Question: Ex 4-47 and 4-48 Saved Help Save & Exit Submit Check my work mode: This shows what is correct or incorrect for the work you

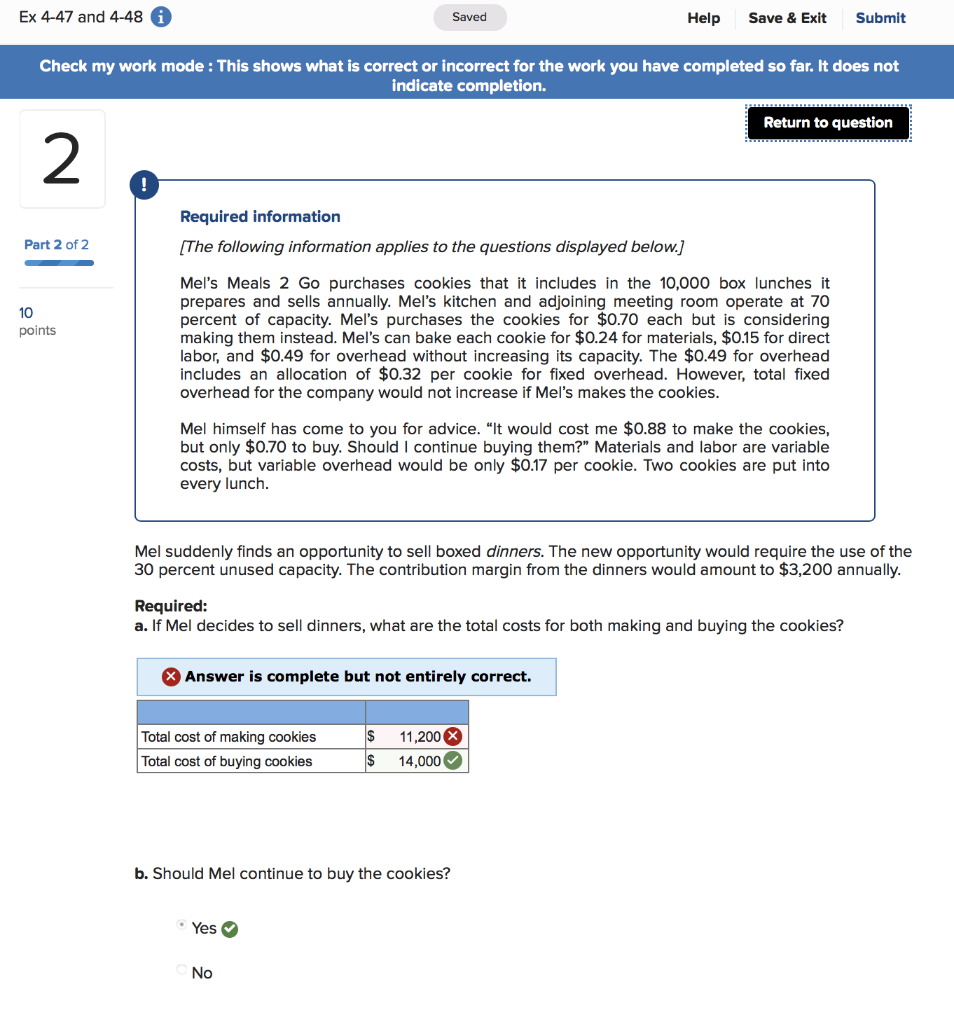

Ex 4-47 and 4-48 Saved Help Save & Exit Submit Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 2 Required information [The following information applies to the questions displayed below.) Part 2 of 2 10 points Mel's Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate at 70 percent of capacity. Mel's purchases the cookies for $0.70 each but is considering making them instead. Mel's can bake each cookie for $0.24 for materials, $0.15 for direct labor, and $0.49 for overhead without increasing its capacity. The $0.49 for overhead includes an allocation of $0.32 per cookie for fixed overhead. However, total fixed overhead for the company would not increase if Mel's makes the cookies. Mel himself has come to you for advice. "It would cost me $0.88 to make the cookies, but only $0.70 to buy. Should I continue buying them?" Materials and labor are variable costs, but variable overhead would be only $0.17 per cookie. Two cookies are put into every lunch. Mel suddenly finds an opportunity to sell boxed dinners. The new opportunity would require the use of the 30 percent unused capacity. The contribution margin from the dinners would amount to $3,200 annually. Required: a. If Mel decides to sell dinners, what are the total costs for both making and buying the cookies? Answer is complete but not entirely correct. Total cost of making cookies Total cost of buying cookies $ $ 11,200 X 14,000 b. Should Mel continue to buy the cookies? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts