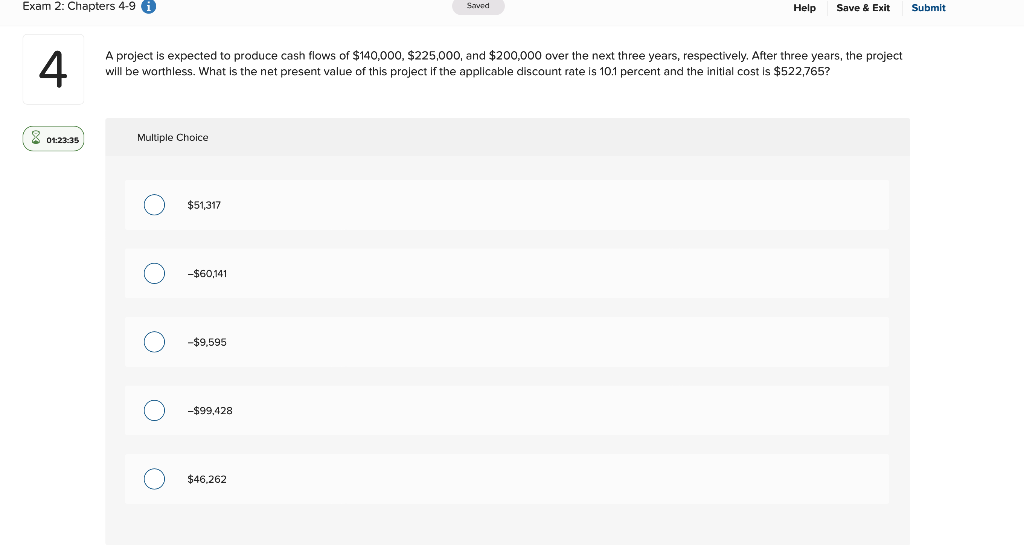

Question: Exam 2: Chapters 4-9 i Saved Help Save & Exit Submit 4 A project is expected to produce cash flows of $140,000, $225,000, and $200,000

Exam 2: Chapters 4-9 i Saved Help Save & Exit Submit 4 A project is expected to produce cash flows of $140,000, $225,000, and $200,000 over the next three years, respectively. After three years, the project will be worthless. What is the net present value of this project if the applicable discount rate is 10.1 percent and the initial cost is $522,765? 01:23:35 Multiple Choice $51,317 O O -$60,141 O -$9,595 O -$99,428 O $46,262

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock