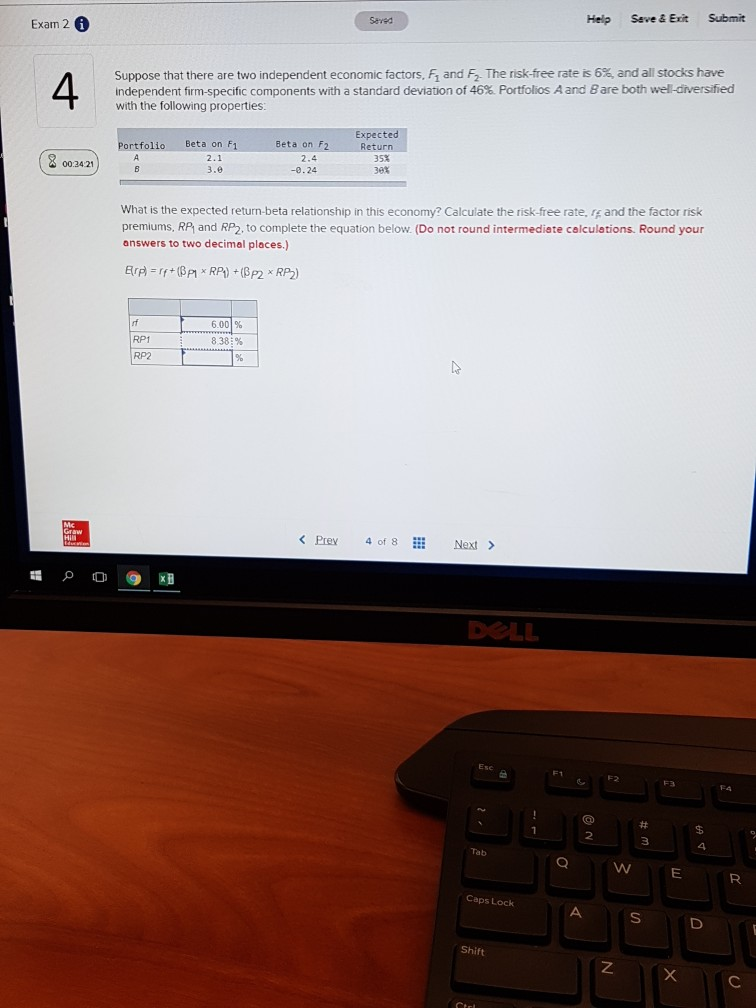

Question: Exam 2 0 Help Seve & Exit Submit 4 Suppose that there are two independent economic factors, F1 and F2. The risk-free rate is 6%,

Exam 2 0 Help Seve & Exit Submit 4 Suppose that there are two independent economic factors, F1 and F2. The risk-free rate is 6%, and all stocks have independent firm-specific components with a standard deviat on of 46% Portfolios A and Bare both we divers ed with the following properties Portfoli o- Beta on F1 Beta on F2 00342)..24J6x 2.4 35% 3.0 -0.24 What is the expected return-beta relationship in this economy? Calculate the risk-free rate, rg and the factor risk premiums, RP1 and RP2, to complete the equation below. (Do not round intermediate celculations. Round your answers to two decimal places.) 6.001% RP1 RP2 8383% Prey4 of 8 Next @KB DOLL F2 2 Caps Lock Shift

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts