Question: Everything is correct except the last four that are blank. I cannot seem ti figure them out correct as my input for PV(X) for RayJ

Everything is correct except the last four that are blank. I cannot seem ti figure them out correct as my input for PV(X) for RayJ was incorrect at 69.61.

Everything is correct except the last four that are blank. I cannot seem ti figure them out correct as my input for PV(X) for RayJ was incorrect at 69.61.

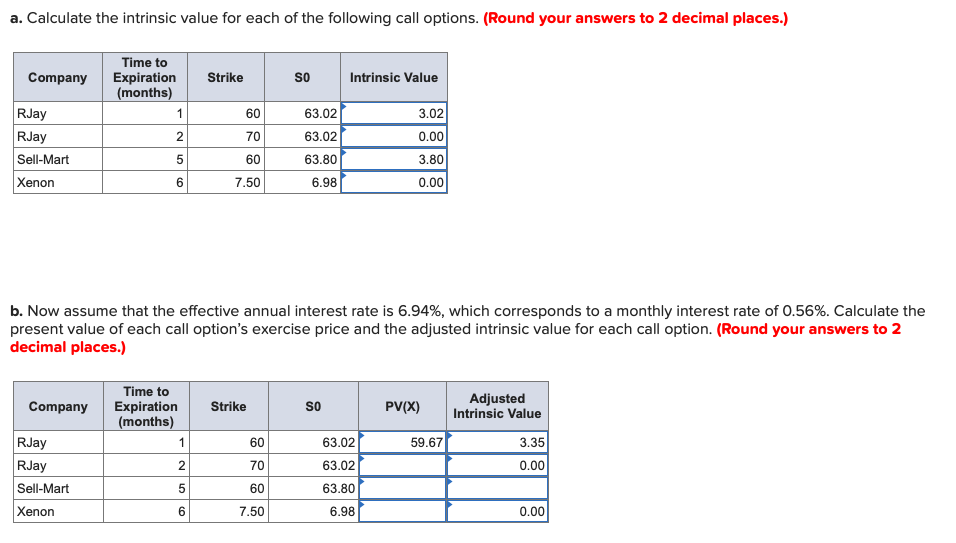

a. Calculate the intrinsic value for each of the following call options. (Round your answers to 2 decimal places.) Company Strike SO Intrinsic Value Time to Expiration (months) 1 60 3.02 0.00 2 RJay RJay Sell-Mart Xenon 63.02 63.02 63.80 70 60 5 3.80 6 7.50 6.98 0.00 b. Now assume that the effective annual interest rate is 6.94%, which corresponds to a monthly interest rate of 0.56%. Calculate the present value of each call option's exercise price and the adjusted intrinsic value for each call option. (Round your answers to 2 decimal places.) Company Strike SO PV(X) Time to Expiration (months) 1 Adjusted Intrinsic Value 60 63.02 59.67 3.35 RJay RJay Sell-Mart 2 70 63.02 0.00 5 60 63.80 Xenon 6 7.50 6.98 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts