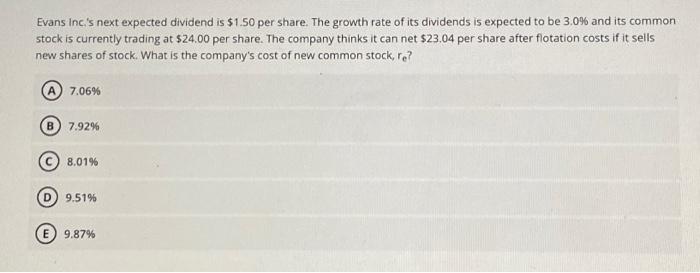

Question: Evans inc.'s next expected dividend is $1.50 per share. The growth rate of its dividends is expected to be 3.09 and its common stock is

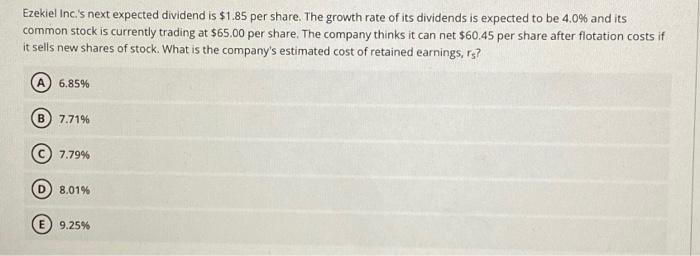

Evans inc.'s next expected dividend is $1.50 per share. The growth rate of its dividends is expected to be 3.09 and its common stock is currently trading at $24.00 per share. The company thinks it can net $23.04 per share after flotation costs if it sells new shares of stock. What is the company's cost of new common stock, re ? 7.06% (B) 7.92% (C) 8.01% (D) 9.51% 9.87% Ezekiel Inc.'s next expected dividend is $1.85 per share. The growth rate of its dividends is expected to be 4.0% and its common stock is currently trading at $65.00 per share. The company thinks it can net $60.45 per share after flotation costs if it sells new shares of stock. What is the company's estimated cost of retained earnings, r5 ? 6.85% (B) 7.71% (C) 7.79% (D) 8.01% (E) 9.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts