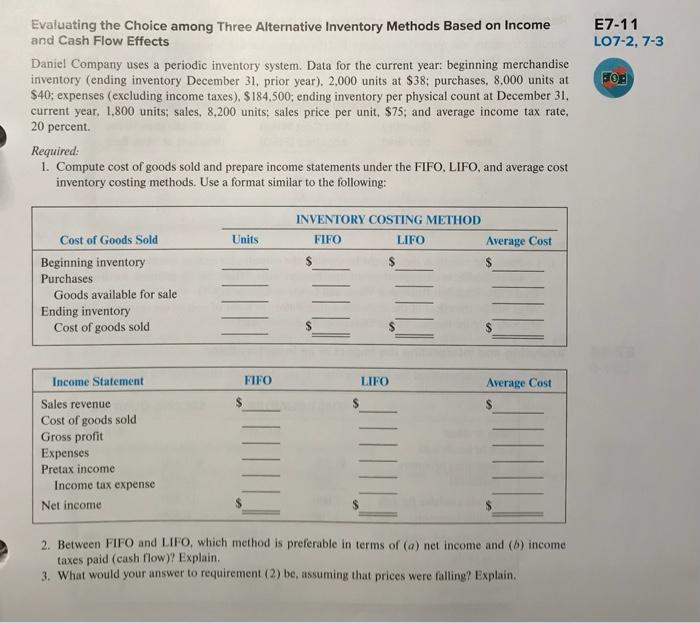

Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $184,500; ending inventory per physical count at December 31 , current year, 1,800 units; sales, 8,200 units; sales price per unit, $75; and average income tax rate, 20 percent. Required: 1. Compute cost of goods sold and prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. Use a format similar to the following: 2. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow)? Explain. 3. What would your answer to requirement (2) be, assuming that prices were falling? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts