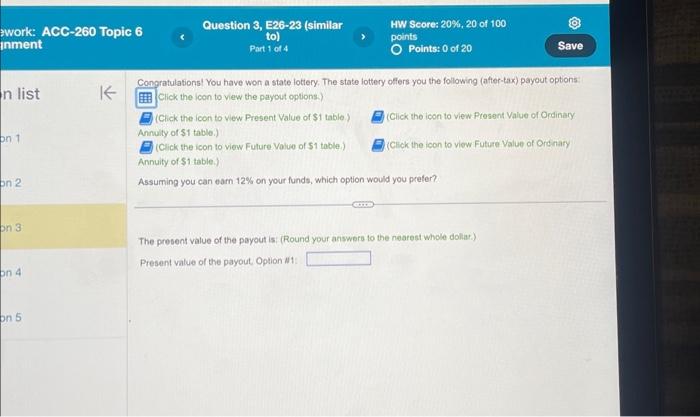

Question: ework: ACC-260 Topic 6 inment n list on 1 on 2 on 3 on 4 on 5 K Question 3, E26-23 (similar to) Part 1

Conqratulations! You have won a state lotiery. The state lottery offers you the following (after-tax) payout options: Click the icon to view the payout options.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Opdinary Anmuity of $1 table.) (Click the icon to view Future Voluo of $1 table.) (Click the icon to view Future Value of Orenary Annuity of $1 table.) Assuming you can earn 12% on your funds, which option would you prefer? The present value of the payout is: (Round your answers to the nearest whole dollar.) Present value of the payout Option N1: Conqratulations! You have won a state lotiery. The state lottery offers you the following (after-tax) payout options: Click the icon to view the payout options.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Opdinary Anmuity of $1 table.) (Click the icon to view Future Voluo of $1 table.) (Click the icon to view Future Value of Orenary Annuity of $1 table.) Assuming you can earn 12% on your funds, which option would you prefer? The present value of the payout is: (Round your answers to the nearest whole dollar.) Present value of the payout Option N1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts