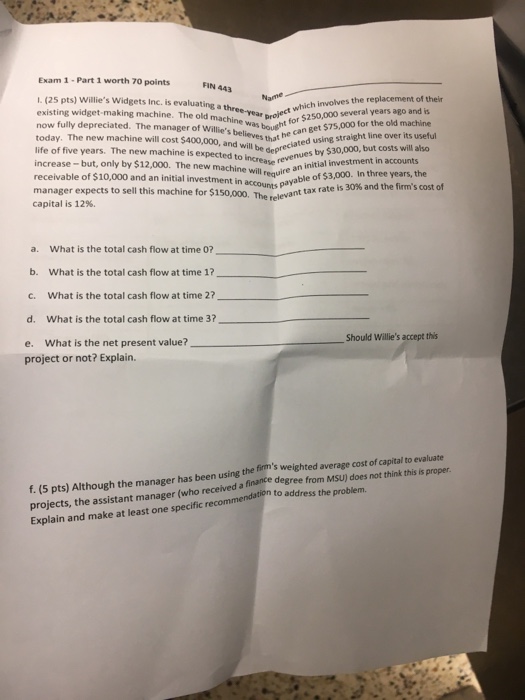

Question: Exam 1 - Part 1 worth 70 points N 443 1. (25 pts) Willie's widgets inc. is evaluating a threctw250,000 several yearsgond t existing widget-making

Exam 1 - Part 1 worth 70 points N 443 1. (25 pts) Willie's widgets inc. is evaluating a threctw250,000 several yearsgond t existing widget-making machine. The old machine which involves the replacement of their now fully depreciated. The meofllieinbor n get $75,000 for the old machine today. The new machine will cost $400,000, and will be deprecat by $30,000, but costs will lso life of five years. The new machine is expected to increate revenuestial investment in accounts sbelieves he can ge that aciated using straight line over its useful in three years, the yable of manager expects to sell this machine for $150,000. The relevant ta capital is 12%. x rate is 30% and the firm's cost of a. What is the total cash flow at time 0? b. What is the total cash flow at time 1? c. What is the total cash flow at time 27 d. What is the total cash flow at time 3? e. What is the net present value? project or not? Explain. Should Willie's accept this f. (5 pts) Although the manager has been using the frm's weighted average cost of capital to evaluate projects, the assistant manager (who received Explain and make at least one specific recommendstion to address the problem. d a finance degree from MSU) does not think this is proper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts