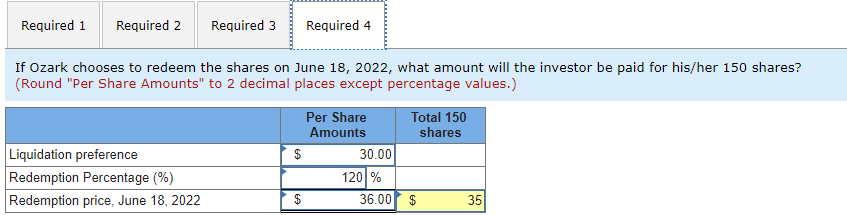

Question: Everything in the last requirement is wrong except liquidation preference Exercise 18-8 (Algo) Reporting preferred shares [LO18-4, 18-7] Ozark Distributing Company is primarily engaged in

![18-8 (Algo) Reporting preferred shares [LO18-4, 18-7] Ozark Distributing Company is primarily](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fc7419484b2_82466fc7418e37ad.jpg)

Everything in the last requirement is wrong except liquidation preference

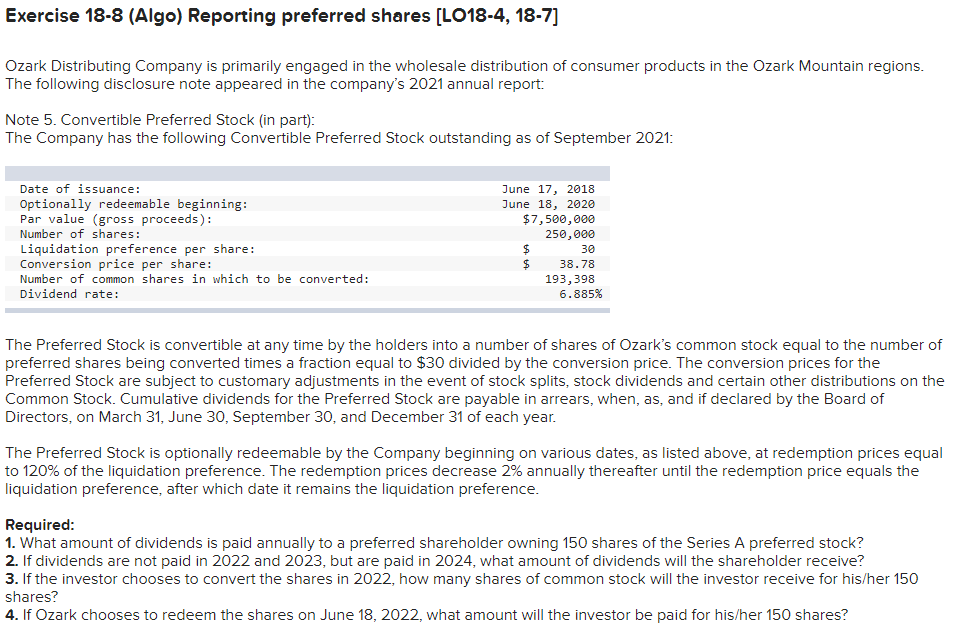

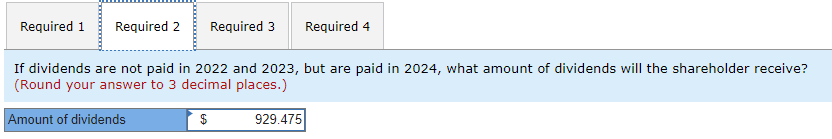

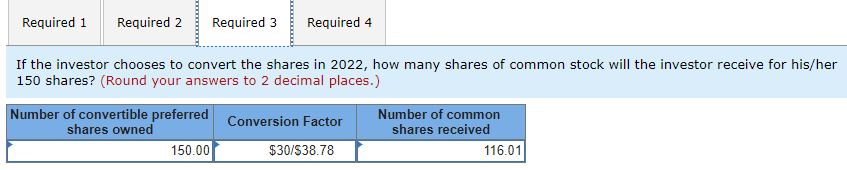

Exercise 18-8 (Algo) Reporting preferred shares [LO18-4, 18-7] Ozark Distributing Company is primarily engaged in the wholesale distribution of consumer products in the Ozark Mountain regions. The following disclosure note appeared in the company's 2021 annual report: Note 5. Convertible Preferred Stock (in part): The Company has the following Convertible Preferred Stock outstanding as of September 2021: Date of issuance: Optionally redeemable beginning: Par value (gross proceeds): Number of shares: Liquidation preference per share: Conversion price per share: Number of common shares in which to be converted: Dividend rate: June 17, 2018 June 18, 2020 $7,500,000 250,000 30 38.78 193,398 6.885% The Preferred Stock is convertible at any time by the holders into a number of shares of Ozark's common stock equal to the number of preferred shares being converted times a fraction equal to $30 divided by the conversion price. The conversion prices for the Preferred Stock are subject to customary adjustments in the event of stock splits, stock dividends and certain other distributions on the Common Stock. Cumulative dividends for the Preferred Stock are payable in arrears, when, as, and if declared by the Board of Directors, on March 31, June 30, September 30, and December 31 of each year. The Preferred Stock is optionally redeemable by the Company beginning on various dates, as listed above, at redemption prices equal to 120% of the liquidation preference. The redemption prices decrease 2% annually thereafter until the redemption price equals the liquidation preference, after which date it remains the liquidation preference. Required: 1. What amount of dividends is paid annually to a preferred shareholder owning 150 shares of the Series A preferred stock? 2. If dividends are not paid in 2022 and 2023, but are paid in 2024, what amount of dividends will the shareholder receive? 3. If the investor chooses to convert the shares in 2022, how many shares of common stock will the investor receive for his/her 150 shares? 4. If Ozark chooses to redeem the shares on June 18, 2022, what amount will the investor be paid for his/her 150 shares? Required 1 Required 2 Required 3 Required 4 What amount of dividends is paid annually to a preferred shareholder owning 150 shares of the Series A preferred stock? (Enter percentage value in 3 decimals.) Par Value Preferred Shares Dividend Rate (%) Total Annual Preferred Dividend Number of Preferred Shares Dividend per preferred share Shares owned Annual preferred dividend 150 shares $ 7,500,000 6.885 % $ 516,375 250,000 $ 2.06550 150 $ 309.825 Required 1 Required 2 Required 3 Required 4 If dividends are not paid in 2022 and 2023, but are paid in 2024, what amount of dividends will the shareholder receive? (Round your answer to 3 decimal places.) Amount of dividends $ 929.475 Required 1 Required 2 Required 3 Required 4 If the investor chooses to convert the shares in 2022, how many shares of common stock will the investor receive for his/her 150 shares? (Round your answers to 2 decimal places.) Conversion Factor Number of convertible preferred shares owned 150.00 Number of common shares received 116.01 $30/538.78 Required 1 Required 2 Required 3 Required 4 If Ozark chooses to redeem the shares on June 18, 2022, what amount will the investor be paid for his/her 150 shares? (Round "Per Share Amounts" to 2 decimal places except percentage values.) Liquidation preference Redemption Percentage (%) Redemption price, June 18, 2022 Per Share Total 150 Amounts shares $ 30.00 120% $ 36.00 $ 35 Exercise 18-8 (Algo) Reporting preferred shares [LO18-4, 18-7] Ozark Distributing Company is primarily engaged in the wholesale distribution of consumer products in the Ozark Mountain regions. The following disclosure note appeared in the company's 2021 annual report: Note 5. Convertible Preferred Stock (in part): The Company has the following Convertible Preferred Stock outstanding as of September 2021: Date of issuance: Optionally redeemable beginning: Par value (gross proceeds): Number of shares: Liquidation preference per share: Conversion price per share: Number of common shares in which to be converted: Dividend rate: June 17, 2018 June 18, 2020 $7,500,000 250,000 30 38.78 193,398 6.885% The Preferred Stock is convertible at any time by the holders into a number of shares of Ozark's common stock equal to the number of preferred shares being converted times a fraction equal to $30 divided by the conversion price. The conversion prices for the Preferred Stock are subject to customary adjustments in the event of stock splits, stock dividends and certain other distributions on the Common Stock. Cumulative dividends for the Preferred Stock are payable in arrears, when, as, and if declared by the Board of Directors, on March 31, June 30, September 30, and December 31 of each year. The Preferred Stock is optionally redeemable by the Company beginning on various dates, as listed above, at redemption prices equal to 120% of the liquidation preference. The redemption prices decrease 2% annually thereafter until the redemption price equals the liquidation preference, after which date it remains the liquidation preference. Required: 1. What amount of dividends is paid annually to a preferred shareholder owning 150 shares of the Series A preferred stock? 2. If dividends are not paid in 2022 and 2023, but are paid in 2024, what amount of dividends will the shareholder receive? 3. If the investor chooses to convert the shares in 2022, how many shares of common stock will the investor receive for his/her 150 shares? 4. If Ozark chooses to redeem the shares on June 18, 2022, what amount will the investor be paid for his/her 150 shares? Required 1 Required 2 Required 3 Required 4 What amount of dividends is paid annually to a preferred shareholder owning 150 shares of the Series A preferred stock? (Enter percentage value in 3 decimals.) Par Value Preferred Shares Dividend Rate (%) Total Annual Preferred Dividend Number of Preferred Shares Dividend per preferred share Shares owned Annual preferred dividend 150 shares $ 7,500,000 6.885 % $ 516,375 250,000 $ 2.06550 150 $ 309.825 Required 1 Required 2 Required 3 Required 4 If dividends are not paid in 2022 and 2023, but are paid in 2024, what amount of dividends will the shareholder receive? (Round your answer to 3 decimal places.) Amount of dividends $ 929.475 Required 1 Required 2 Required 3 Required 4 If the investor chooses to convert the shares in 2022, how many shares of common stock will the investor receive for his/her 150 shares? (Round your answers to 2 decimal places.) Conversion Factor Number of convertible preferred shares owned 150.00 Number of common shares received 116.01 $30/538.78 Required 1 Required 2 Required 3 Required 4 If Ozark chooses to redeem the shares on June 18, 2022, what amount will the investor be paid for his/her 150 shares? (Round "Per Share Amounts" to 2 decimal places except percentage values.) Liquidation preference Redemption Percentage (%) Redemption price, June 18, 2022 Per Share Total 150 Amounts shares $ 30.00 120% $ 36.00 $ 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts