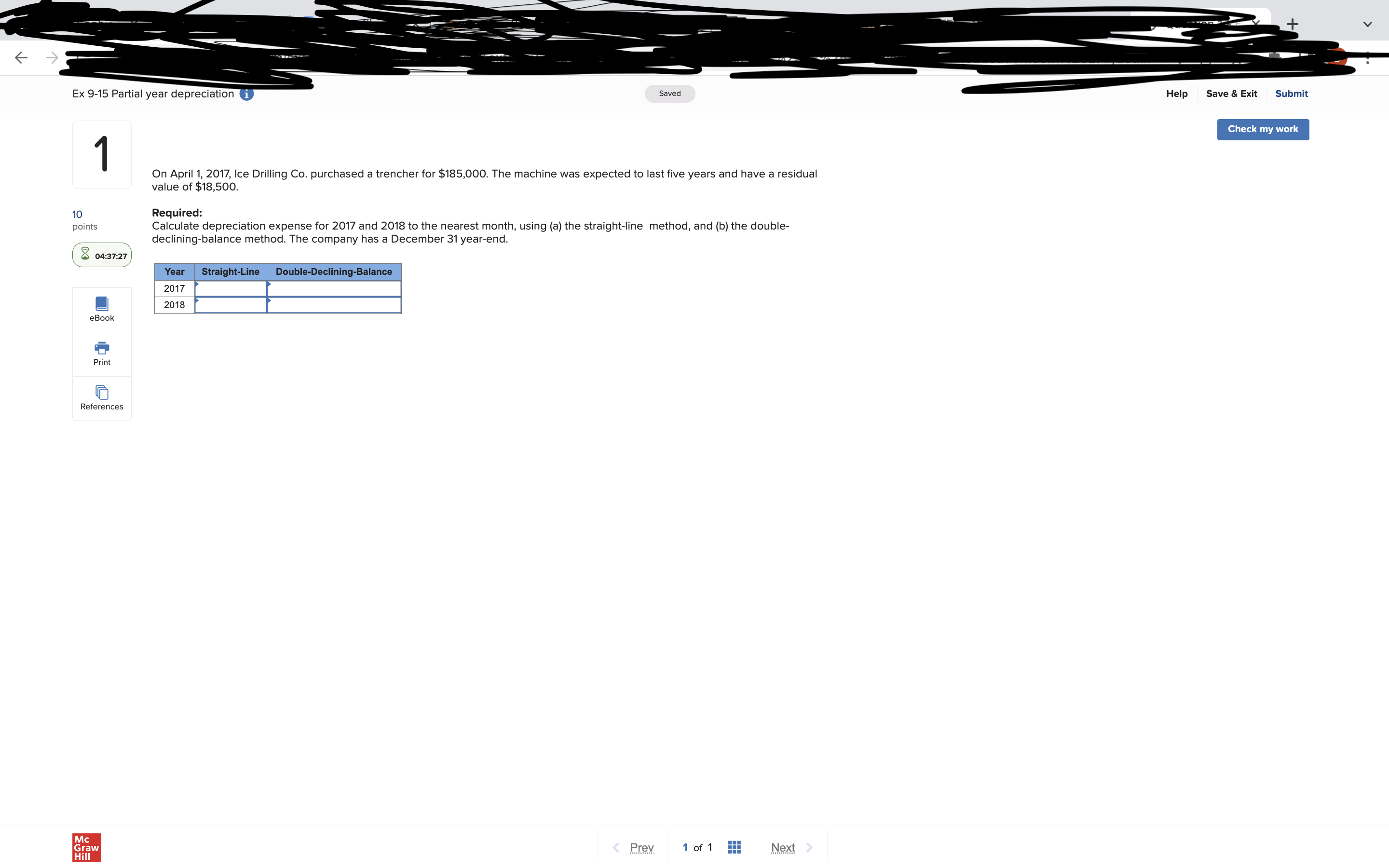

Question: + Ex 9-15 Partial year depreciation i Saved Help Save & Exit Submit Check my work On April 1, 2017, Ice Drilling Co. purchased a

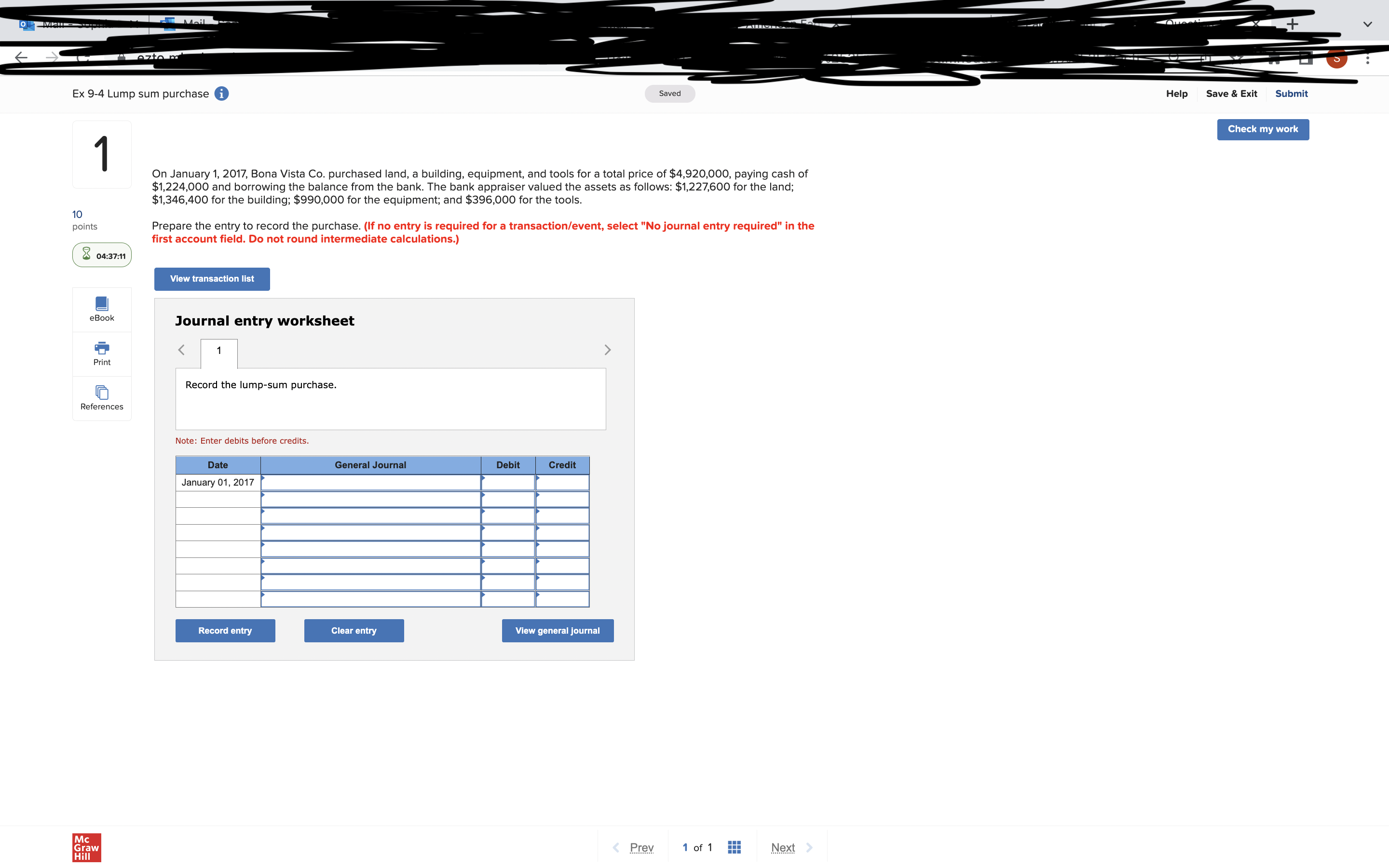

+ Ex 9-15 Partial year depreciation i Saved Help Save & Exit Submit Check my work On April 1, 2017, Ice Drilling Co. purchased a trencher for $185,000. The machine was expected to last five years and have a residual value of $18,500. 10 Required: points Calculate depreciation expense for 2017 and 2018 to the nearest month, using (a) the straight-line method, and (b) the double- declining-balance method. The company has a December 31 year-end. 04:37:27 Year Straight-Line Double-Declining-Balance 2017 2018 Book Print References ozto m Ex 9-4 Lump sum purchase i Saved Help Save & Exit Submit Check my work On January 1, 2017, Bona Vista Co. purchased land, a building, equipment, and tools for a total price of $4,920,000, paying cash of $1,224,000 and borrowing the balance from the bank. The bank appraiser valued the assets as follows: $1,227,600 for the land; $1,346,400 for the building; $990,000 for the equipment; and $396,000 for the tools. 10 points Prepare the entry to record the purchase. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) 804:37:11 View transaction list Book Journal entry worksheet Print Record the lump-sum purchase. References Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2017 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts