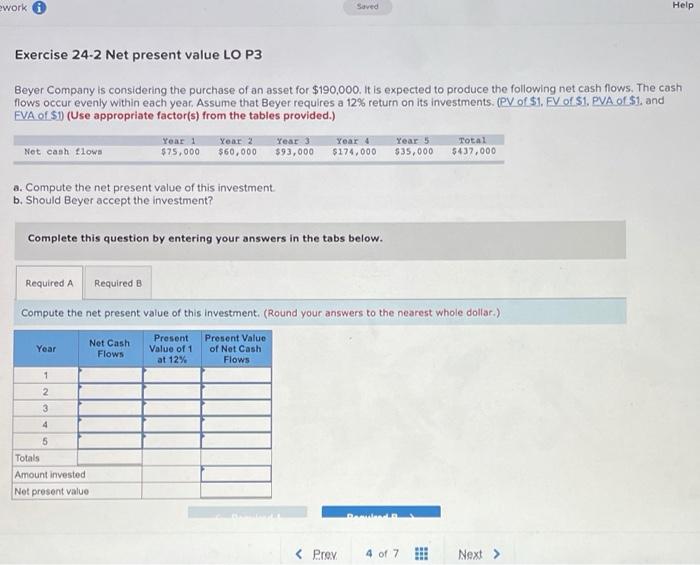

Question: ework Saved Help Help Exercise 24-2 Net present value LO P3 Beyer Company is considering the purchase of an asset for $190,000. It is expected

ework Saved Help Help Exercise 24-2 Net present value LO P3 Beyer Company is considering the purchase of an asset for $190,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Assume that Beyer requires a 12% return on its investments. (PV of $1. FV of $1. PVA of $1. and EVA of $1 (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flown $75,000 $60,000 $93,000 $174,000 $35,000 $437,000 Total a. Compute the net present value of this investment b. Should Beyer accept the investment? Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this investment (Round your answers to the nearest whole dollar) Present Present Value Year Net Cash Flows Value of 1 at 12% of Net Cash Flows 1 2 3 4 5 Totals Amount invested Not present value D Complete this question by entering your answers in the tabs below. Required A Required B Should Beyer accept the investment? Should Beyer accept the investment?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts