Question: Exam 3 - Chapters 9 to 12 Saved Help Save & Exit Submit On January 15, the end of the first pay period of the

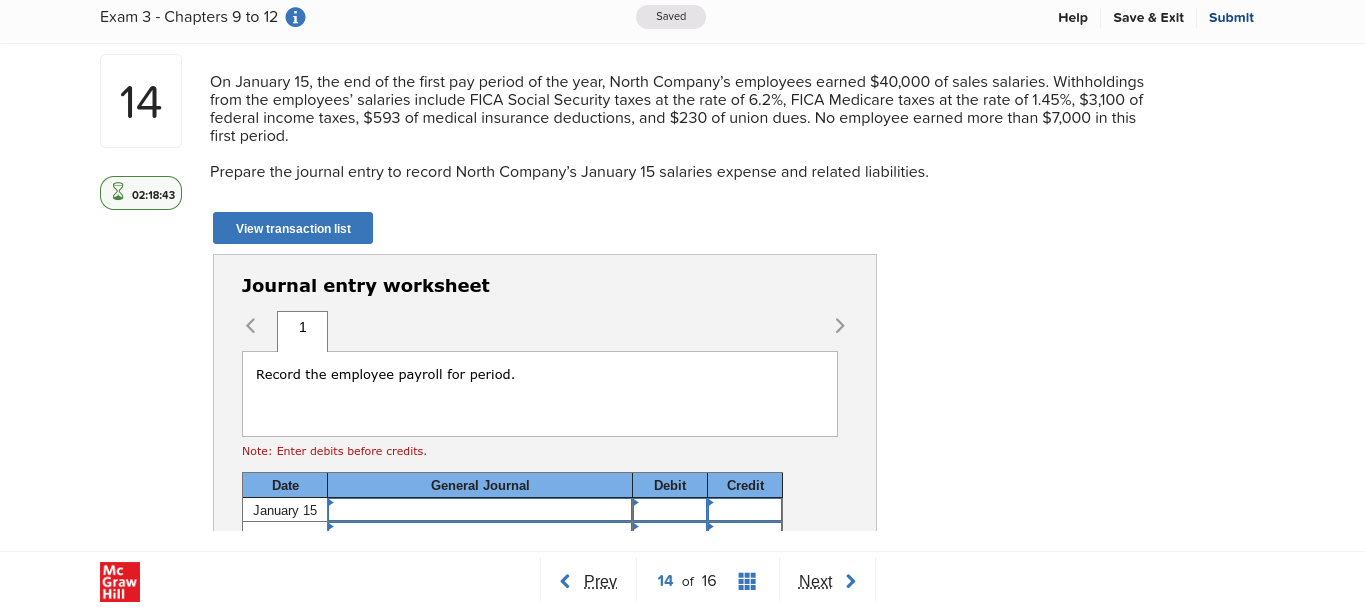

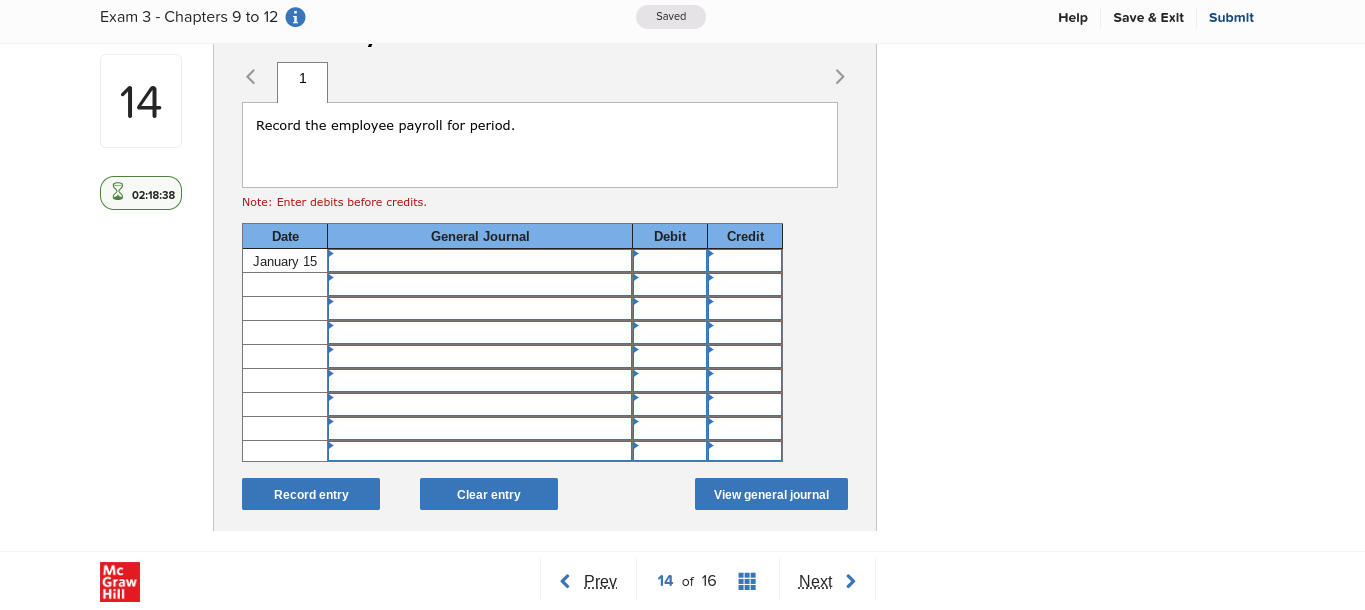

Exam 3 - Chapters 9 to 12 Saved Help Save & Exit Submit On January 15, the end of the first pay period of the year, North Company's employees earned $40,000 of sales salaries. Withholdings 14 from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $3,100 of federal income taxes, $593 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. 02:18:43 View transaction list Journal entry worksheet Record the employee payroll for period. Note: Enter debits before credits. Date General Journal Debit Credit January 15 Mc Graw HillExam 3 - Chapters 9 to 12 1 Saved Help Save & Exit Submit 14 Record the employee payroll for period. 02:18:38 Note: Enter debits before credits. Date General Journal Debit Credit January 15 Record entry Clear entry View general journal Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts