Question: Exam 3 Case Study: In Debt Joe is a single 22-year-old living in Austin who just graduated from college with a BA in political science.

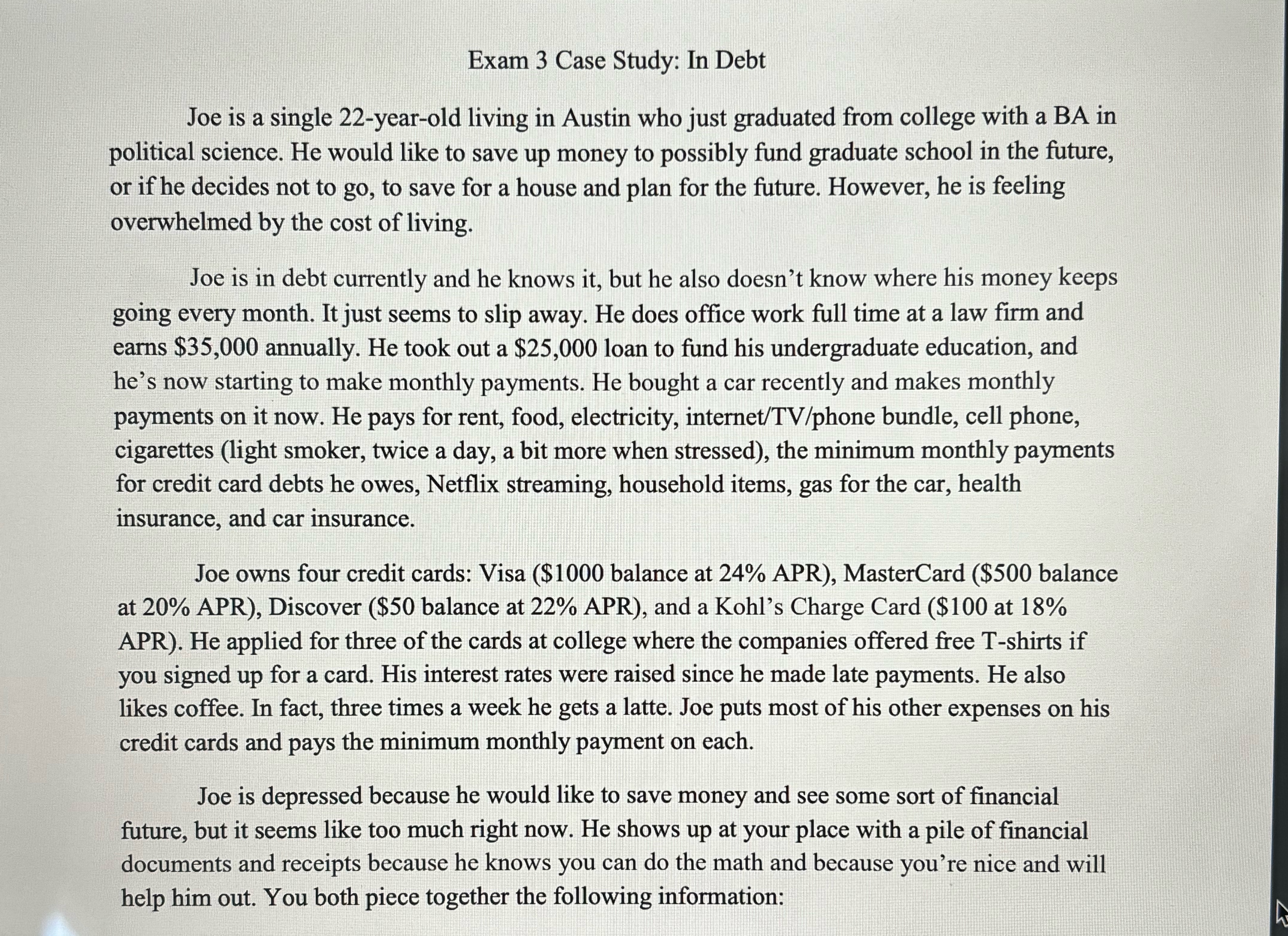

Exam 3 Case Study: In Debt Joe is a single 22-year-old living in Austin who just graduated from college with a BA in political science. He would like to save up money to possibly fund graduate school in the future, or if he decides not to go, to save for a house and plan for the future. However, he is feeling overwhelmed by the cost of living. Joe is in debt currently and he knows it, but he also doesn't know where his money keeps going every month. It just seems to slip away. He does office work full time at a law firm and eamns $35,000 annually. He took out a $25,000 loan to fund his undergraduate education, and he's now starting to make monthly payments. He bought a car recently and makes monthly payments on it now. He pays for rent, food, electricity, internet/TV/phone bundle, cell phone, cigarettes (light smoker, twice a day, a bit more when stressed), the minimum monthly payments for credit card debts he owes, Netflix streaming, household items, gas for the car, health insurance, and car insurance. Joe owns four credit cards: Visa ($1000 balance at 24% APR), MasterCard ($500 balance at 20% APR), Discover ($50 balance at 22% APR), and a Kohl's Charge Card ($100 at 18% APR). He applied for three of the cards at college where the companies offered free T-shirts if you signed up for a card. His interest rates were raised since he made late payments. He also likes coffee. In fact, three times a week he gets a latte. Joe puts most of his other expenses on his credit cards and pays the minimum monthly payment on each. Joe is depressed because he would like to save money and see some sort of financial future, but it seems like too much right now. He shows up at your place with a pile of financial documents and receipts because he knows you can do the math and because you're nice and will help him out. You both piece together the following information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts