Question: Exam 3 Chapters 7 and 8 Multiple Choices 2-points each, short question 6 points, total 80 Points E.$41.00 10.The common stock of Textile Mills pays

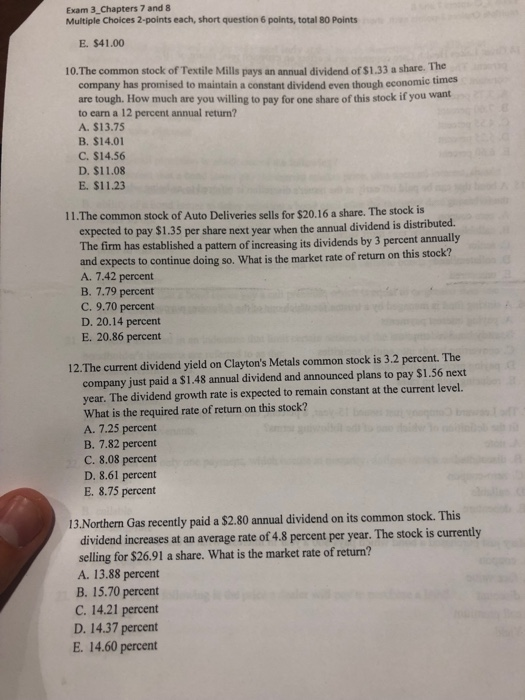

Exam 3 Chapters 7 and 8 Multiple Choices 2-points each, short question 6 points, total 80 Points E.$41.00 10.The common stock of Textile Mills pays an annual dividend of $1.33 a share. The company has promised to maintain a constant dividend even though are tough. How much are you willing to pay for one share of this stock if you want to earn a 12 percent annual return? A. $13.75 B. $14.01 C. $14.56 D. $11.08 E. $11.23 economic times 11.The common stock of Auto Deliveries sells for $20.16 a share. The stock is expected to pay $1.35 per share next year when the annual dividend is distributed. The firm has established a pattern of increasing its dividends by 3 percent and expects to continue doing so. What is the market rate of return on this stock? A. 7.42 percent B. 7.79 percent C. 9.70 percent D. 20.14 percent E. 20.86 percent annually 12.The current dividend yield on Clayton's Metals common stock is 3.2 percent. The company just paid a $1.48 annual dividend and announced plans to pay S1.56 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on this stock? A. 7.25 percent B. 7.82 percent C. 8.08 percent D. 8.61 percent E. 8.75 percent 13.Northern Gas recently paid a $2.80 annual dividend on its common stock. This dividend increases at an average rate of 4.8 percent per year. The stock is currently selling for $26.91 a share. What is the market rate of return? A. 13.88 percent B. 15.70 percent C. 14.21 percent D. 14.37 percent E. 14.60 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts