Question: Evans Technology has the following capital structure. Debt Common equity 25% 75 The aftertax cost of debt is 7.00 percent, and the cost of common

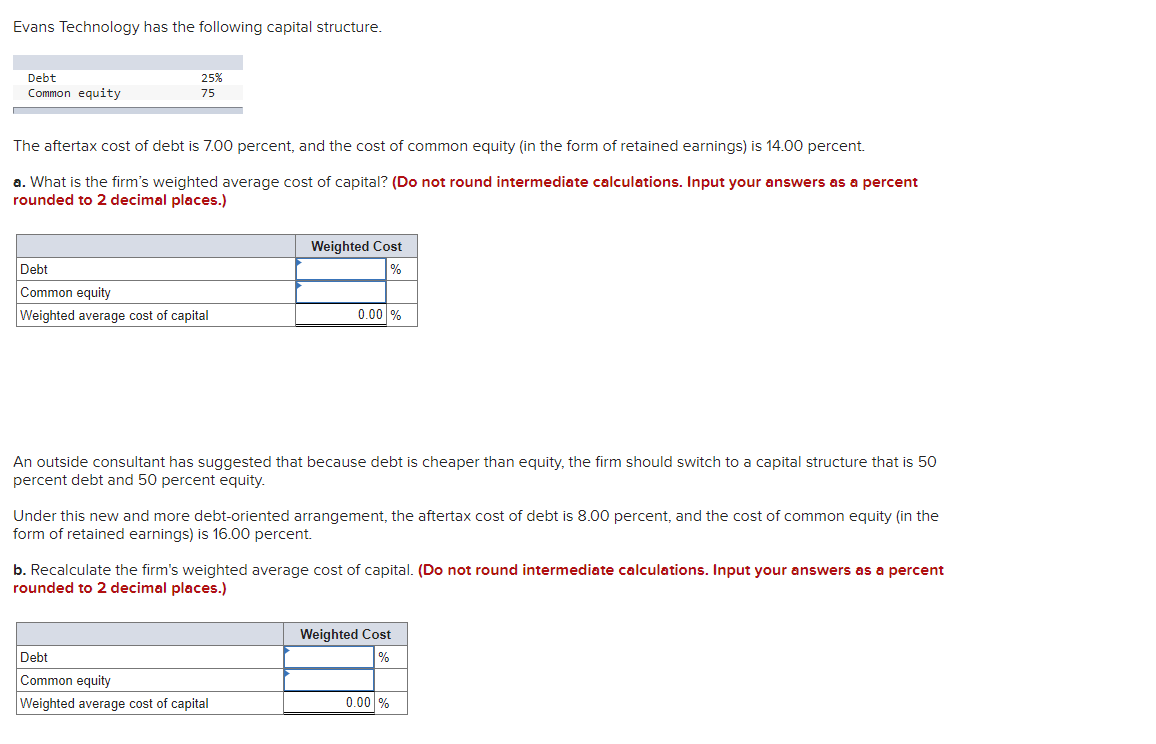

Evans Technology has the following capital structure. Debt Common equity 25% 75 The aftertax cost of debt is 7.00 percent, and the cost of common equity (in the form of retained earnings) is 14.00 percent. a. What is the firm's weighted average cost of capital? (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost % Debt Common equity Weighted average cost of capital 0.00 % aper equity, the firm should switch a pital that is 50 An outside consultant has suggested that because debt is percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 8.00 percent, and the cost of common equity (in the form of retained earnings) is 16.00 percent. b. Recalculate the firm's weighted average cost of capital. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost % Debt Common equity Weighted average cost of capital 0.00 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts