Question: Exam 2 ( Ch . 5 - 6 & 8 ) i Help Sav Part 3 of 3 5 points q , eBook References (

Exam Ch & i

Help

Sav

Part of

points

eBook

References

Required information

Question

The following information applies to the questions displayed below.

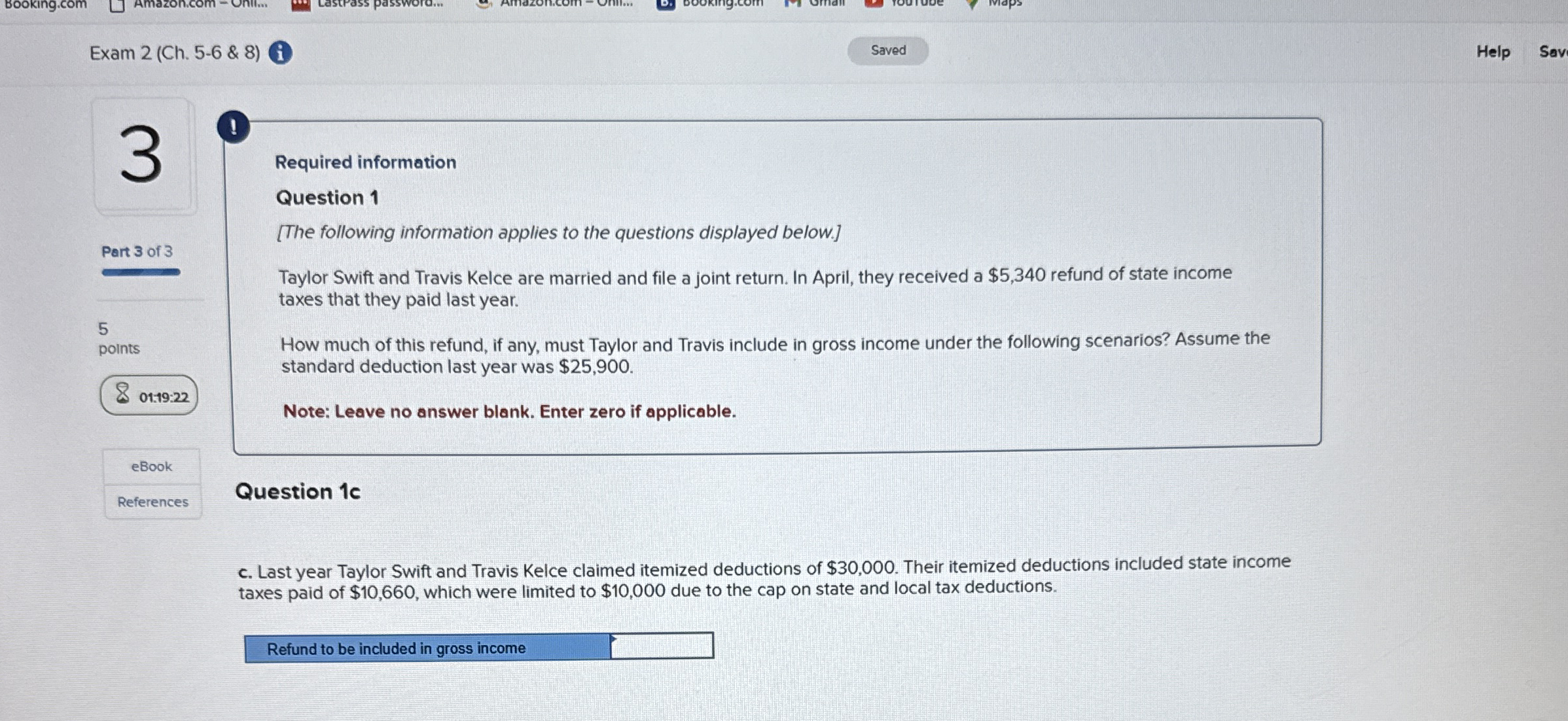

Taylor Swift and Travis Kelce are married and file a joint return. In April, they received a $ refund of state income taxes that they paid last year.

How much of this refund, if any, must Taylor and Travis include in gross income under the following scenarios? Assume the standard deduction last year was $

Note: Leave no answer blank. Enter zero if applicable.

Question c

c Last year Taylor Swift and Travis Kelce claimed itemized deductions of $ Their itemized deductions included state income taxes paid of $ which were limited to $ due to the cap on state and local tax deductions.

Refund to be included in gross income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock