Question: Everything is needed for this problem. But one minor change is required: Compute the value of the inventory under FIFO and LIFO using 500. pter

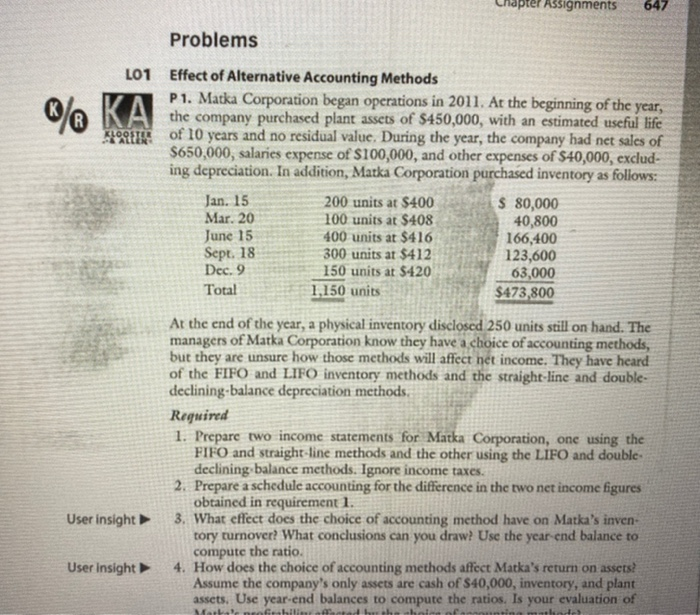

pter Assignments 647 Problems % KA KLOOSTER ALLEN L01 Effect of Alternative Accounting Methods P1. Matka Corporation began operations in 2011. At the beginning of the year, the company purchased plant assets of $450,000, with an estimated useful life of 10 years and no residual value. During the year, the company had net sales of $650,000, salaries expense of $100,000, and other expenses of $40,000, exclud- ing depreciation. In addition, Marka Corporation purchased inventory as follows: Jan. 15 200 units at $400 $ 80,000 Mar. 20 100 units at $408 40,800 June 15 400 units at $416 166,400 Sept. 18 300 units at $412 123,600 Dec. 9 150 units at $420 63,000 Total 1,150 units $473,800 At the end of the year, a physical inventory disclosed 250 units still on hand. The managers of Matka Corporation know they have a choice of accounting methods, but they are unsure how those methods will affect net income. They have heard of the FIFO and LIFO inventory methods and the straight-line and double- declining-balance depreciation methods Reguired 1. Prepare two income statements for Matka Corporation, one using the FIFO and straight-line methods and the other using the LIFO and double declining balance methods. Ignore income taxes. 2. Prepare a schedule accounting for the difference in the two net income figures obtained in requirement 1. 3. What effect does the choice of accounting method have on Matka's inven- tory turnover? What conclusions can you draw? Use the year end balance to compute the ratio. 4. How does the choice of accounting methods affect Matka's return on assets? Assume the company's only assets are cash of $40,000, inventory, and plant assets. Use year-end balances to compute the ratios. Is your evaluation of User insight User Insight Martat Geblinde hoir de

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts