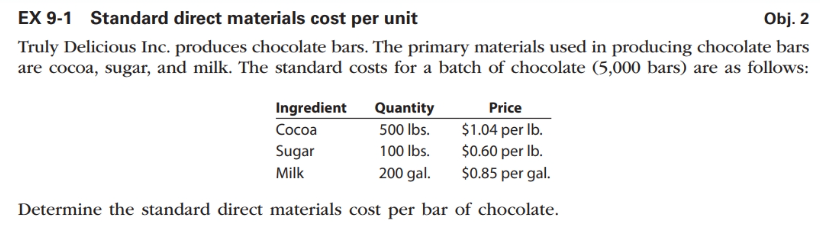

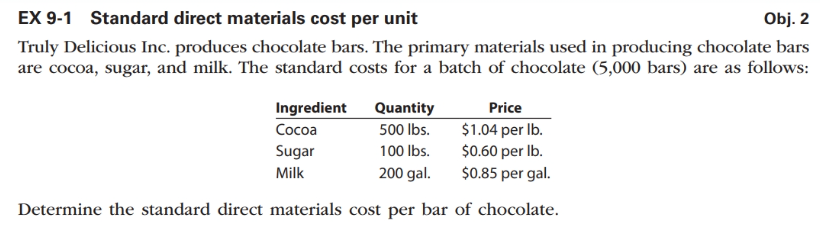

Question: EX 9-1 Standard direct materials cost per unit Obj. 2 Truly Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are

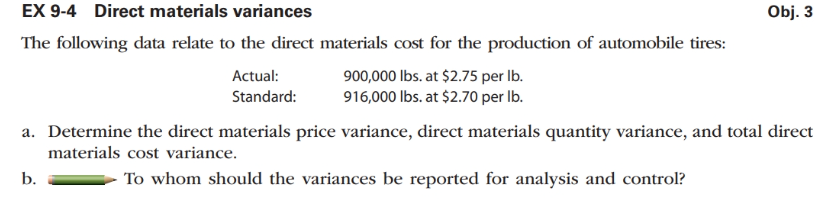

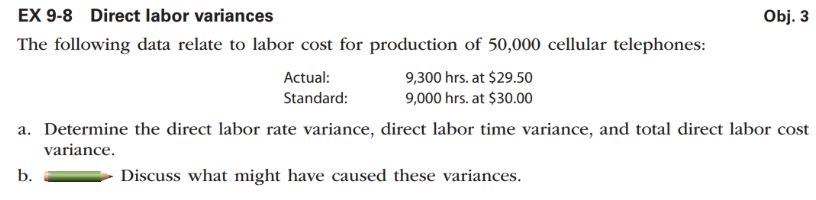

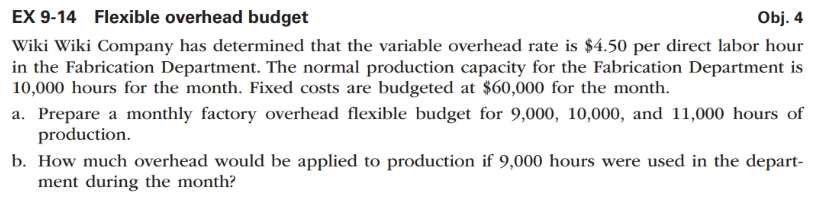

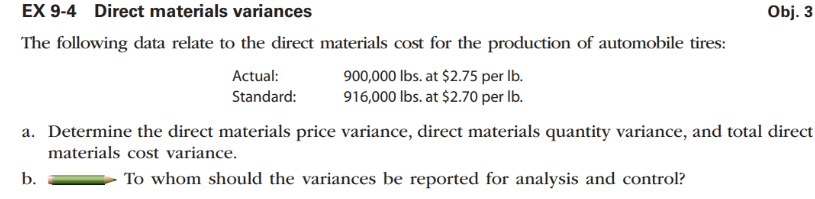

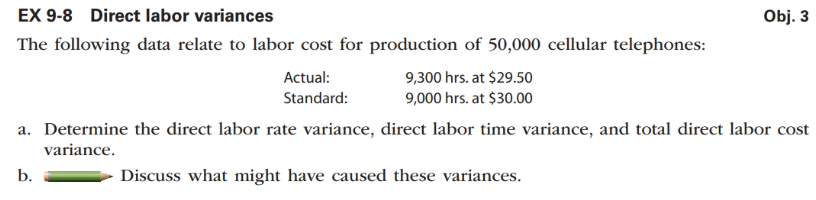

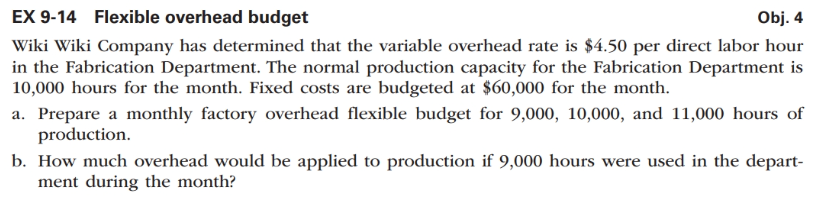

EX 9-1 Standard direct materials cost per unit Obj. 2 Truly Delicious Inc. produces chocolate bars. The primary materials used in producing chocolate bars are cocoa, sugar, and milk. The standard costs for a batch of chocolate (5,000 bars) are as follows: Ingredient Quantity Price Cocoa 500 lbs. $1.04 per lb. Sugar 100 lbs. $0.60 per lb. Milk 200 gal. $0.85 per gal. Determine the standard direct materials cost per bar of chocolate.EX 9-4 Direct materials variances Obj. 3 The following data relate to the direct materials cost for the production of automobile tires: Actual: 900,000 lbs. at $2.75 per lb. Standard: 916,000 lbs. at $2.70 per lb. a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. b. To whom should the variances be reported for analysis and control?EX 9-8 Direct labor variances Obj. 3 The following data relate to labor cost for production of 50,000 cellular telephones: Actual: 9,300 hrs. at $29.50 Standard: 9,000 hrs. at $30.00 a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. b. Discuss what might have caused these variances.EX 9-14 Flexible overhead budget Obj. 4 Wiki Wiki Company has determined that the variable overhead rate is $4.50 per direct labor hour in the Fabrication Department. The normal production capacity for the Fabrication Department is 10,000 hours for the month. Fixed costs are budgeted at $60,000 for the month. a. Prepare a monthly factory overhead flexible budget for 9,000, 10,000, and 11,000 hours of production. b. How much overhead would be applied to production if 9,000 hours were used in the depart- ment during the month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts