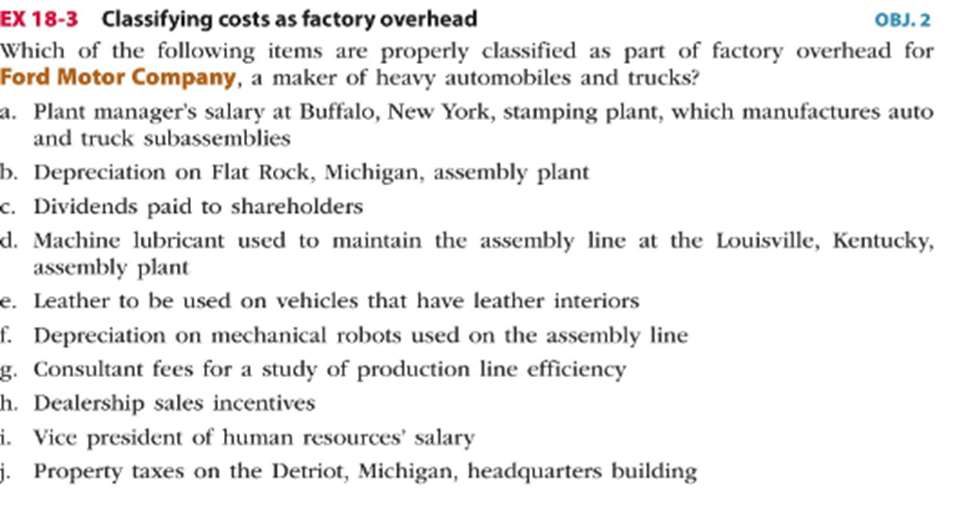

Question: EX 18-3 Classifying costs as factory overhead OBJ. 2 Which of the following items are properly classified as part of factory overhead for Ford Motor

EX 18-3 Classifying costs as factory overhead OBJ. 2 Which of the following items are properly classified as part of factory overhead for Ford Motor Company, a maker of heavy automobiles and trucks? a. Plant manager's salary at Buffalo, New York, stamping plant, which manufactures auto and truck subassemblies b. Depreciation on Flat Rock, Michigan, assembly plant c. Dividends paid to shareholders d. Machine lubricant used to maintain the assembly line at the Louisville, Kentucky, assembly plant e. Leather to be used on vehicles that have leather interiors f. Depreciation on mechanical robots used on the assembly line g. Consultant fees for a study of production line efficiency h. Dealership sales incentives Vice president of human resources' salary Property taxes on the Detriot, Michigan, headquarters building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts