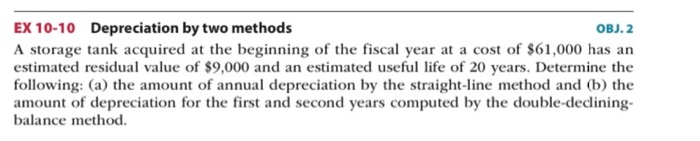

Question: EX 10-10 Depreciation by two methods OBJ. 2 A storage tank acquired at the beginning of the fiscal year at a cost of $61,000 has

EX 10-10 Depreciation by two methods OBJ. 2 A storage tank acquired at the beginning of the fiscal year at a cost of $61,000 has an estimated residual value of $9,000 and an estimated useful life of 20 years. Determine the following: (a) the amount of annual depreciation by the straight-line method and (b) the amount of depreciation for the first and second years computed by the double-declining- balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts