Question: ex 1: ex 2: ex 3 Differential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. Indicated the

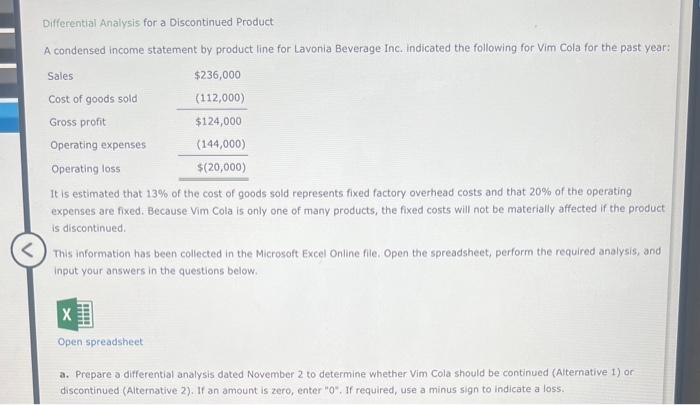

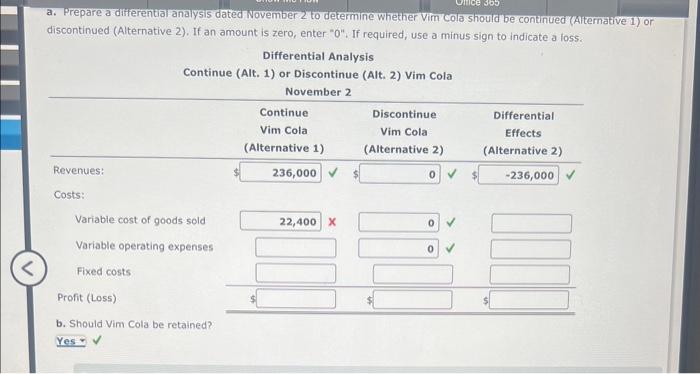

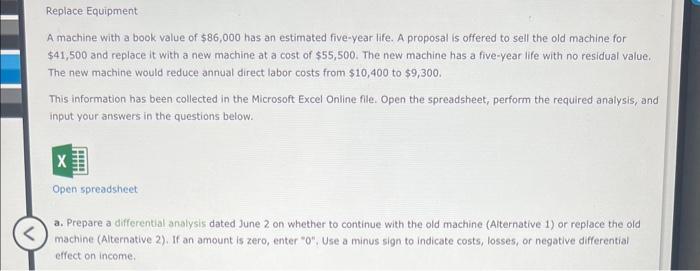

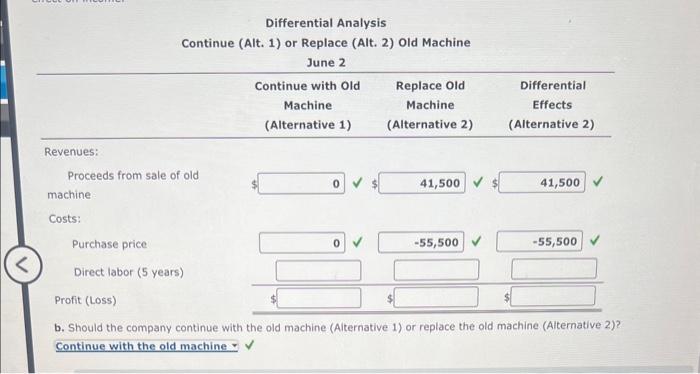

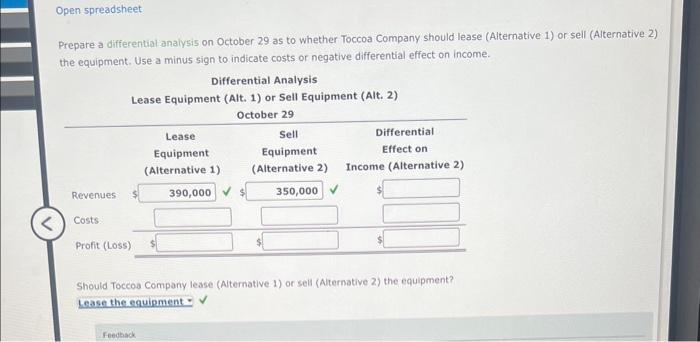

Differential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. Indicated the following for Vim Cola for the past year: It is estimated that 13% of the cost of goods sold represents fixed factory overhead costs and that 20% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Prepare a differential analysis dated November 2 to determine whether Vim Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0*. If required, use a minus sign to indicate a loss. a. Prepare a differential analysis dated November 2 to determine whether Virm cola should be contanued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis A machine with a book value of $86,000 has an estimated five-year life. A proposal is offered to sell the old machine for $41,500 and replace it with a new machine at a cost of $55,500. The new machine has a five-year life with no residual value. The new machine would reduce annual direct labor costs from $10,400 to $9,300. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Prepare a differential analysis dated June 2 on whether to continue with the old machine (Aiternative 1 ) or replace the old machine (Alternative .2). If an amount is zero, enter " 0 ". Use a minus sign to indicate costs, losses, or negative differential effect on income. Differential Analysis Continue (Alt. 1) or Replace (Alt. 2) Old Machine b. Should the company continue with the old machine (Alternative 1) or replace the old machine (Alternative 2)? Toccoa Company owns equipment with a cost of $550,000 and accumulated depreciation of $390,000 that can be sold for $350,000, less a 5% sales commission. Alternatively, Toccoa Company can lease the equipment for four years for a total of $390,000, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Toccoa Company on the equipment would total $41,000 over the four-year lease. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Prepare a differential analyas on October 29 as to whether Toccoa Company should lease (Alternative 1) or sell (Alternative 2) the equipment. Use a minus sign to indicate costs or negative differential effect on income. Prepare a differential analysis on October 29 as to whether Toccoa Company should lease (Alternative 1) or sell (Alternative 2) the equipment. Use a minus sign to indicate costs or negative differential effect on income. nichanntisi Analueie Should Toccoa Company lease (Aiternative 1) or sell (Alternative 2) the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts