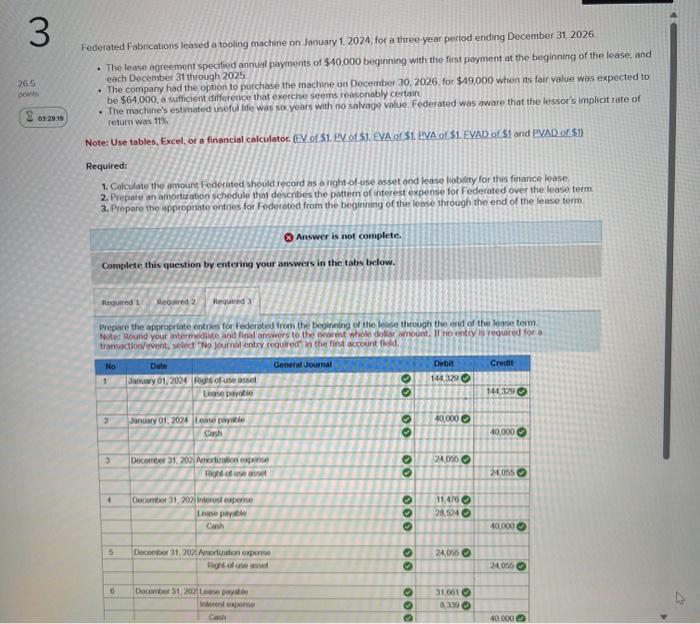

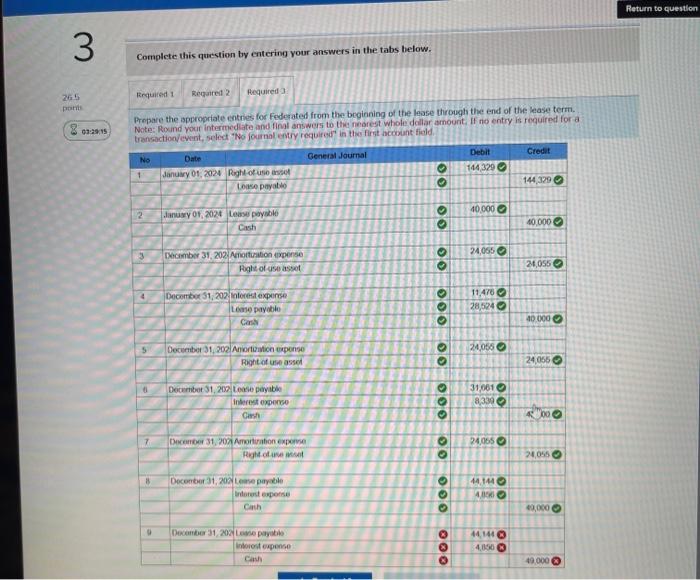

Question: everything is right beside journal entry 9: record the entry to reflect the change from a leased asset to ownership of that asset Federated Fatrications

Federated Fatrications leased a tooling machine on January 1. 2024, for a three-year period ending December 31.2026 - The lease agreement spectiod anmial payments of $40,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. - The company had the option to purchase the machine on December 30,2026 , for $49,000 when its fair value was expected to be $64,000, a sufficient difference that exercise seems reasonably certain - The machine's estmated useful hfe was sa years with no salvage value. Federated was aware that the lessor's implicit rate of return was 118 Note: Use tables, Excel, or a finencial calculator. (NV of S1. EN of S1. EVA of S1. EVA orS1. EVAD or S1 and PVAD of 51] Required: 1. Calculate the omount Federafed should record as onght-of use asset ond lease liobltry for this finance lease 2. Prepare an amprtizabon schedule that describes the pottem of interest expense for Federated over the lease term. 3. Prepare the approptiate enthes for Federoted from the beginning of the lease through the end of the lease term. Q Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the approgriate entries for Federated from the begineing of the lease through the orid of the lease term. Notet Round your intermetiate and final answors to. the bearest wholo dollar amount. II ro entry is required for a Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for Federated from the beginning of the lease through the end of the lease term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts