Question: Exam Exercise Ten - 3 {Maximum RRSP Deduction) During 2013, Mrs. White has taxable capital gains of $21,750, net rental income of $5,720, pays spousal

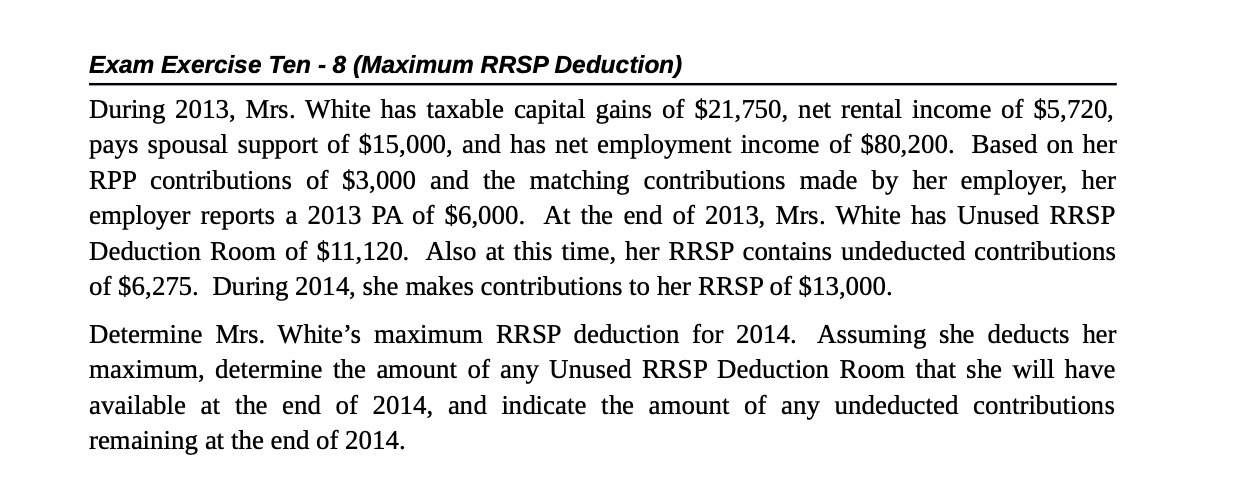

Exam Exercise Ten - 3 {Maximum RRSP Deduction) During 2013, Mrs. White has taxable capital gains of $21,750, net rental income of $5,720, pays spousal support of $15,000, and has net employment income of $80,200. Based on her RPP contributions of $3,000 and the matching contributions made by her employer, her employer reports a 2013 PA of $6,000. At the end of 2013, Mrs. White has Unused RRSP Deduction Room of $11,120. Also at this time, her RRSP contains undeducted contributions of $6,275. During 2014, she makes contributions to her RRSP of $13,000. Determine Mrs. White's maximum RRSP deduction for 2014. Assuming she deducts her maximum, determine the amount of any Unused RRSP Deduction Room that she will have available at the end of 2014, and indicate the amount of any undeducted contributions remaining at the end of 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts