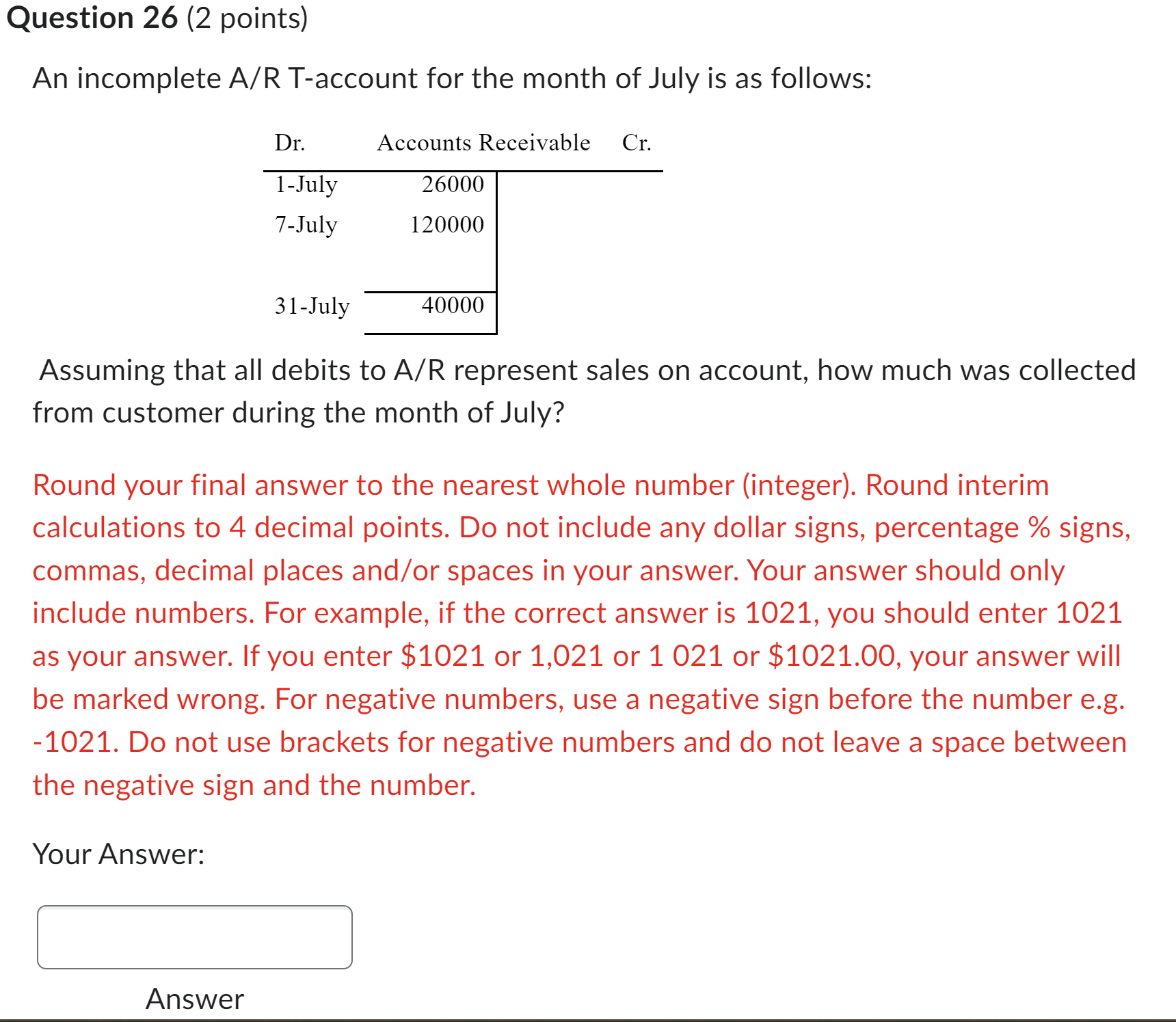

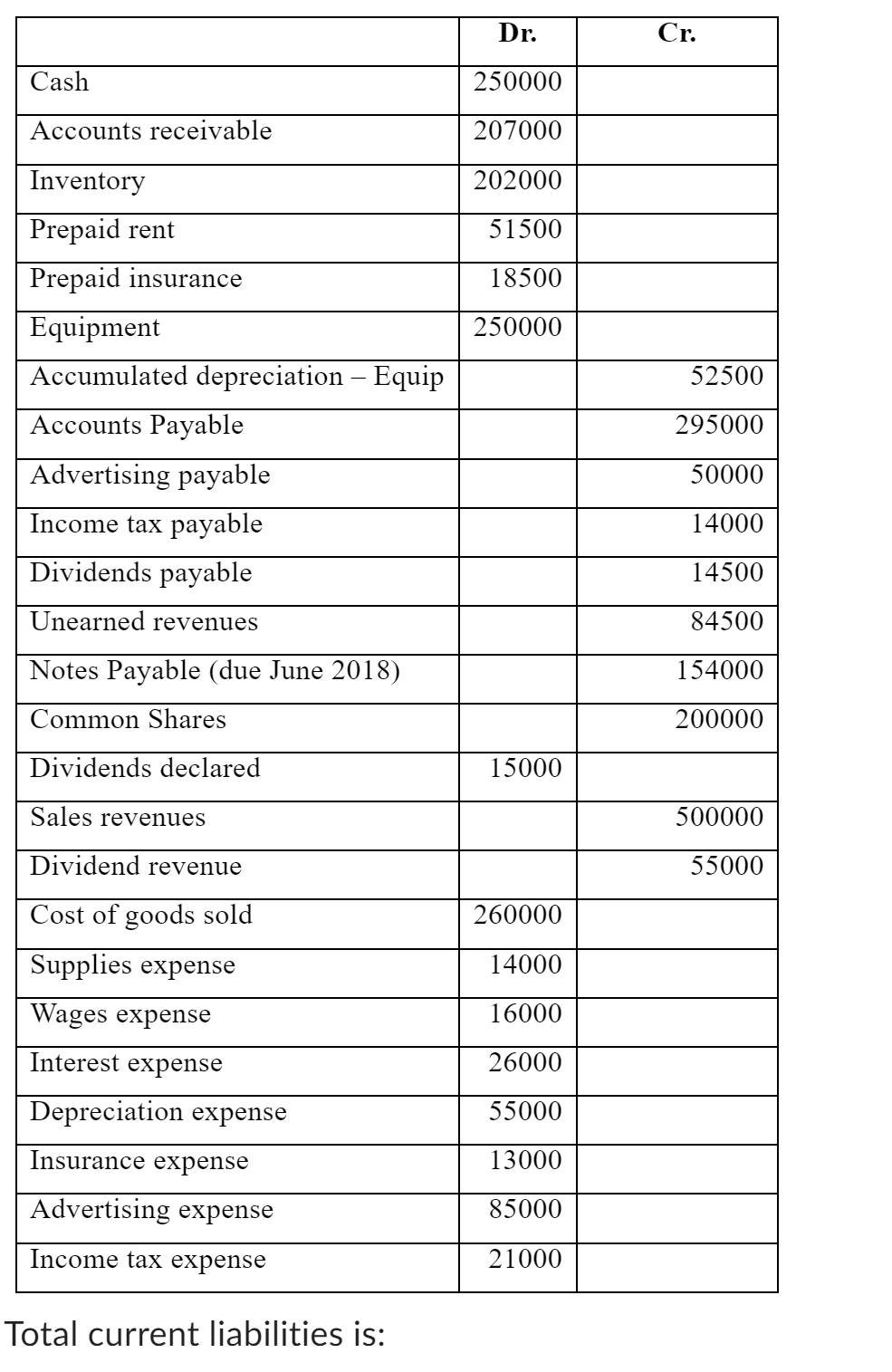

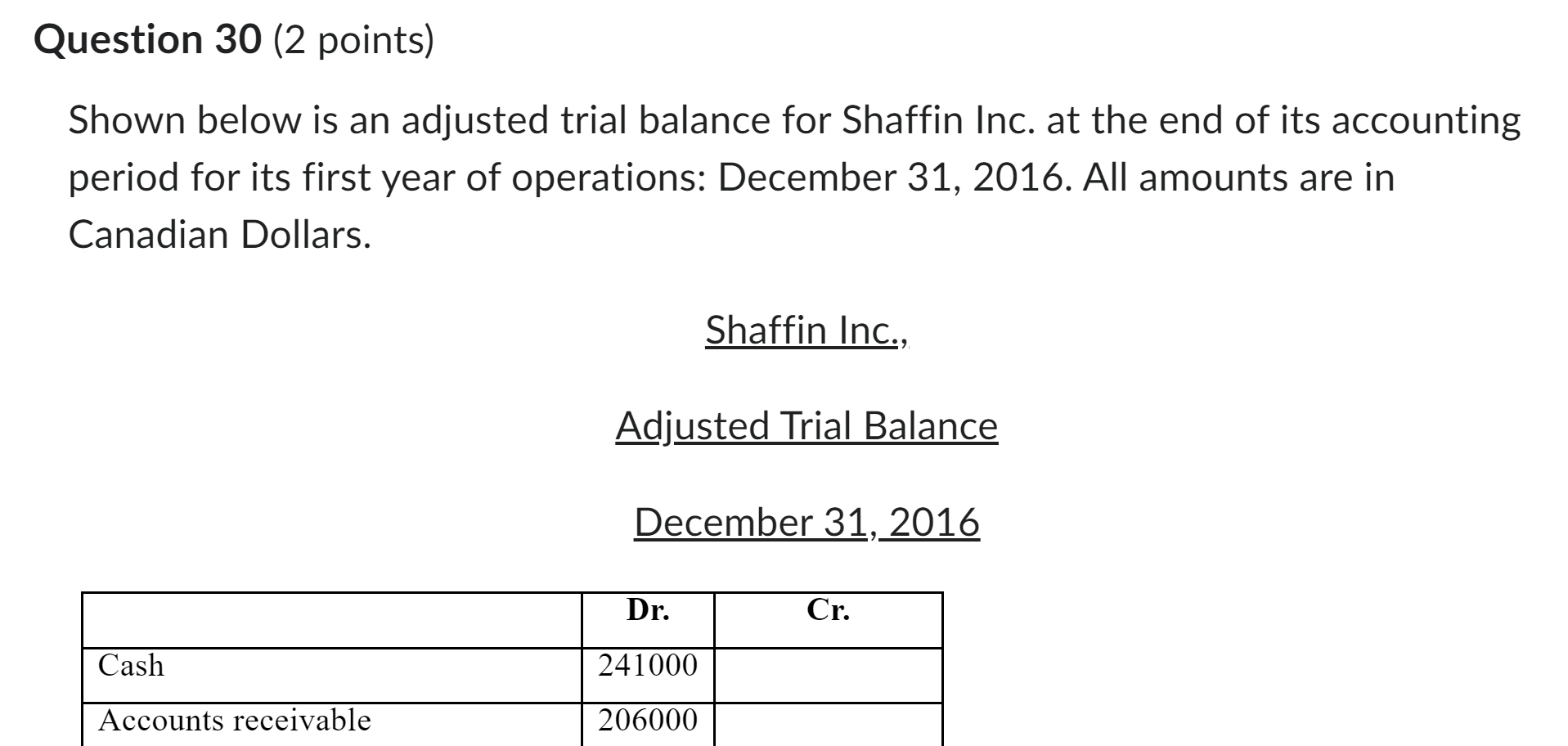

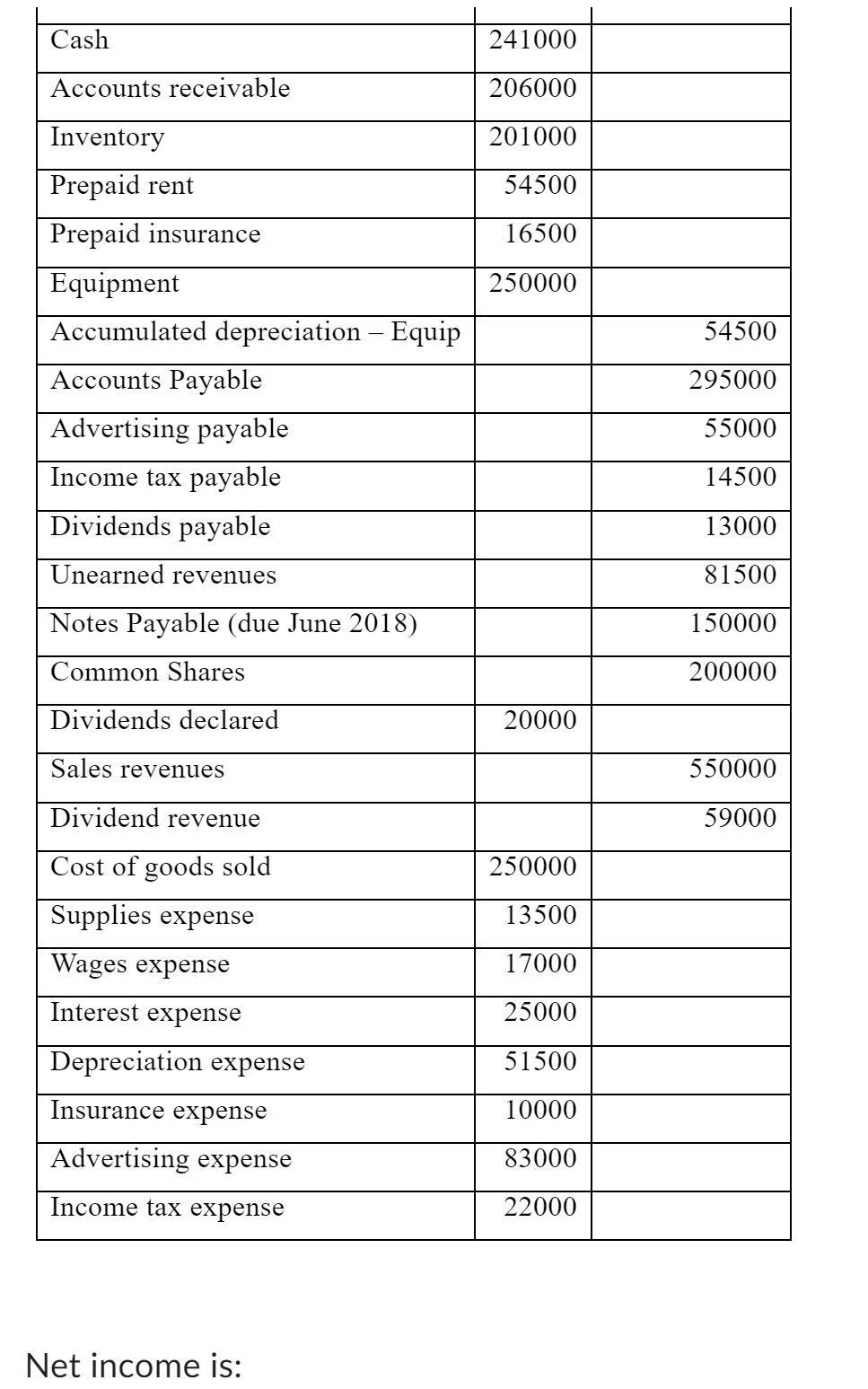

Question: everything is included Question 26 (2 points) An incomplete A/R T-account for the month of July is as follows: Dr. Accounts Receivable Cr. l-July 26000

everything is included

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock