Question: exam prep help?? go forward with it or sell off the land. Real estate values increase annually at 4.5% for unimproved property in this area.

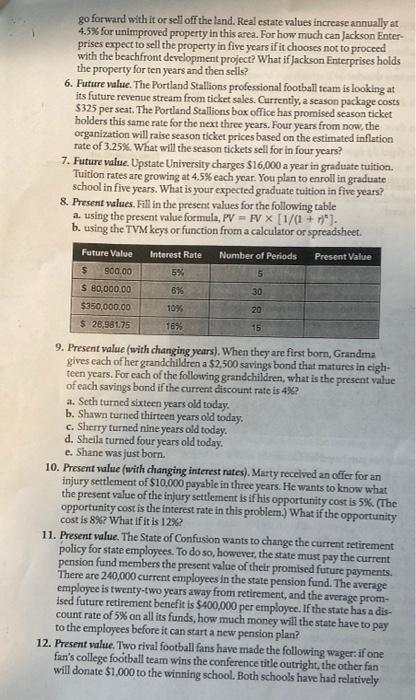

go forward with it or sell off the land. Real estate values increase annually at 4.5% for unimproved property in this area. For how much can Jackson Enter- prises expect to sell the property in five years if it chooses not to proceed with the beachfront development project? What if Jackson Enterprises holds the property for ten years and then sells? 6. Future value. The Portland Stallions professional football team is looking at its future revenue stream from ticket sales. Currently, a season package costs $325 per seat. The Portland Stallions box office has promised season ticket holders this same rate for the next three years. Four years from now, the organization will raise season ticket prices based on the estimated inflation rate of 3.25%. What will the season tickets sell for in four years? 7. Future value. Upstate University charges $16,000 a year in graduate tuition. Tuition rates are growing at 4.5% each year. You plan to enroll in graduate school in five years. What is your expected graduate tuition in five years? 8. Present values. Fill in the present values for the following table a. using the present value formula, PV=FVX [1/(1+r)]. b. using the TVM keys or function from a calculator or spreadsheet. Future Value Interest Rate Number of Periods Present Value $ 900.00 5% 5 $ 80,000.00 6% 30 $350,000.00 10% 20 $ 26,981.75 16% 15 9. Present value (with changing years). When they are first born, Grandma gives each of her grandchildren a $2,500 savings bond that matures in eigh- teen years. For each of the following grandchildren, what is the present value of each savings bond if the current discount rate is 4%? a. Seth turned sixteen years old today. b. Shawn turned thirteen years old today. c. Sherry turned nine years old today. d. Sheila turned four years old today. e. Shane was just born. 10. Present value (with changing interest rates). Marty received an offer for an injury settlement of $10,000 payable in three years. He wants to know what the present value of the injury settlement is if his opportunity cost is 5%. (The opportunity cost is the interest rate in this problem.) What if the opportunity cost is 8%? What if it is 12%? 11. Present value. The State of Confusion wants to change the current retirement policy for state employees. To do so, however, the state must pay the current pension fund members the present value of their promised future payments. There are 240,000 current employees in the state pension fund. The average employee is twenty-two years away from retirement, and the average prom- ised future retirement benefit is $400,000 per employee. If the state has a dis- count rate of 5% on all its funds, how much money will the state have to pay to the employees before it can start a new pension plan? 12. Present value. Two rival football fans have made the following wager: if one fan's college football team wins the conference title outright, the other fan will donate $1,000 to the winning school. Both schools have had relatively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts