Question: ew Roman 10 AaBbcel AaBbch. AaBbce Aabel Aabe AaBb tabelabel Didascalia Enlaces Enter Parte MULTIPLE CHOICE QUESTIONS: Choose the one alternative that best completes the

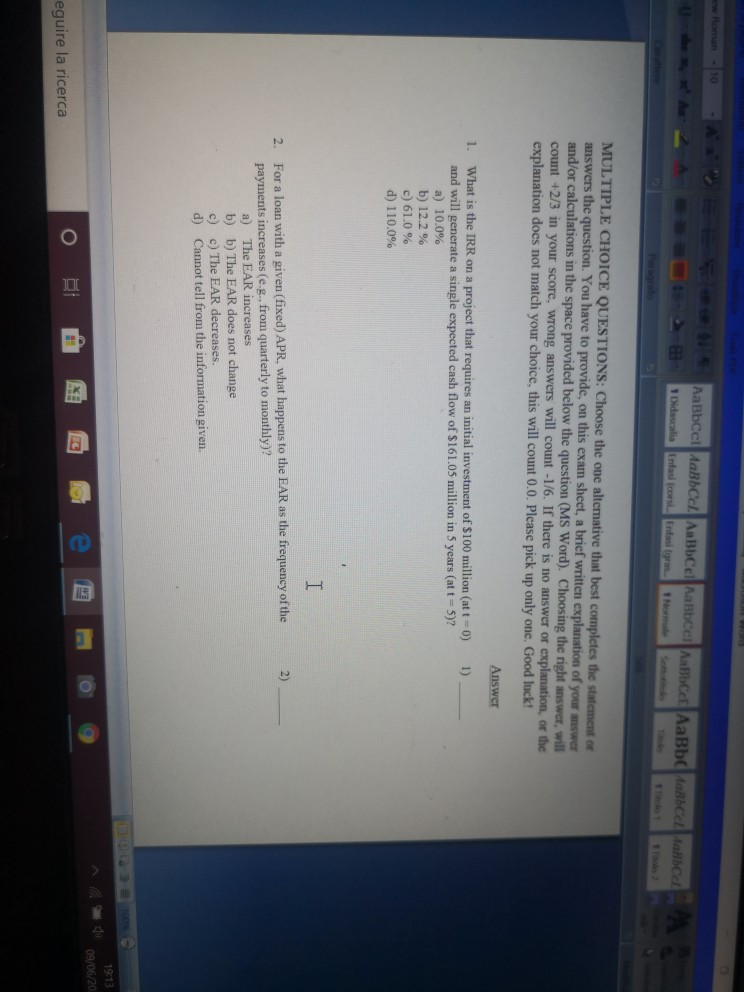

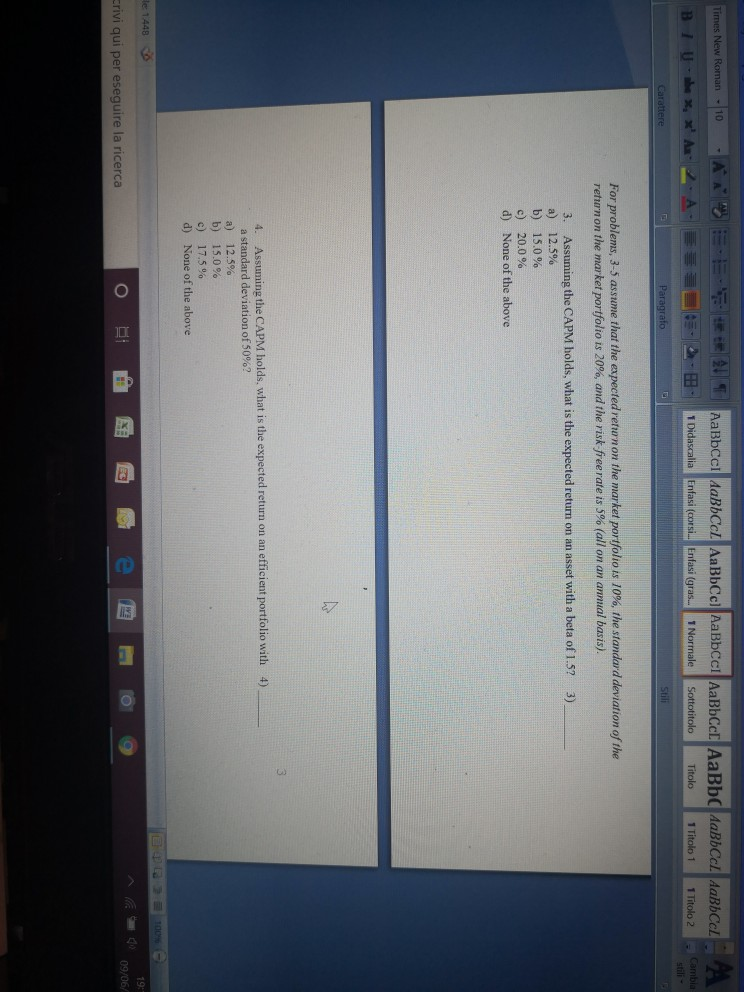

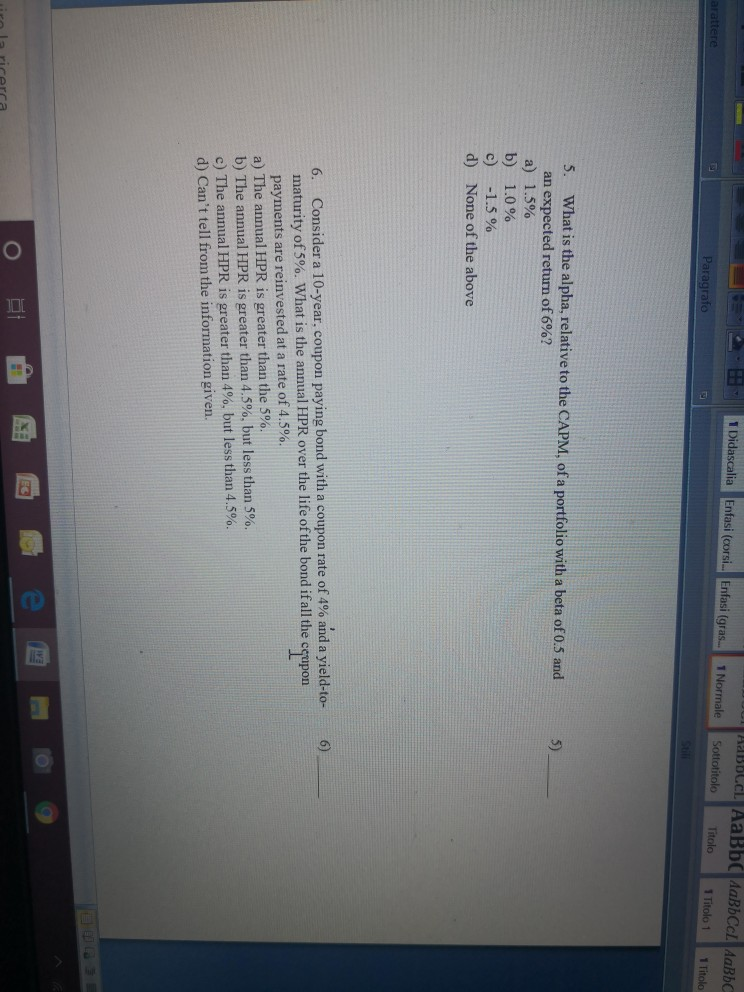

ew Roman 10 AaBbcel AaBbch. AaBbce Aabel Aabe AaBb tabelabel Didascalia Enlaces Enter Parte MULTIPLE CHOICE QUESTIONS: Choose the one alternative that best completes the statement or answers the question. You have to provide on this exam sheet, a brief written explanation of your answer and/or calculations in the space provided below the question (MS Word). Choosing the right answer, will count +2/3 in your score, wrong answers will count-1/6. If there is no answer or explanation, or the explanation does not match your choice, this will count 0.0. Please pick up only one. Good luck! Answer 1) 1. What is the IRR on a project that requires an initial investment of $100 million (att-0) and will generate a single expected cash flow of $161.05 million in 5 years (at t=5)? a) 10.0% b) 12.2 % c) 61.0% d) 110.0% I 2) 2. For a loan with a given (fixed) APR, what happens to the EAR as the frequency of the payments increases (e.g., from quarterly to monthly)? a) The EAR increases b) b) The EAR does not change c) c) The EAR decreases. d) Cannot tell from the information given. 19:13 09/06/2013 O ot eguire la ricerca 1 Didascalia Enfasi (corsi... Enfasi (gras... Abbuch AaBb AaBbCcl AaBbc Sottotitolo Titolo 1 Titolo 1 1 Titolo arattere 1 Normale Paragrafo 5. What is the alpha, relative to the CAPM, of a portfolio with a beta of 0.5 and an expected return of 6%? a) 1.5% b) 1.0% c) -1.5 % d) None of the above 6) 6. Consider a 10-year,coupon paying bond with a coupon rate of 4% and a yield-to- maturity of 5%. What is the annual HPR over the life of the bond if all the payments are reinvested at a rate of 4.5%. coupon a) The annual HPR is greater than the 5%. b) The annual HPR is greater than 4.5%, but less than 5%. c) The annual HPR is greater than 4%. but less than 4.5%. d) Can't tell from the information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts