Question: . Every portfolio on the Efficient Frontier represents the highest expected return for a given amount of risk. Answer: [ Select ] . Risk averse

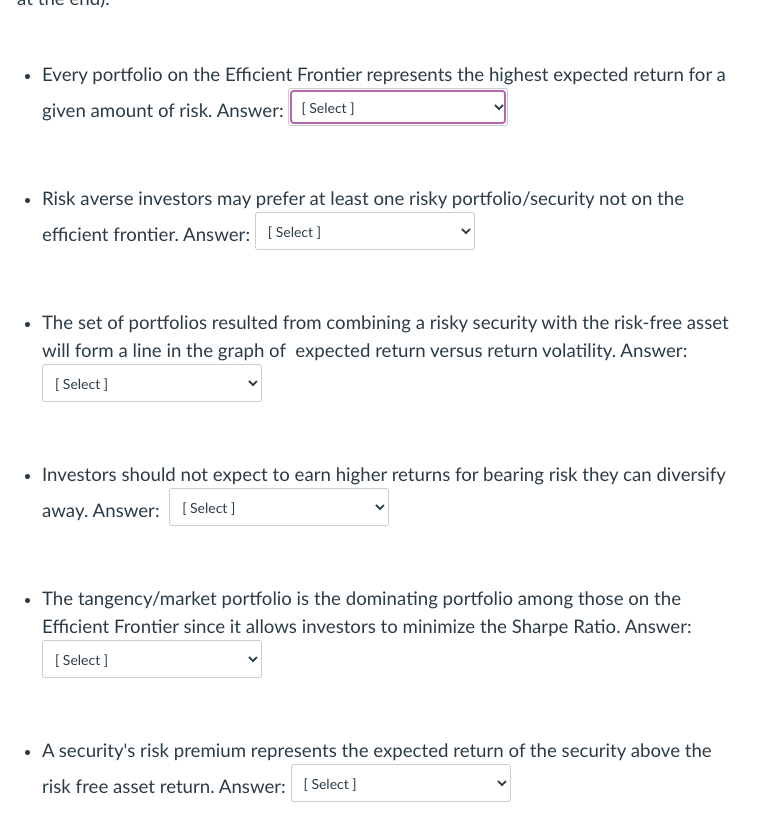

. Every portfolio on the Efficient Frontier represents the highest expected return for a given amount of risk. Answer: [ Select ] . Risk averse investors may prefer at least one risky portfolio/security not on the efficient frontier. Answer: [ Select ] . The set of portfolios resulted from combining a risky security with the risk-free asset will form a line in the graph of expected return versus return volatility. Answer: [ Select ] . Investors should not expect to earn higher returns for bearing risk they can diversify away. Answer: [ Select ] . The tangency/market portfolio is the dominating portfolio among those on the Efficient Frontier since it allows investors to minimize the Sharpe Ratio. Answer: [ Select ] . A security's risk premium represents the expected return of the security above the risk free asset return. Answer: [ Select ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts