Question: EX 15-1 Classifying costs as materials, labor, or factory overhead Obj. 2 Indicate whether each of the following costs of an automobile manufacturer would be

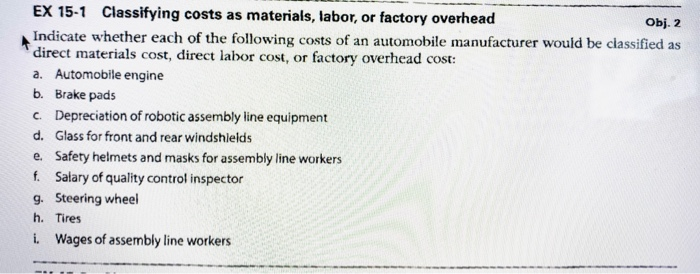

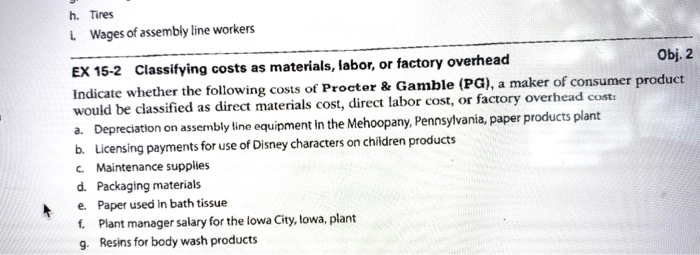

EX 15-1 Classifying costs as materials, labor, or factory overhead Obj. 2 Indicate whether each of the following costs of an automobile manufacturer would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Automobile engine b. Brake pads c. Depreciation of robotic assembly line equipment d. Glass for front and rear windshields e Safety helmets and masks for assembly line workers f. Salary of quality control inspector g. Steering wheel h. Tires i. Wages of assembly line workers h. Tires Wages of assembly line workers EX 15-2 Classifying costs as materials, labor, or factory overhead Obj. 2 Indicate whether the following costs of Procter & Gamble (PG), a maker of consumer product would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Depreciation on assembly line equipment in the Mehoopany, Pennsylvania, paper products plant b. Licensing payments for use of Disney characters on children products C. Maintenance supplies d. Packaging materials e Paper used in bath tissue f. Plant manager salary for the lowa City, lowa, plant g. Resins for body wash products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts