Question: Exam 1 (35 points in total, one point each question) his e 1. A( ) is the right authorized by a stockholder to allow other

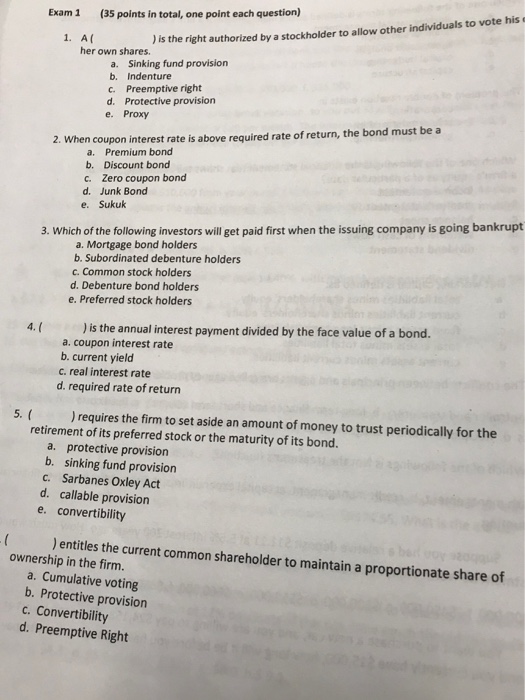

Exam 1 (35 points in total, one point each question) his e 1. A( ) is the right authorized by a stockholder to allow other individuals to vote her own shares. a. Sinking fund provision b. Indenture c. Preemptive right d. Protective provision e. Proxy 2. When coupon interest rate is above required rate of return, the bond must be a a. Premium bond b. Discount bond c. Zero coupon bond d. Junk Bond e. Sukuk 3. Which of the following investors will get paid first when the issuing company is going bankrupt a. Mortgage bond holders b. Subordinated debenture holders c. Common stock holders d. Debenture bond holders e. Preferred stock holders 4.() ) is the annual interest payment divided by the face value of a bond. a. coupon interest rate b. current yield c. real interest rate d. required rate of return 5. requires the firm to set aside an amount of money to trust periodically for the retirement of its preferred stock or the maturity of its bond. a. protective provision b. sinking fund provision c. Sarbanes Oxley Act d. callable provision e. convertibility (entitles the current common shareholder to maintain a proportionate share of ownership in the firm. a. Cumulative voting b. Protective provision c. Convertibility d. Preemptive Right

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts