Question: Exam 1 BFNT - Blackboard Lear X WP NWP Assessment Player UI App X + C 8 https://education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=e572ae8c-4fc3-4918-8558-a46e68 Exam 1 BENT Question 28 of 29

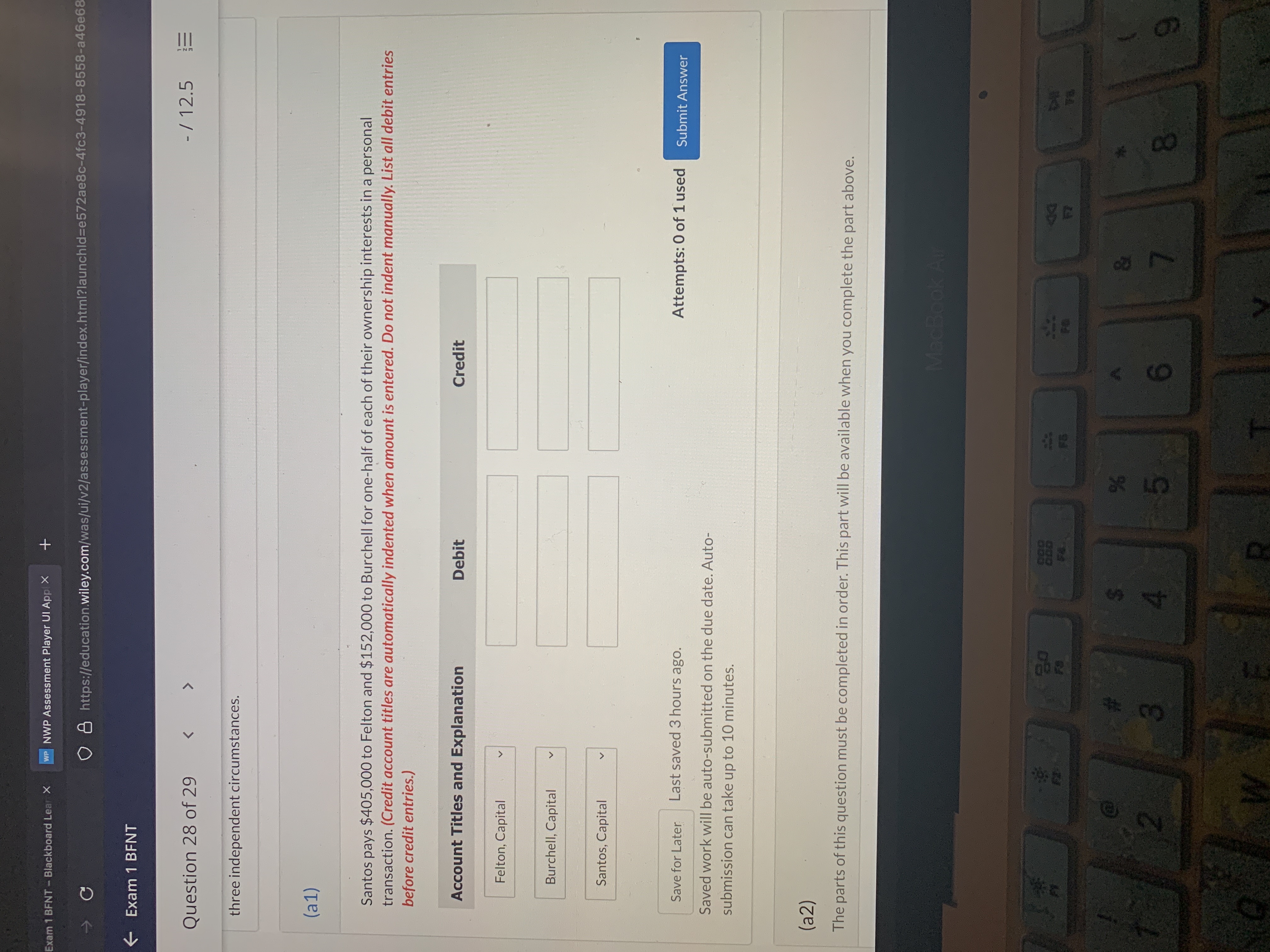

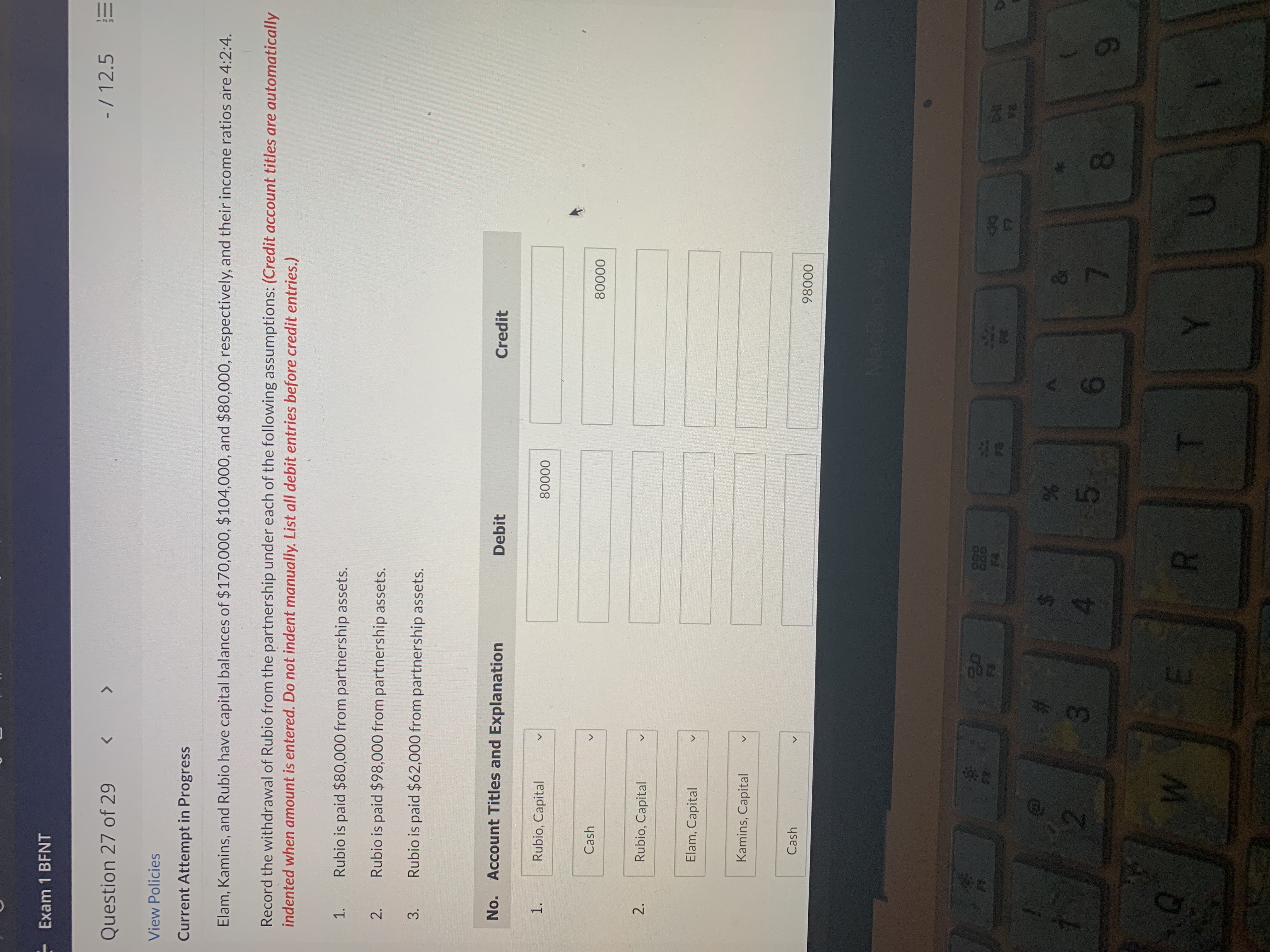

Exam 1 BFNT - Blackboard Lear X WP NWP Assessment Player UI App X + C 8 https://education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=e572ae8c-4fc3-4918-8558-a46e68 Exam 1 BENT Question 28 of 29 - /12.5 three independent circumstances. (a1) Santos pays $405,000 to Felton and $152,000 to Burchell for one-half of each of their ownership interests in a personal transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit Felton, Capital Burchell, Capital Santos, Capital Save for Later Last saved 3 hours ago. Attempts: 0 of 1 used Submit Answer Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. (a2) The parts of this question must be completed in order. This part will be available when you complete the part above. MacBook 888 FS 3 4 6Exam 1 BFNT Question 27 of 29 - /12.5 View Policies Current Attempt in Progress Elam, Kamins, and Rubio have capital balances of $170,000, $104,000, and $80,000, respectively, and their income ratios are 4:2:4. Record the withdrawal of Rubio from the partnership under each of the following assumptions: (Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) 1. Rubio is paid $80,000 from partnership assets. 2. Rubio is paid $98,000 from partnership assets. 3. Rubio is paid $62,000 from partnership assets. No. Account Titles and Explanation Debit Credit Rubio, Capital 80000 Cash 80000 2 Rubio, Capital Elam, Capital Kamins, Capital Cast 98000 MacBook N 3 6 8 g Q W E R T Y U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts