Question: EVALUATION Given the following mutually - exclusive alternatives and a Minimum Attractive Rate of Return ( MARR ) of 7 % , which should be

EVALUATION

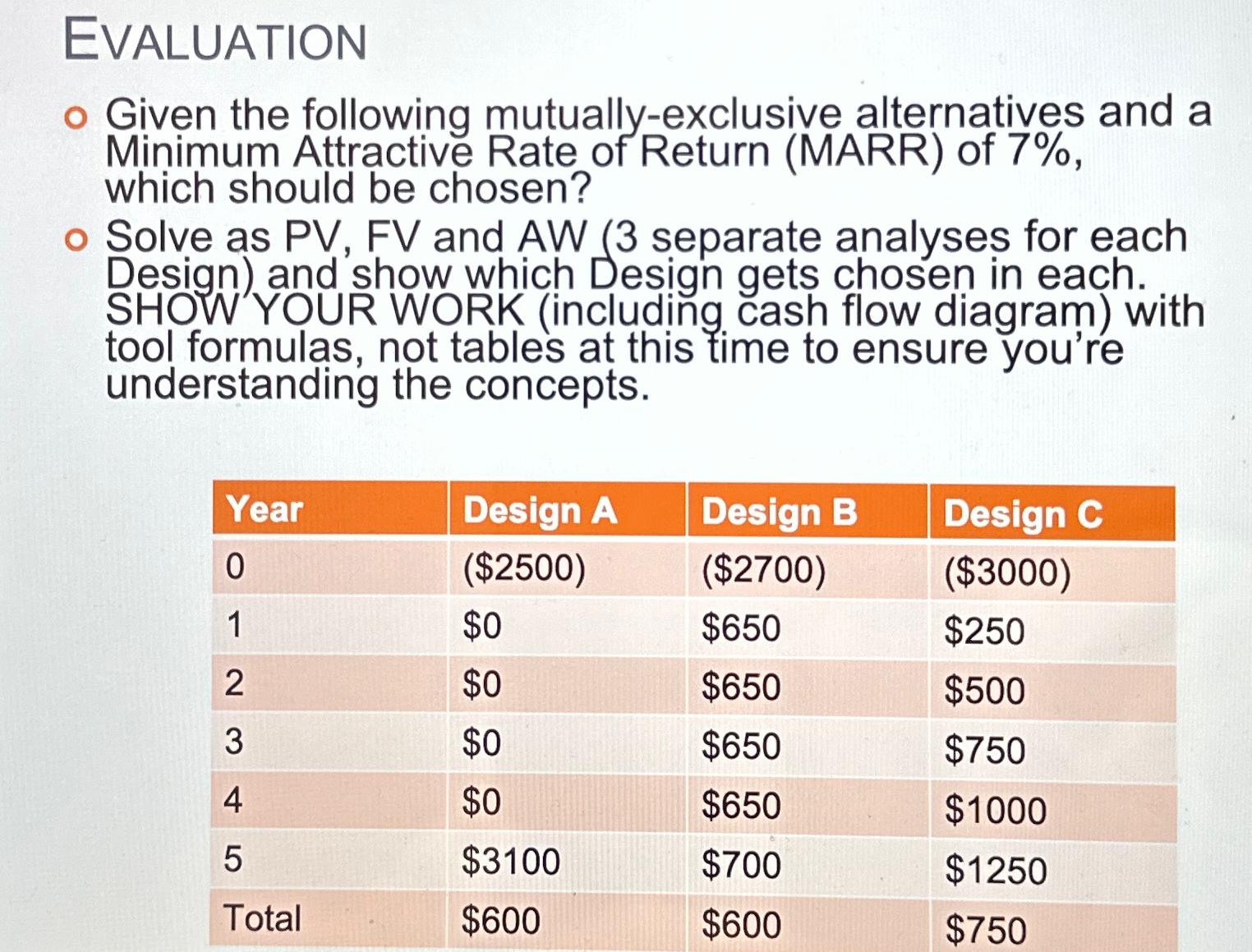

Given the following mutuallyexclusive alternatives and a Minimum Attractive Rate of Return MARR of which should be chosen?

Solve as PV FV and AW separate analyses for each Design and' show which Design gets chosen in each. SHOW YOUR WORK including cash flow diagram with tool formulas, not tables at this time to ensure you're understanding the concepts.

tableYearDesign ADesign BDesign C$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock