Question: EX 11-14 I need help understanding and resolving please!! tale of s%2 why or whhy issued $25,000,000 of fi fective) interest rate of 9%, Determine

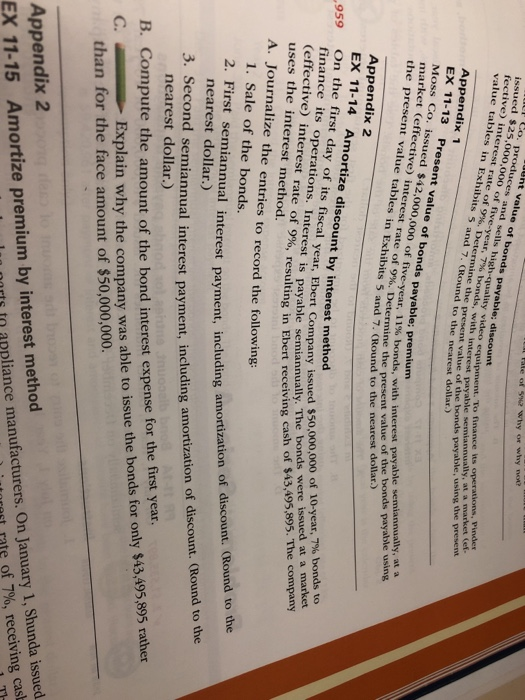

tale of s%2 why or whhy issued $25,000,000 of fi fective) interest rate of 9%, Determine the present value,dollar.) value tables in Exhibits 5 and 7. (Round to the neares duces and sells high-qualityv ve-year, 7% bonds, y video equipment. To finance its operationms with interest est payable semiannually, at a market (ef of the bonds payable, using the present Appendix 1 EX 11-13 Present value of bonds payable: pre Moss Co. issued $42,000,000 ma rket (effective) um at a of five-year, 11% bonds, with interest payable semian 1 interest rate of 9%. Dete the present value table rmine the present value of the bonds payable using n Exhibits 5 and 7. (Round to the nearest dollar.) Appendix 2 EX 11-14 On the first day of its finance its operations. Interest is payable semiannualy (effective) interest rate of 9%, resulting in Ebert uses the interest method. Amortize discount by interest method scar year, Ebert Company issued $50,000,000 of 10-year, 7% bonds, to is payable semiannually. The bonds were issued at a market 959 Ebert Company cash of $A345 A. Journalize the entries to record the following: 1. Sale of the bonds. 2. First semiannual interes t payment, including amortization of discount. (Round to the nearest dollar.) 3. nual interest payment, including amortization of discount. (Round to the B. Compute the amount of the bond interest expense for the first year C. Explain why the company was able to issue the bonds for only $43,495895 rather nearest dollar.) than for the face amount of $50,000,000. Appendix 2 EX 11-15 Amortize premium by interest method orts to appliance manufacturers. On January 1, Shunda issued -terest rate of 7%, receiving cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts