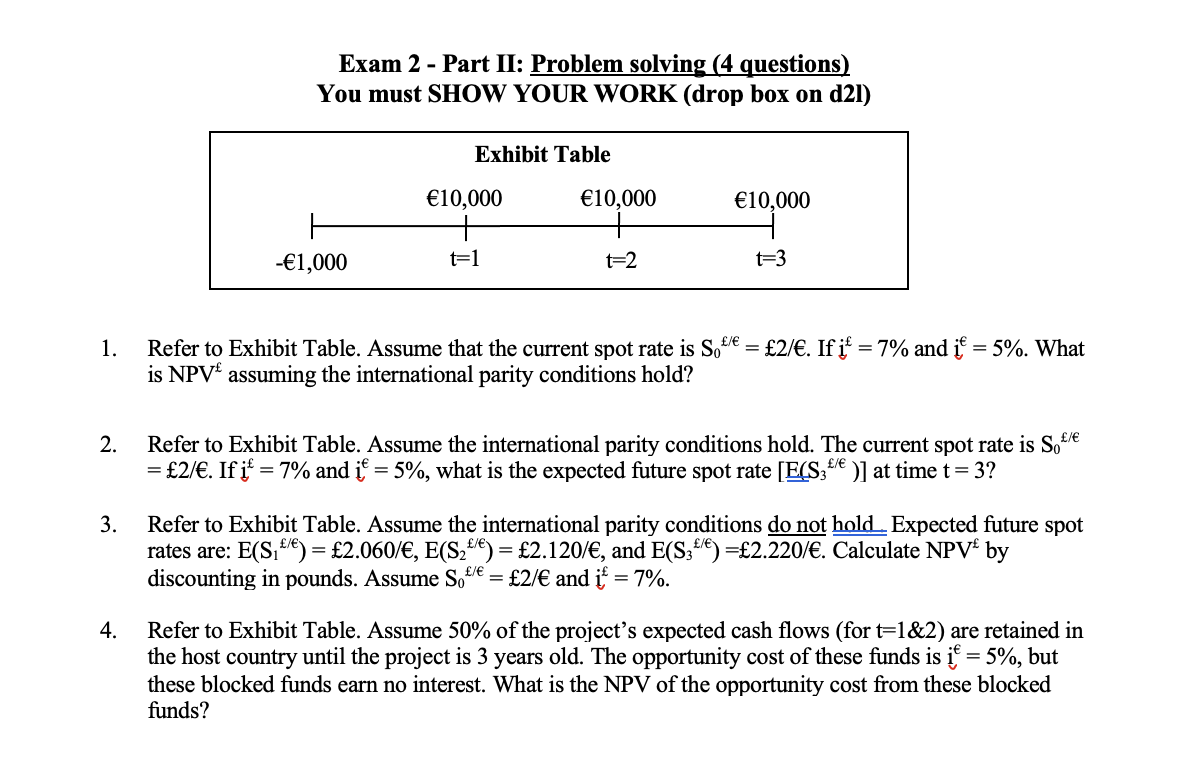

Question: Exam 2 - Part II: Problem solving (4 questions) You must SHOW YOUR WORK (drop box on d21) Exhibit Table 10,000 10,000 10,000 -1,000 t=1

Exam 2 - Part II: Problem solving (4 questions) You must SHOW YOUR WORK (drop box on d21) Exhibit Table 10,000 10,000 10,000 -1,000 t=1 t=2 t=3 1. Refer to Exhibit Table. Assume that the current spot rate is Sokle = 2/. If 4 = 7% and i = 5%. What is NPV assuming the international parity conditions hold? / 2. Refer to Exhibit Table. Assume the international parity conditions hold. The current spot rate is Sot = 2/. If = 7% and if = 5%, what is the expected future spot rate [E(S3 )] at time t = 3? 3. Refer to Exhibit Table. Assume the international parity conditions do not hold. Expected future spot rates are: E(S. /) = 2.060/, E(S2/) = 2.120/, and E(S;/) =2.220/. Calculate NPV by discounting in pounds. Assume S. = 2/ and i = 7%. / 4. Refer to Exhibit Table. Assume 50% of the project's expected cash flows (for t=1&2) are retained in the host country until the project is 3 years old. The opportunity cost of these funds is ie = 5%, but these blocked funds earn no interest. What is the NPV of the opportunity cost from these blocked funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts