Question: ew Insert ForTools Add-ons Help Last edit was made seconds ago by Tony Gonzalez 100% Normal text Arial 11 B TUA - 15 - E-EEX

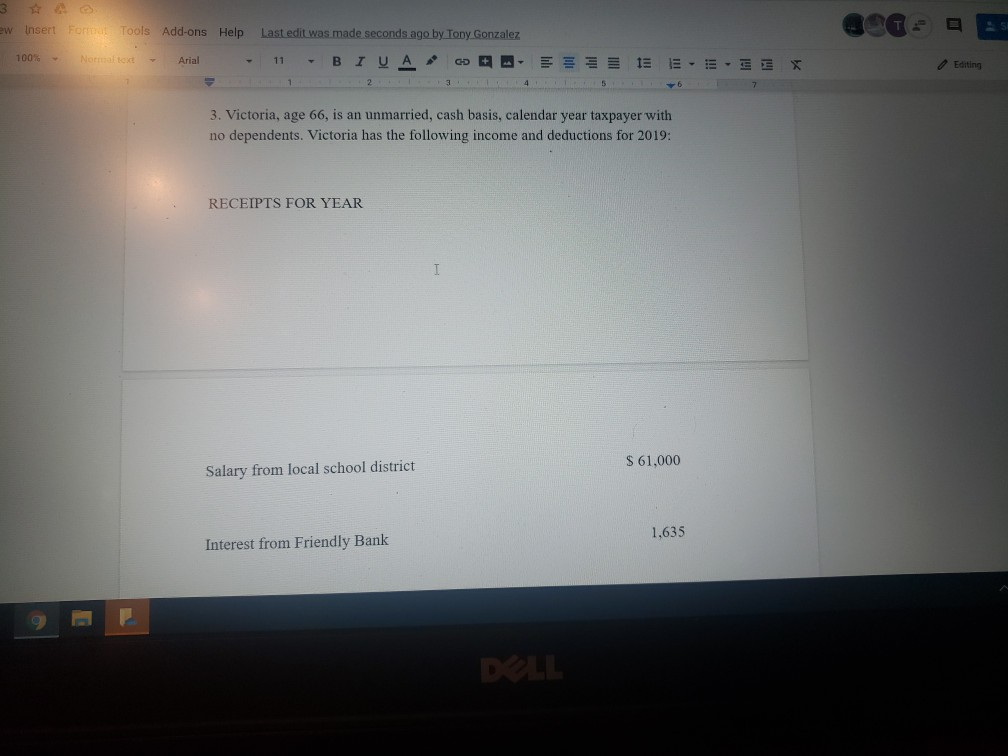

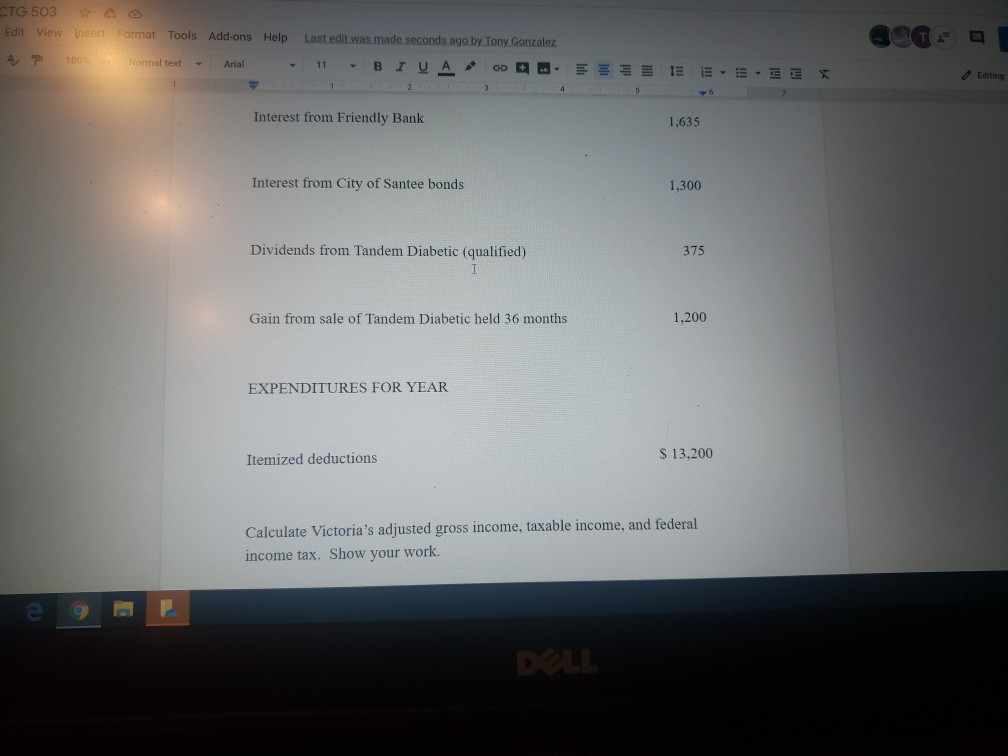

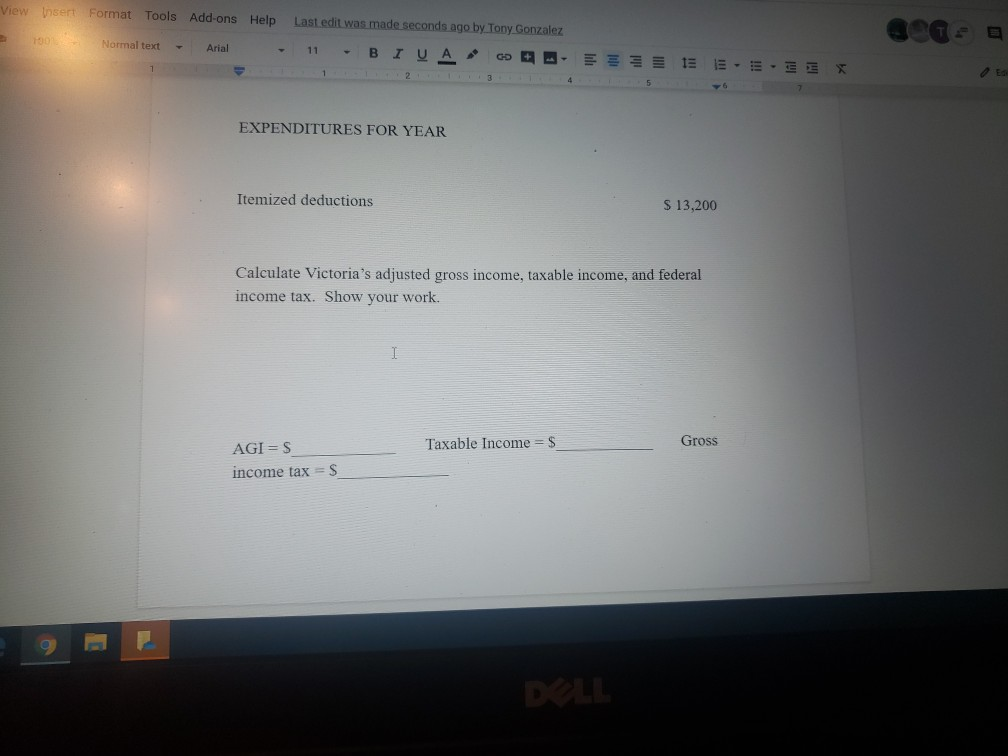

ew Insert ForTools Add-ons Help Last edit was made seconds ago by Tony Gonzalez 100% Normal text Arial 11 B TUA - 15 - E-EEX Editing 1 4 3. Victoria, age 66, is an unmarried, cash basis, calendar year taxpayer with no dependents. Victoria has the following income and deductions for 2019: RECEIPTS FOR YEAR I $ 61,000 Salary from local school district 1,635 Interest from Friendly Bank DLL CTG 503 Edit View insert Format Tools Add-ons Help Last edit was made seconds ago by Tony Gonzalez AP 100 Normal text Arial 11 B TUA GD + E 13 EE-EE Editing 1 Interest from Friendly Bank 1.635 Interest from City of Santee bonds 1,300 Dividends from Tandem Diabetic (qualified) 375 Gain from sale of Tandem Diabetic held 36 months 1.200 EXPENDITURES FOR YEAR Itemized deductions S 13.200 Calculate Victoria's adjusted gross income, taxable income, and federal income tax. Show your work. DALL View Insert Format Tools Add-ons Help Last edit was made seconds ago by Tony Gonzalez HD Normal text Arial 11 BIU 13 E - EX 3 EXPENDITURES FOR YEAR Itemized deductions $ 13,200 Calculate Victoria's adjusted gross income, taxable income, and federal income tax. Show your work. Taxable Income S Gross AGI=S income tax = S DLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts