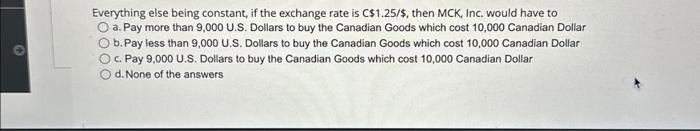

Question: Everything else being constant, if the exchange rate is C$1.25/$, then MCK, Inc. would have to a. Pay more than 9,000 U.S. Dollars to buy

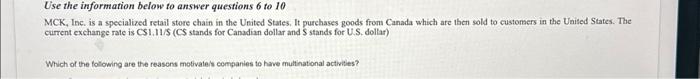

Everything else being constant, if the exchange rate is C$1.25/$, then MCK, Inc. would have to a. Pay more than 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar b. Pay less than 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar c. Pay 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar d. None of the answers Use the information below to answer questions 6 to 10 MCK. Inc. is a specialized retail store chain in the United States, It purehases goods from Canada which are then sold to custonsers in the United States. The cuirent exchange rate is CS1,11/S (CS stands for Canadian dollar and $ stands for U.S. dollat) Which of the folowing are the reasons motivate/s companies to have multinational actwities? Everything else being constant, if the exchange rate is C$1.25/$, then MCK, Inc. would have to a. Pay more than 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar b. Pay less than 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar c. Pay 9,000 U.S. Dollars to buy the Canadian Goods which cost 10,000 Canadian Dollar d. None of the answers Use the information below to answer questions 6 to 10 MCK. Inc. is a specialized retail store chain in the United States, It purehases goods from Canada which are then sold to custonsers in the United States. The cuirent exchange rate is CS1,11/S (CS stands for Canadian dollar and $ stands for U.S. dollat) Which of the folowing are the reasons motivate/s companies to have multinational actwities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts