Question: ew Go Tools Window Help Final Project FINC 3340 Spring 2020.pdf (page 2 of 3) @ Q Search 4. Using the BS model and the

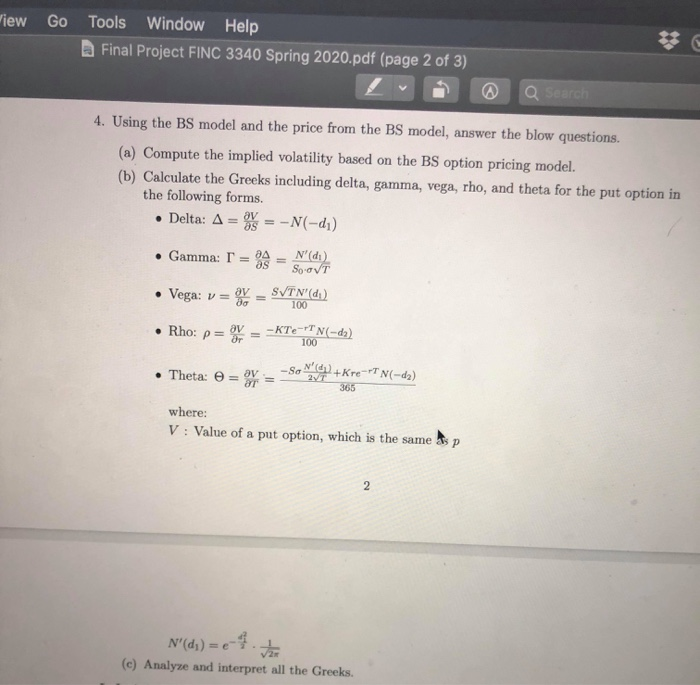

ew Go Tools Window Help Final Project FINC 3340 Spring 2020.pdf (page 2 of 3) @ Q Search 4. Using the BS model and the price from the BS model, answer the blow questions. (a) Compute the implied volatility based on the BS option pricing model. (b) Calculate the Greeks including delta, gamma, vega, rho, and theta for the put option in the following forms. Delta: A = = -N(-d) Gamma: I = 39 = N(di Vega: v= * = SVT N'(d) Rho: p= * = - KTE-TN-da) 100 -Son Theta: 6 = +Kre-TN-ds) 365 where: V: Value of a put option, which is the same sp N'(dj) = -1.the (e) Analyze and interpret all the Greeks. ew Go Tools Window Help Final Project FINC 3340 Spring 2020.pdf (page 2 of 3) @ Q Search 4. Using the BS model and the price from the BS model, answer the blow questions. (a) Compute the implied volatility based on the BS option pricing model. (b) Calculate the Greeks including delta, gamma, vega, rho, and theta for the put option in the following forms. Delta: A = = -N(-d) Gamma: I = 39 = N(di Vega: v= * = SVT N'(d) Rho: p= * = - KTE-TN-da) 100 -Son Theta: 6 = +Kre-TN-ds) 365 where: V: Value of a put option, which is the same sp N'(dj) = -1.the (e) Analyze and interpret all the Greeks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts