Question: ework Tools TET Assignment com 75.00 Submit Assignment for Grading Save Questions Problem 8.01 Expected Return) 2 o Check My Work O 4 . 6

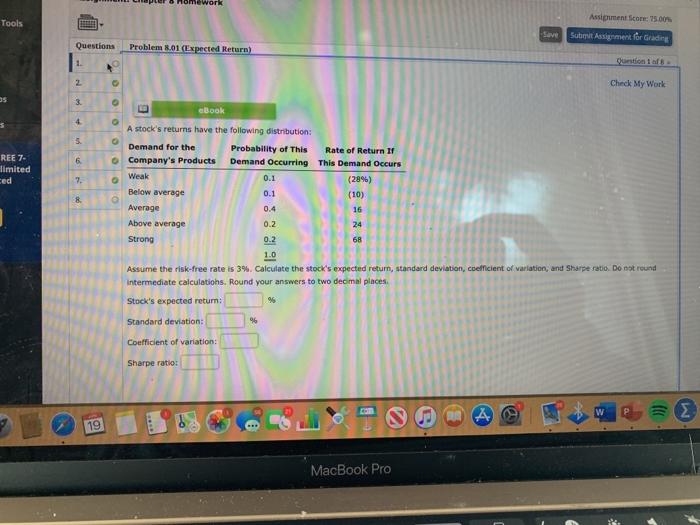

ework Tools TET Assignment com 75.00 Submit Assignment for Grading Save Questions Problem 8.01 Expected Return) 2 o Check My Work O 4 . 6 REE 7. limited ced 7. 0 0 8 eBook A stock's returns have the following distribution: Demand for the Probability of this Rate of Return 11 Company's Products Demand Occurring This Demand Occurs Weak 0.1 (28%) Below average 0.1 (10) Average 0.4 16 Above average 0.2 24 Strong 0.2 68 1.0 Assume the risk-free rate is 3% Calculate the stock's expected return, standard deviation, coefficient of variation, and Sharpe ratio. Do not round Intermediate calculations. Round your answers to two decimal places Stock's expected retum: 9 Standard deviation: 96 Coefficient of variations: Sharpe ratio: 19 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts