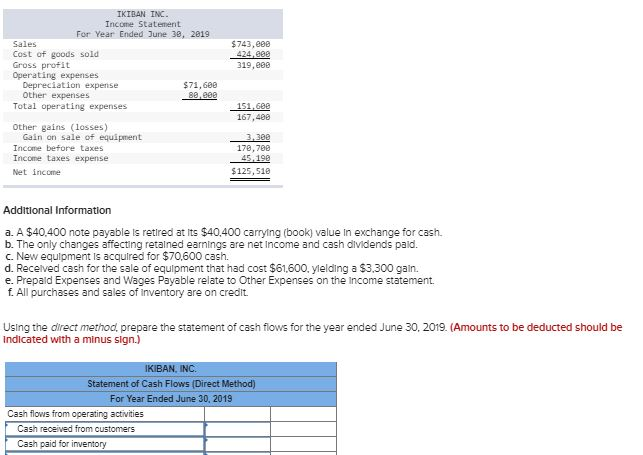

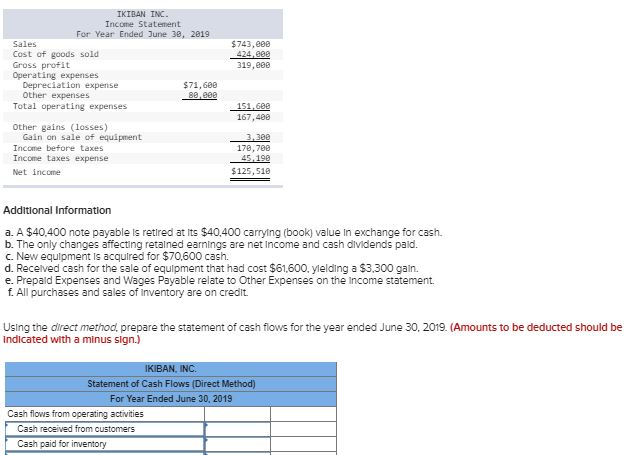

Question: Everything that is given in the question is here. IKTBAN INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross

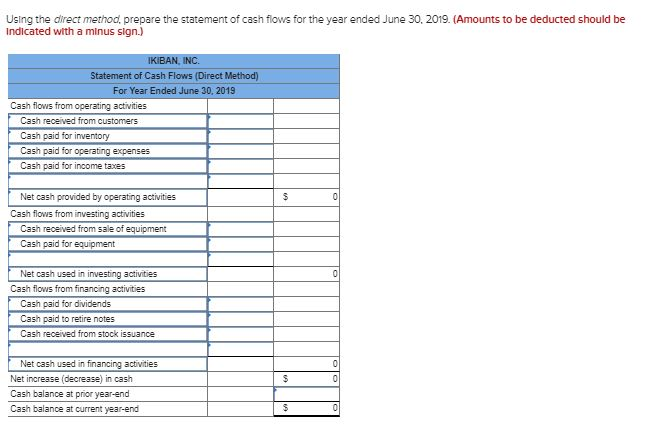

IKTBAN INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $71,680 Other expenses 88,888 Total operating expenses $743,000 424,888 319,00 151,682 167,480 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3,300 170,700 45,198 $125, sie Additional Information a. A $40.400 note payable is retired at its $40,400 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net Income and cash dividends paid. C. New equipment is acquired for $70.600 cash. d. Received cash for the sale of equipment that had cost $61,600. yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities | Cash received from customers Cash paid for inventory IKTBAN INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $71,680 Other expenses 88,888 Total operating expenses $743,000 424,888 319,00 151,682 167,480 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3,300 170,700 45,198 $125, sie Additional Information a. A $40.400 note payable is retired at its $40,400 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net Income and cash dividends paid. C. New equipment is acquired for $70.600 cash. d. Received cash for the sale of equipment that had cost $61,600. yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities | Cash received from customers Cash paid for inventory Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities Cash received from customers Cash paid for inventory Cash paid for operating expenses Cash paid for income taxes $ Net cash provided by operating activities Cash flows from investing activities Cash received from sale of equipment Cash paid for equipment Net cash used in investing activities Cash flows from financing activities Cash paid for dividends Cash paid to retire notes Cash received from stock issuance Net cash used in financing activities Net increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end IKTBAN INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $71,680 Other expenses 88,888 Total operating expenses $743,000 424,888 319,00 151,682 167,480 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3,300 170,700 45,198 $125, sie Additional Information a. A $40.400 note payable is retired at its $40,400 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net Income and cash dividends paid. C. New equipment is acquired for $70.600 cash. d. Received cash for the sale of equipment that had cost $61,600. yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities | Cash received from customers Cash paid for inventory IKTBAN INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $71,680 Other expenses 88,888 Total operating expenses $743,000 424,888 319,00 151,682 167,480 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 3,300 170,700 45,198 $125, sie Additional Information a. A $40.400 note payable is retired at its $40,400 carrying (book) value in exchange for cash b. The only changes affecting retained earnings are net Income and cash dividends paid. C. New equipment is acquired for $70.600 cash. d. Received cash for the sale of equipment that had cost $61,600. yielding a $3,300 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities | Cash received from customers Cash paid for inventory Using the direct method, prepare the statement of cash flows for the year ended June 30, 2019. (Amounts to be deducted should be Indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Direct Method) For Year Ended June 30, 2019 Cash flows from operating activities Cash received from customers Cash paid for inventory Cash paid for operating expenses Cash paid for income taxes $ Net cash provided by operating activities Cash flows from investing activities Cash received from sale of equipment Cash paid for equipment Net cash used in investing activities Cash flows from financing activities Cash paid for dividends Cash paid to retire notes Cash received from stock issuance Net cash used in financing activities Net increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts